The

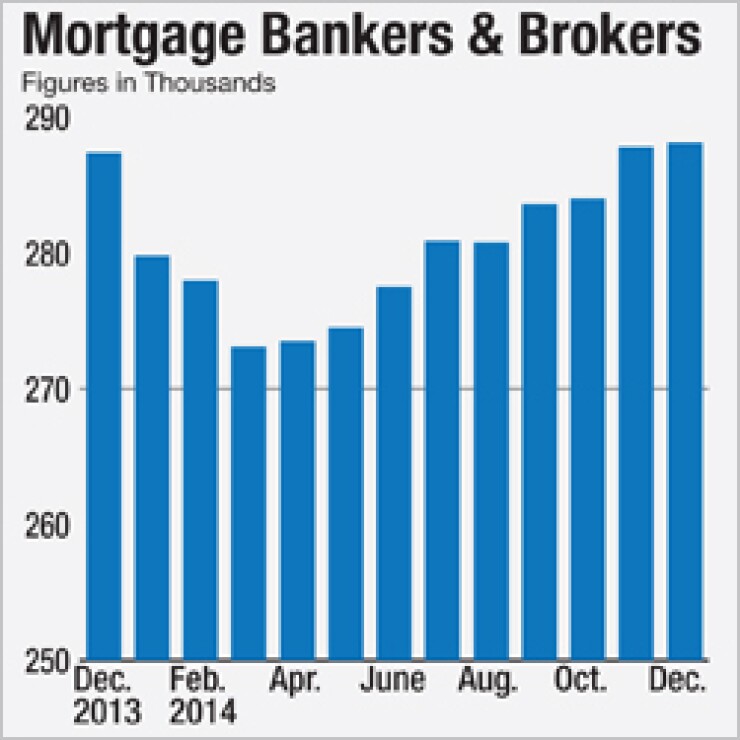

Lenders shed 32,100 jobs from July 2013 to March 2014, nearly 4,000 more than the Bureau of Labor Statistics originally estimated. After that downward trend reached its trough, lenders have added 15,000 jobs from April to December, bringing total nonbank lender employment to an estimated 288,100 workers at the end of the year.

The revised figures released Friday are a result of annual adjustments the Bureau makes to the sample-based estimates it uses in its monthly employment statistics. According to the revised numbers, lender

The fall-off in employment came amid

"With the end of the refi boom and move into more of a purchase market, productivity in terms of loans per LO is typically lower," he added. "Instead of taking inbound phone calls, LOs are out in the street working with Realtors and builders. Each transaction takes more work and more time."

Recent announcements of new low down payment loan products and a cut to Federal Housing Administration mortgage insurance has led some lenders to

"The other trend that we're seeing, particularly among larger lenders, is a pickup in turnover. Because the overall economy has improved and volume is growing relative to 2014, top LOs have opportunities elsewhere," Fratantoni said. "That's not going to impact aggregate employment, but you may see many lenders actively hiring just to replace personnel that they lost."

The BLS previously said nonbank mortgage employment had only fallen to

"This is what happens when you have a lot of movement in the whole economy or the industry. Like anybody else, they do better when things are more stable," Fratantoni said.

"When you had that tremendous drop in volume, some of that [employment] adjustment takes place through changes in levels of employment at each company and some of it takes place through some companies shutting down, merging or being acquired," he added.

There is a one-month lag in reporting for mortgage lender employment figures. Overall, total nonfarm payroll employment grew by 257,000 in January, but the unemployment rate crept up one basis point, to 5.7%.

The employment-population ratio of 59.3% changed little, reflecting a jobless rate that has shown "no net change since October," according to the BLS. Long-term unemployment (individuals who have unsuccessfully sought work for 27 weeks or more) "was essentially unchanged," at 2.8 million the BLS said in its monthly release.

Construction employment did increase by 39,000 in January, fueled by gains in the residential and nonresidential building sectors, which added 13,000 and 7,000 jobs respectively. The construction industry as a whole added an average of 28,000 jobs per month in 2014, a positive indication for demand that could bring hope for January's nonbank mortgage lender numbers.