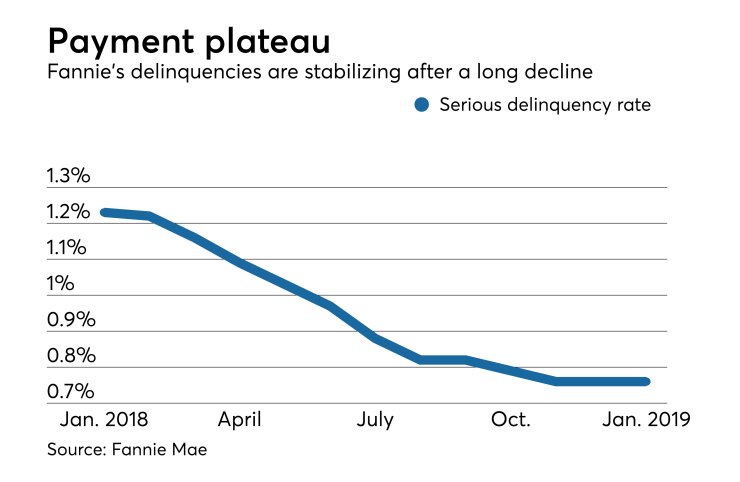

Fannie Mae's serious delinquency rate stood firm for the third month running, adding to evidence that it has hit a floor after dropping for most of the past year.

The government-sponsored enterprise's single-family serious delinquency rate stood firm at 0.76% in January, matching its serious delinquency rate in November and December of last year, despite expectations that there would be upward pressure on delinquencies from a

In January 2018, Fannie's serious delinquency rate was 1.23%.

In comparison, Freddie Mac's single-family serious delinquency rate ticked slightly up in January. Freddie's delinquency rate was 0.7% during the month, up from 0.69% in December 2018, but down from 1.07% in January of last year.

Freddie's delinquency rate dropped each month last year except between September and October. It was 0.73% both months.

The market has been expecting an eventual uptick in single-family delinquencies after a long-run of relatively higher rates in the past year. Higher rates historically have put strain on underwriting as lenders make more allowances for exceptions to offset declines in rate-driven refinancing.

Also factors in Fannie and Freddie's overall single-family delinquency rates are poorer-performing 2005-2008 vintage loans, which run off as they age, and a long run of particularly tight underwriting in more recent years.

The multifamily delinquency rate at both GSEs remains very low, but it increased slightly at Fannie in January to 0.07% from 0.06% the previous month. A year ago, Fannie's multifamily delinquency rate was 0.11%.

Freddie Mac's multifamily delinquency rate was 0.01% in January. It has been at this level since April of last year. A year ago, it was 0.02%.