Federal Housing Administration lenders and servicers need to make sure they are ready for a March 14 rule change that reduces the cap on late fees.

Under the change, one of many

Some FHA lenders and servicers as a practice are already capping their late fees based on P&I alone rather than PITI, but for those that are not, the change could add to servicers' costs and pressure on lenders to ensure they

Lenders need "to make sure their disclosures are set up correctly as of March 14 so that they don't have a non-saleable or [non-]insurable loan due to a defective disclosure," said Daniel Jacobs, the managing director in retail lending at Michigan Mutual in Southfield.

Closing-cost disclosures before and after the implementation of mortgage-disclosure reform have required information about late fees, so these may also have to be adjusted.

Michigan Mutual has already been capping its late charges at 4% of P&I, but it is unclear how many other lenders have already done so, Jacobs said.

The voluminous FHA handbook makes it easy to search online for the particulars of any rule, but lenders have to compare them with past documentation or read them in detail so they do not miss changes like this, he said.

New borrowers probably will not notice the reduction in the late-charge cap disclosed at origination, but if they have difficulty paying later on they will appreciate it, Jacobs said.

How servicers and investors handle distressed FHA borrowers has been

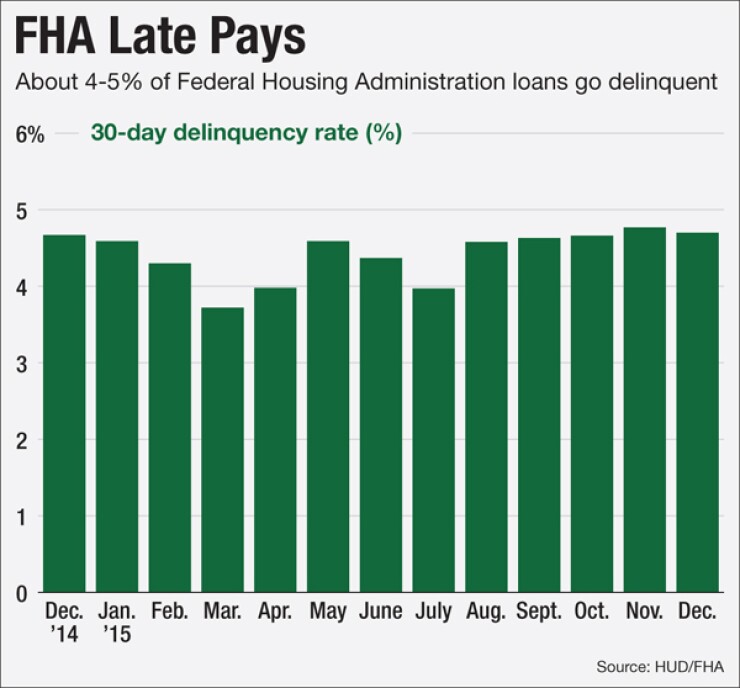

Delinquencies

On a randomly chosen FHA loan with about $811 in P&I and $180 in T&I, Jacobs found under previous rules the late fee cap would have been about $40 as compared to closer to $33 under the new rule.

The extent of the change varies based on the location of the mortgaged property involved and what local property values and taxes are, noted Ralph Gerardi, director of servicing solutions at the Lincolnshire, Ill.-based Opus Capital Market Consultants.

"In New Jersey or New York, you have high escrow balances, but in Alabama you have lower property taxes," he said.

Servicers who handle loans guaranteed by the Department of Housing and Urban Development's insurance arm might be concerned about the change because in recent years new regulations have been adding to expenses, but compliance is mandatory.

"It's a reduction of income. As costs go up you have fees going down, but if HUD says that's the rule, that's the rule," Gerardi said.