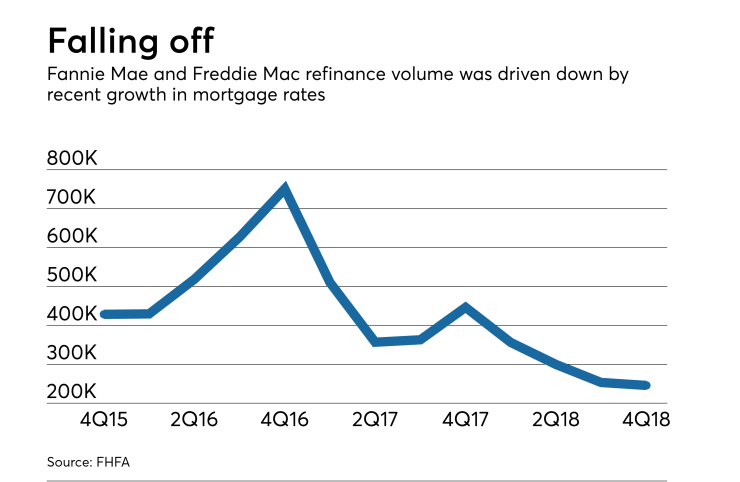

Refinance mortgage volume slipped at the end of the year following interest rate growth, and loans refinanced through the Home Affordable Housing Program barely made a dent in overall volume, according to the Federal Housing Finance Agency.

Fannie Mae and Freddie Mac completed 245,620 total refinances in the fourth quarter, which is down from 253,135 from the previous quarter. Looking at the year as a whole, 1,154,216 refinances were completed in 2018, compared to 1,676,013 throughout 2017.

This annual refi decline comes after a year of incremental mortgage rate hikes.

A total of 1,390 mortgage loans were refinanced via HARP, with delinquency rates for consumers who refinanced through HARP being lower than the share for those who were eligible but did not refi.

The rate of loans that were 90 or more days delinquent for borrowers who refinanced through HARP in June 2017 was 3.1% in the fourth quarter; for consumers who were eligible but did not exhaust a HARP refinance during that same period, the delinquency rate was a more elevated 3.8%.

Still, HARP refinances only accounted for 1% of total refis during the fourth quarter, which has been the standard for every quarter since the fourth quarter of 2017. This figure is considerably lower than the 27% peak hit in the second quarter of 2012.

Since HARP's inception back in 2009, a total of 3,494,395 mortgages have been refinanced through the program, with 33% going to underwater borrowers for shorter-term, 15- and 20-year loans, according to the FHFA.