WASHINGTON — Employees at the Office of Financial Research have raised concerns about racial discrimination and dysfunction at the agency, according to internal documents and videos posted online.

The agency, tasked with gathering data and conducting research about the stability of the financial system, is struggling to combat low morale, as shown by two years of employee survey data. An anonymous person or group of people has also posted two videos to YouTube raising concerns about the agency's treatment of African-American employees, prompting an investigation by the head of the OFR.

The alleged problems come on the heels of similar ones at the Consumer Financial Protection Bureau revealed in a series of reports by American Banker starting in 2014. The new concerns suggest that management issues at agencies created by the Dodd-Frank Act may be more widespread than previously reported.

The revelations also come as the OFR prepares for a new future under President-elect Donald Trump. Although the OFR is an independent office, it is housed within the Treasury Department. Analysts have already predicted that substantive work could grind to a halt at the Financial Stability Oversight Council, which the OFR supports with its research, and it's possible the same could happen within the office.

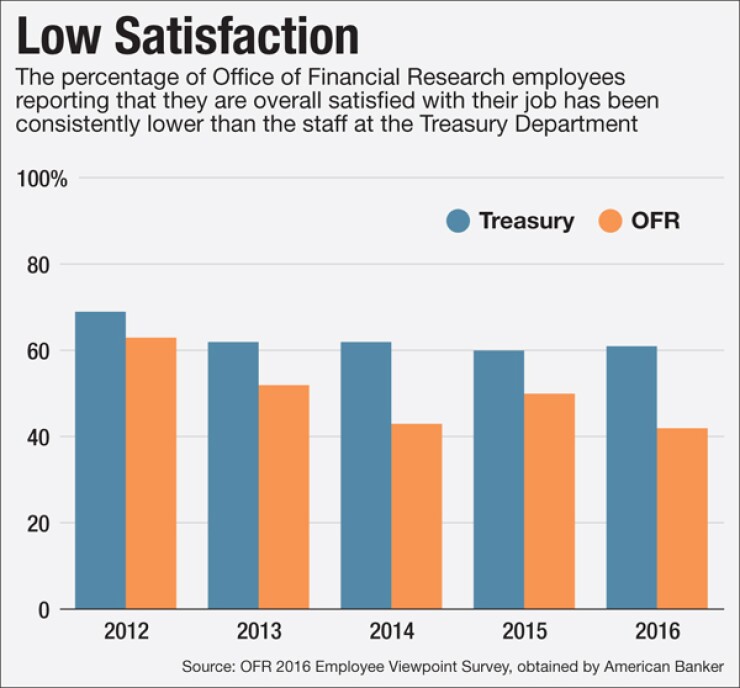

This year's survey results show that just 42% of employees are satisfied with the office and their jobs, down from 63% in 2012, the first year for which survey data is available. The decline compares with more stable employee satisfaction results at the Treasury Department overall, where rates have hovered between 60% and 72% back to 2006.

Top OFR officials acknowledge those statistics show there is a problem.

"These scores are not good enough and do not represent what the OFR is capable of achieving together," Director Richard Berner said in a statement to American Banker. "We will focus on improving the scores and focus on addressing employees' concerns. We are a new organization that is constantly changing and change can be difficult. The OFR is still expanding and implementing new policies and procedures and this takes time. I take these scores seriously and have taken steps to address such concerns."

The findings from 2016 suggest a particular concern among employees with respect to the direction and leadership of the agency. Just 30% of OFR survey respondents in 2016 said that they were satisfied with the policies and practices of senior leaders, compared with 41% of Treasury workers, while 35% said they have "a high level of respect for my organization's senior leaders." Fifty-two percent of Treasury respondents agreed with the same statement. Meanwhile, 42% of OFR employees agreed that "managers communicate the goals and priorities of the organization," compared with 68% at Treasury.

The OFR also lagged on some questions regarding the treatment of employees. Less than half, 46%, agreed that "arbitrary action, personal favoritism and coercion for partisan political purposes are not tolerated," compared with 59% at Treasury. And just 57% agreed that prohibited personnel practices, including illegally discriminating against an employee, are not tolerated. That compares with 68% of employees at Treasury.

The survey did have a few bright spots for the agency, which received stronger ratings that were closer in line with Treasury on questions regarding work-life balance and the performance of employees' direct supervisor or team leader.

But the results also come at the same time that others are making allegations of racial discrimination, which Berner says he is investigating.

An online video, posted on YouTube Sept. 16 by an anonymous group called "OFR SOS," shows the face of an African-American man and lists a series of stark allegations regarding the agency's treatment of black employees. American Banker has been unable to independently verify the claims made in the Sept. 16 video or a second video uploaded on Oct. 25. A request made through social media to speak with the creator or creators was not returned.

While agency officials dispute many of the specific charges in the videos, they say they are treating the matter seriously.

"We believe that diversity promotes a strong workforce and a healthy workplace. We are committed to fostering a diverse and inclusive workplace that promotes trust and empowerment for every employee," Berner said. "After investigating the allegations in the video, we have confirmed that the data broadly do not support them, but that some require more analysis, which we are doing."

He added:

Most important, however, even a perception that employees are being treated unfairly is a serious concern to me and to the entire organization. We will not tolerate discrimination and we are committed to implementing best practices to ensure diversity. To that end, an external group of experts will help us assess OFR's diversity and culture and provide recommendations to improve them. We will also conduct additional diversity and management training, and we will continue to work closely with the Equal Employment Opportunity Office.

Berner made similar comments to employees following the release of the first video, according to internal emails obtained by American Banker.

"Many of you have become aware of a video circulating on the Internet that raises concerns about the treatment of certain employees at the OFR," he wrote in a staff-wide email on Oct. 4. "We want you to know that we take the allegations seriously, and that we are looking further into this matter. If you have any concerns that you would like to raise with me or directly with your supervisor, please do not hesitate to do so."

In a second email, dated Oct. 18, the director goes into further detail about the video and also discusses preliminary results from the agency's 2016 employee viewpoint survey, which had not yet been released to staff.

"I believe that the scores do not represent what we are capable of achieving together," Berner wrote to the agency's staff in an email titled "OFR Culture," adding that he takes "both the EVS results and these claims [in the video] seriously."

Berner wrote that senior officials are working on a "response proposal" to the survey and that they met with the Treasury Department's human resources division and Equal Employment Opportunity Office, as well as its Office of Minority and Women Inclusion and the Office of the General Counsel, to discuss the issues and to gather data related to the allegations in the video.

He added that the leadership plans on taking several additional steps. The agency will bring in an outside group to conduct a "cultural assessment" of its workforce and schedule more training for senior officials and staff on conflict management and diversity issues, as well as maintain its "close partnership" with the EEO Office "so that leadership can keep abreast of general trends and developments."

"Together, we will continue to strive toward making the OFR the world class organization that I know it can be — one that ensures the principles of equal opportunity and diversity by fostering a positive, inclusive and professional work environment that respects and values the differences of its employees and capitalizes on their diverse talents," he wrote.

Still, the decline in overall satisfaction rates suggests that complaints about the agency and its management are longstanding.

Morale seems to vary considerably across departments within the OFR, according to the 2015 survey results, which were also obtained by American Banker. While employees in the research division generally reported being satisfied with their organization — nearly three-quarters said that considering everything, they were satisfied — those in the data center, information technology and operating departments reported much lower levels of happiness. Fewer than half, 48%, of employees in the data center and IT departments said they were satisfied, and just 6% of those working under the chief operating officer at the time agreed with the statement.

The 2016 results obtained by American Banker did not include any departmental breakdowns. Eighty percent of OFR employees completed the survey this year, down from 85% last year. Each of the surveys was conducted in the spring. The agency currently has about 200 employees.

Amidst the internal discussions, a second video from "OFR SOS" appeared on YouTube on Oct. 25, launching fresh charges about racial problems at the agency and the failure of leaders to address ongoing issues.

The newest video highlights the efforts of Rep. Maxine Waters to increase diversity at the federal banking agencies during the writing of Dodd-Frank and provisions included in the statute aimed to do so.

"There's been no oversight of the OFR's activities since the enactment of the law six years ago," it says. "Those entrusted by statute to oversee diversity and its internal implementation have failed us."