Lennar Corp. closed its first fully electronic digital mortgage with a remote notary, just a few months after the homebuilder made an equity investment in digital mortgage vendor Notarize.

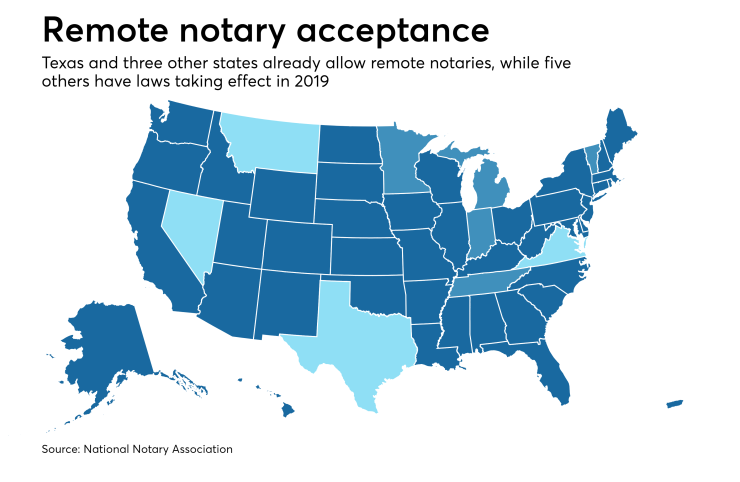

The closing took place in Kyle, Texas, a suburb of Austin, through Lennar's lender division, Eagle Home Mortgage, and its title agency, North American Title Co. Notarize facilitated the buyer and seller's electronic signatures and the notary's certifications on the closing package documents, which included an electronic promissory note.

"The technological capabilities offered by Notarize not only make the transaction process seamless, but also resolves many of the time-sensitive issues for all pertinent parties, ensuring that all documents are signed in a timely manner," Tom Fischer, president and CEO of North American Title Group, said in a press release.

The move comes amid an industrywide effort to embrace automation, paperless processing and other

"Eagle and the Lennar family of companies have a long history of embracing systems and technologies that put borrowers at the center of the mortgage transaction," Laura Escobar, president of Eagle Home Mortgage, said in the release.

Notarize completed five practice runs with Eagle prior to the actual closing date. The company is working with eight other lenders to execute similar transactions, and hopes to triple that figure by the end of the year, according to Megan Holsinger, the company's senior customer success manager.

The onboarding process for lenders working with Notarize takes four to eight weeks, but companies working with the platform need to have a secondary market strategy in place as the notes will eventually need to be sold.

Lennar and real estate franchise conglomerate Realogy led a $20 million investment in Notarize in May, bringing the total outside investment in the company to $30.4 million,