Bankers are entering a new year feeling a sense of déjà vu about regulatory warnings over commercial real estate concentrations.

A decade earlier, regulators were warning that CRE exposure could lead to earnings and capital volatility. While many bankers said those concerns were overblown — arguing that few

Fast forward to today and regulators are expressing similar reservations, warning that areas such as multifamily could become problematic. Bankers, however, say they believe the industry is better equipped to handle an economic shock, pointing to a system with more capital, backstops from borrowers and improved risk management processes.

Only time will tell if those views are correct and whether bankers will remain relatively cautious.

"You see comments about taking a foot off the gas," said Peter Cherpack, principal of credit technology at Ardmore Banking Advisors. "The enthusiasm for real estate for many bankers is now somewhat tempered."

Still, the industry struggles "with bankers who have short memories," Cherpack said.

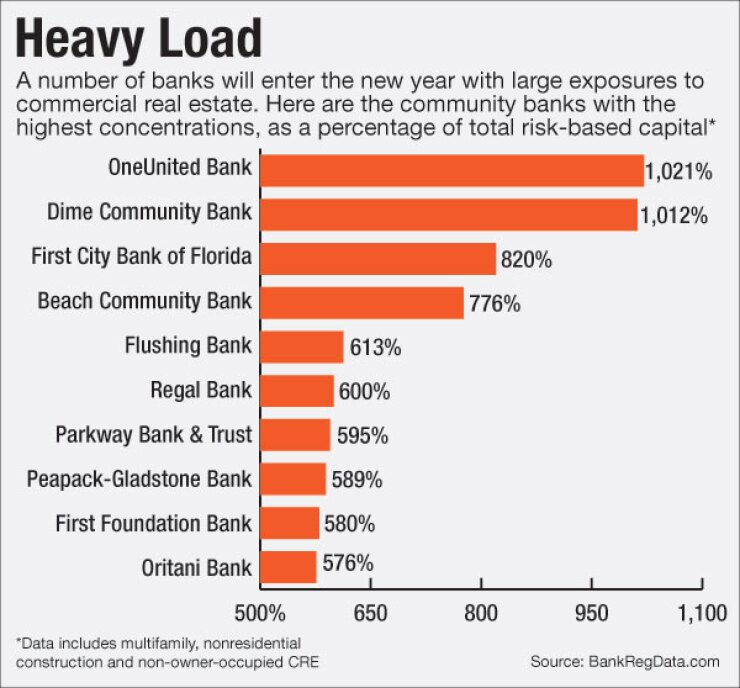

Several banks exceed recommended CRE levels, as a percentage of total risk-based capital, prompting regulators late last year to remind banks of their guidance on concentrations. Regulators prefer that CRE remain below 300% of a bank's total risk-based capital and for construction and land development loans to stay under 100%.

Regulators said in a joint statement that "many CRE asset and lending markets are experiencing substantial growth, and that increased competitive pressures are contributing significantly to historically low capitalization rates and rising property values."

There is no prohibition for going over those levels, and the numbers aren't considered limits. Banks may still be targeted for more supervisory analysis and, as a result, should implement enhanced risk controls, such as stress testing for CRE portfolios.

CRE exposure has seemingly influenced other strategic decisions at banks, including consolidation

New York Community Bancorp and Astoria Financial earlier this week terminated a $2 billion merger after facing regulatory

It seems unlikely that a focus on CRE will let up next year. Fitch Ratings warned last month that CRE lending at U.S. banks had reached record levels that are unsustainable.

"I don't think commercial real estate will be dropping off the radar," said Patrick Ryan, president and CEO of First Bank in Hamilton, N.J. "Other areas like cybersecurity might also become an area of focus…but it may not replace CRE."

A review of the financial crisis provides some rationale for regulators' diligence. A 2013 report from the Office of the Comptroller of the Currency and the Federal Reserve found that 23% of banks that exceeded guided levels for both CRE and C&D loans failed during the three-year economic downturn, compared with less than 1% of banks that stayed below those levels.

The Federal Deposit Insurance Corp. did not provide a comment for this story. The OCC and the Fed did not comment on the record.

"There's the sense that the industry got a little ahead of itself and loaned too much on deals that were not tangible," said James Kaplan, a lawyer at Quarles & Brady. "It was unclear that these buildings would have tenants, and banks got left holding…something that didn't have too much value."

Some industry observers believe those numbers don't tell the full story, pointing out that not all types of CRE perform the same. Many of the defaulted loans were tied to residential projects that failed when people stopped buying homes.

"I think the way regulators classify CRE — at least from a numbers standpoint — is suboptimal," said Jon Winick, CEO at Clark Street Capital. "Many of those losses weren't really CRE projects. They were…classified as CRE but they were really residential."

Banks largely pulled out of funding speculative construction and development loans after the crisis. Roughly 320 banks at mid-2016 exceeded the 100% guidance on C&D loans as a percentage of total risk-based capital, versus nearly 2,400 in 2007, based on regulatory data.

"Banks understand that construction is more of a risky market…and the first one to collapse," said Tim Scholten, founder of Visible Progress, a consulting firm. "A project that is half done isn't good collateral."

The $4.8 billion-asset Peapack-Gladstone Financial is among the banks that pulled back from C&D loans, which accounted for most of its losses during the last downturn, said Vincent Spero, the Bedminster, N.J., company's head of commercial real estate.

"We just don't have the stomach and the appetite for those loans," Spero said. "You need the infrastructure in place to complete those loans, so we have pursued a different strategy."

Peapack-Gladstone is focusing on the rent-regulated space for multifamily loans, an area that has historically had lower chargeoff rates and better credit analytics, Spero said. The bank has a CRE to total risk-based capital ratio of almost 590%, according to BankRegData.com.

Peapack-Gladstone has spent close to $1 million on processes, data analytics and third-party vendors to "ensure from a risk management perspective that we're on top of it," said Chief Credit Officer Lisa Chalkan. The company earlier this year hired a real estate expert to provide granular data on asset classes that management uses to evaluate limits on different types of loans.

"With the reissuance of the guidance, it was abundantly clear that the regulators were focused on real estate," Chalkan said. "It just seemed like a prudent time to make changes."

Industry experts also believe that banks are better capitalized today and would be in a better position to withstand a significant economic downturn. Total risk-based capital at banks with less than $10 billion of assets averaged 15.5% at Sept. 30, up from 14.4% a decade earlier, according to the FDIC.

Banks have also been more careful about underwriting, risk management and deals outside of their comfort zone, said Mitch Razook, president of RLR Management Consulting. Stress testing is also helping a number of banks.

"Lenders are better educated now and underwriters are more conservative," Razook said. "Banks have a lot more controls in place."

Though the $1 billion-asset First Bank has a CRE focus — CRE to total risk-based capital was roughly 390%, according to BankRegData.com — it has resisted the urge to diversify by branching out into areas where it lacks expertise, Ryan said. Rather, the company works to have varied assets, such as retail, industrial and mixed use, within its CRE book.

While there is talk that banks are loosening standards, Ryan said he believes many institutions are normalizing their stance after years of having tight criteria.

"If you compare what banks and borrowers are doing today, it is much more controlled, rational and logical compared with what was happening from 2005 to 2007," Ryan said. "It is probably a better, happy medium."