Community banks are continuing to book more loans, though the pace of growth is showing signs of slowing down.

Small banks' quarterly results reflected stronger revenue, in part due to expanding loans portfolios and relatively stable net interest margins. A stronger economy and more opportunities for lending to small businesses played important roles in the results.

"As the economic revitalization continues, we will continue to see strong loan growth," said Steven Reider, president of Bancography. "The recession is a thing of the past except for a few areas. Everywhere else we are seeing a strong economic revival and hiring with a return to solid balance sheet growth."

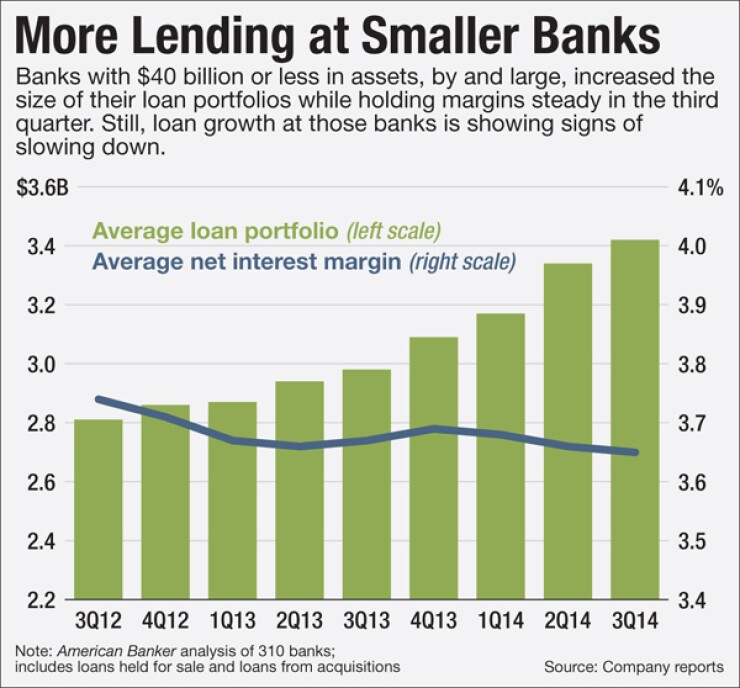

Loan portfolios at banks with less than $40 billion in assets rose, on average, by 15% in the third quarter compared to a year earlier, based on American Banker analysis of 310 institutions. Net interest income rose by 11%, as slight net interest margin compression offset loan growth.

Granted, there are signs that loan growth is decelerating. The loan books at banks analyzed by American Banker increased by 2.4% from the second quarter, marking the lowest linked-quarter increase since the third quarter of 2013. (The data include loans gained through acquisitions.)

Still, bankers said they are making more commercial-and-industrial loans. There are also more opportunities to make small-business loans as bigger banks turn their attention to larger corporate clients, industry experts said.

Regional banks have also "gone upstream in terms of where they are fishing," and are no longer looking to make loans for amounts below $250,000, said Tim Scholten, founder of consulting firm Visible Progress.

"Larger banks don't want to do a $50,000 line of credit," said Joe Sullivan, chief executive of consulting firm Market Insights. "They'd rather do a $5 million loan. So there's a continued realignment where the big banks are pushing the small businesses out the door and small banks are picking up the slack."

Lending tied to commercial real estate is also making a comeback, though Reider said many smaller banks are reluctant to heavily skew their portfolios like they did in the years prior to the recession and financial crisis.

Needham Bank in Massachusetts has benefited from a "perfect storm" that includes an economic recovery, demand for housing and the addition of experienced lenders, said Paul Totino, the $1.5 billion-asset mutual's executive vice president. Total loans at Needham rose 32% from a year earlier, to $1.3 billion.

The mutual, which has traditionally been a construction lender working with builders and developers, has seen a boost in that segment due to a rebound in demand for rental properties and apartment buildings.

Needham has also worked over the last year to diversify its loan book, focusing on C&I loans and residential mortgages. The thrift, which provides financing from $25,000 up to $5 million, has been promoting personal service to small business owners in an effort to contrast itself from bigger banks that may rely on modeling and automated decisions, Totino said.

"We don't have a huge marketing budget, so a lot of our business is word of mouth," Totino said. "We're also quick to respond to loan requests."

Loan growth may also reflect the fact that banks are becoming more willing to lend, Scholten said, adding that higher capital levels often allow for increased lending limits, which would let smaller banks hold larger loans on their books.

A number of industry observers said they will be watching loan growth in coming quarters, expecting to see a continued slow down. Still, any growth is a good sign for banks. The loan-to-deposit ratio for the banks analyzed by American Banker averaged 85.3% at Sept. 30, an improvement from 82.4% two years earlier.

Totino also said it is unlikely that Needham can continue its current pace of booking loans, though he is pleased with the thrift's outlook.

"We'll continue to have strong loan growth but not at this pace," Totino said. "It goes in cycles. When the economy dips, that will slow us down. What we do is really only a reflection of what is going on in the economy."

Paul Davis contributed to this report.