An institution that services housing finance authority loans is putting $2.65 billion in servicing rights from Washington state up for bid through the Mortgage Industry Advisory Corp.

The Washington State Housing Finance Commission must consent to the sale. The sale date is negotiable and the portfolio transfer date will be subject to investor approval and subservicer transfer timelines. MIAC is the exclusive broker for the unnamed seller.

Weighted averages for the more than 16,000 loans in the mortgage servicing rights package are as follows: original term, 30 years; remaining term, 26.5 years; and interest rate, 4.19%. Most of the MSRs are for first-lien mortgages originated as

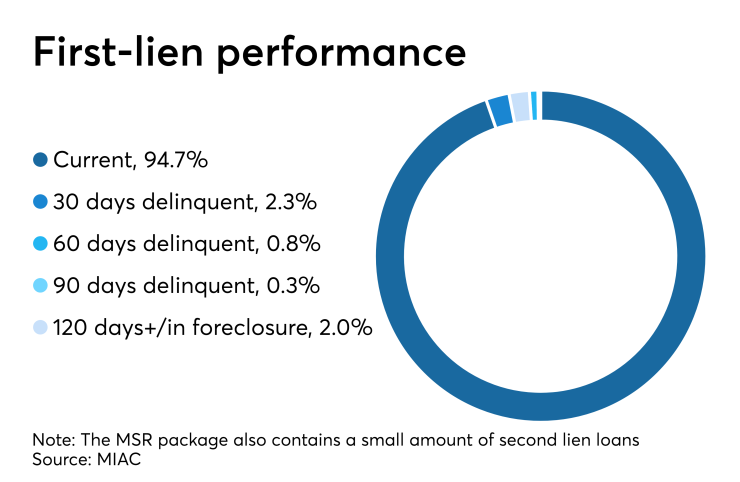

More than 5% of the loans are distressed with the following distribution: 2.3%, 30 days late; 0.8%, 60 days late; less than 0.3%, 90 days late; and nearly 2% are late by 120 days or more or in foreclosure.

Almost half of the mortgages in the portfolio are government-guaranteed loans based on unpaid principal balance. The remaining loans are primarily Fannie Mae products, most of which have mortgage insurance.

The information provided by the seller is based on the state of the portfolio as of April 30. Written bid letters are due by 5 p.m. Eastern on May 28. The buyer may need to submit financial statements and operational information related to its ability to service the portfolio to investors.