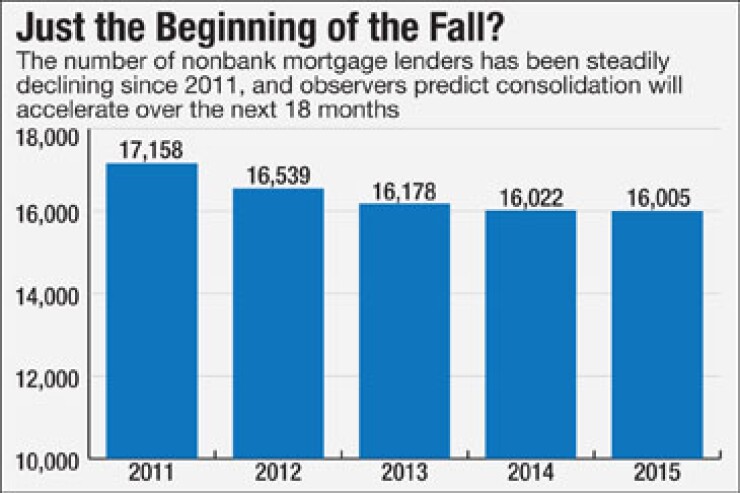

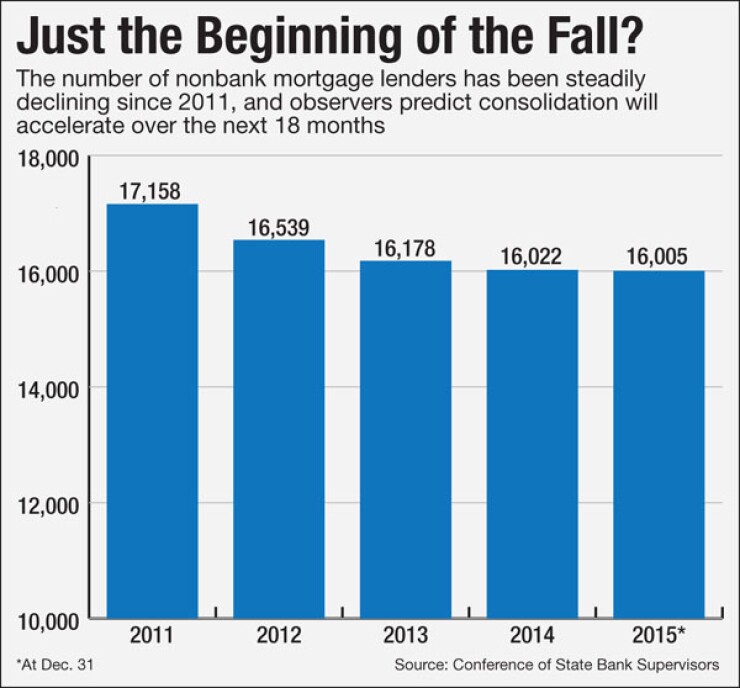

Independent mortgage lenders are bracing for a wave of consolidation prompted by heavy compliance costs and a tepid housing recovery.

The Consumer Financial Protection Bureau's promise to increase scrutiny of independent lenders tops their list of worries because any fines would hit the top dogs directly in their wallets.

Many of these lenders are actively raising capital, searching for equity partners or considering whether to sell out to larger firms. As many as 20% to 25% of independent mortgage companies could change hands or simply shut down in the next 12 to 18 months, according to one estimate.

Bill Dallas, the CEO of Skyline Home Loans in Calabasas, Calif., said competitive and regulatory pressures have created a growing angst among independents.

"We do home loans but we spend more time doing things that don't matter and very little time doing things that were fun, which is why we got into the business in the first place — to help people buy homes," he said.

Dallas, whose Ownit Mortgage Solutions Inc. was the first high-profile casualty of the financial crisis when its funding was cut off by Merrill Lynch in 2007, and other lenders fear they may not have enough stable backing to cope with the new challenges. Many of them are nearing retirement and worry their net worth could be drained by

a large CFPB fine, or the investments necessary to please tech-savvy consumers seeking a better loan-application experience.

"A lot of lenders are long in the tooth, and have all their capital invested in the business and they just want to get the heck out," said Dallas. "They aren't capitalized or structured to deal with the new regulatory platform. It's time for a new generation of lenders to take over."

Hirt said that because the loan-officer-compensation rules are unclear, and not all mortgage lenders have interpreted and executed the rules in the same manner, more enforcement actions will likely occur.

"This will fix or eliminate some bad actors, but it will also strain many great brokers and bankers who are responsibly serving their communities, and they will look to [or be forced to] sell," Hirt said in an email. RPM is among the larger nonbank lenders shopping for takeover targets, he said.

Rick Roque, a mortgage consultant who is managing director of retail originations at MiMutual, a unit of Michigan Mutual Mortgage in Southfield, Mich., estimates that $25 billion in annual home loan production will change hands or simply be eliminated in the next 12 to 18 months.

Small lenders with $200 million to $1 billion a year in loan volume are particularly vulnerable because they are struggling to keep up with the high costs of closing a home loan, said Roque, whose consulting firm is called Menlo Co. Global.

Many lenders "simply do not have the cash on hand to financially subsidize the management and growth of their operations," Roque said. "If you don't invest in the growth of your operation, your margins are eroding because the cost to close a loan is going up. To grow you have to have capital."

A nonbank lender typically spends from $50,000 to $75,000 to open a retail branch, and it can take $250,000 to support several branches before the mortgage shop becomes profitable, he said.

"When your net worth is $3 million to $4 million and it's tied up in warehouse lines, you don't have $200,000 to throw around," he added.

Still, many firms are having a hard time getting valuations for their companies above what they have put into them. Some of the larger nonbank lenders have raised capital by issuing debt to fund growth. Others are trying to get backing from private-equity firms. Stearns Lending, a large nonbank lender in Santa Ana, Calif.,

Though lenders' gain on sale margins remain high, the cost to produce a home loan has skyrocketed. Moreover, the transition from a refinance-driven market to one driven by home purchases has caught some lenders unprepared for as much as a 40% drop in overall volume — yet with no change in fixed costs.

"The fixed costs associated with compliance and technology have forced lenders to do more loans to be profitable," said Rick Seehausen, the president and CEO of LenderLive, a Denver provider of fulfillment services to mortgage companies. "We'll continue to see consolidation occurring because of the need for greater scale."

The Mortgage Bankers Association expects a 10% drop in mortgage originations this year to $1.3 trillion, with $905 billion in home purchases and $415 billion in refinances.

In the past, independent mortgage banks grew market share by buying branches or groups of loan officers. But that strategy is unsustainable in a market with lower loan volume and

"This is a great time for investors to get into the business," Roque said. "It's consolidating, volume is contracting, refinances are going down and purchase is flat. So it's ripe for market consolidation."