Pressure is building on mortgage servicers to make life easier for consumers who want to modify loans after taking over mortgaged property from the original borrowers.

The Consumer Financial Protection Bureau last fall indicated it

"It's a substantial problem" that could involve thousands, if not a million or more, borrowers, said Sarah Mancini, an attorney at the National Consumer Law Center in Boston, which issued a report on the matter in mid-March.

Successors might not be deemed legal borrowers if their names are not on the promissory notes, and this can threaten their right to homes unless they can prove that they have inherited or otherwise been given ownership. Many servicers make that process needlessly complex, the report said.

Some reforms have been enacted governing

The ownership question compounds common mod complications that regulators already have in their sights, such as

To overcome the problem, successors often have to hire aggressive lawyers to cut through red tape — meaning most cash-strapped successors seeking mods have low odds of success.

In one example in the report, a woman who was granted a property in a divorce from an abusive husband could not get a mod she applied for after JPMorgan Chase put in her name. Chase accepted a deed in her name; but the bank was said to have insisted on her ex-husband's signature for the modification.

JPMorgan declined to comment on the loan. The loan's servicing has since been transferred from JPMorgan to Nationstar and is in foreclosure, according to Ainat Margalit, a senior attorney in LAF's Consumer Practice Group in Chicago who represents the woman.

Nationstar Mortgage in Coppell, Texas, confirmed it has received the loan and the modification is in the ex-husband's name, but disputed the status of the loan.

"The loan is not in foreclosure," Nationstar spokeswoman Christen Reyenga said. "We just need to work with her to handle the modification request and work out paperwork to get everything straight."

It would be in servicers' self-interest to fix the current system, Mancini said. If successors qualify for modifications under commonly used net present value tests, the servicer would save money by granting the mods and avoiding costly foreclosures, she added.

But right now there is little in CFPB regulations to specifically protect people like widows or widowers who inherit property, or divorcees who receive it, other than

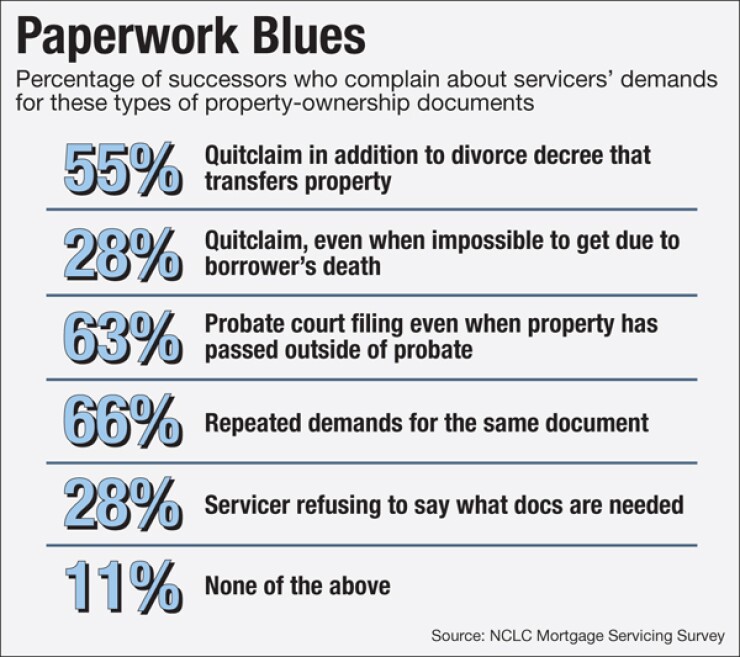

Many successors surveyed by NCLC complained that it was hard to communicate with servicers and to get them to accept documentation commonly used to establish ownership. A death certificate and a deed that shows that the survivor gets the property in question should be sufficient, Mancini said. Instead servicers often request unnecessary documents that are hard to find, she said.

If the CFPB's

In addition to clear rules, servicers might benefit from better training in determining which documents are sufficient to establish ownership, and from incentives for providing good customer service, Mancini said.

She acknowledged that resources for training and incentive pay are limited at many companies, but any solution "gets back to the way servicers are compensated and what their incentives are," she said.