Capital is king in a marketplace where compliance rules the day. Higher compliance costs and fewer originations take their toll on mortgage loan officers' earning potential, so where an MLO works has a greater impact than ever before on what he or she is able to achieve. As the purchasing market heats up, the earnings advantage will go to MLOs who are backed by mortgage lenders that have a strong brand, deep pockets and an

Brokers and smaller lenders have lost the competitive advantages they enjoyed prior to the Dodd-Frank Act. Many MLOs are being asked to do more, and are often working much harder but earning less. The latest Dodd-Frank requirement, the integrated mortgage lending disclosure rules issued by the CFPB, went into effect on Oct.3 and instituted new standards for lenders in communicating with consumers.

These latest changes require lenders to adapt systems and internal processes to follow new guidelines, but it is mortgage loan officers who carry the front-line burden of managing expectations, educating consumers and handling the mortgage process. Since maintaining compliance has been, and will continue to be, a moving target, many MLOs are facing serious considerations regarding their careers and their futures.

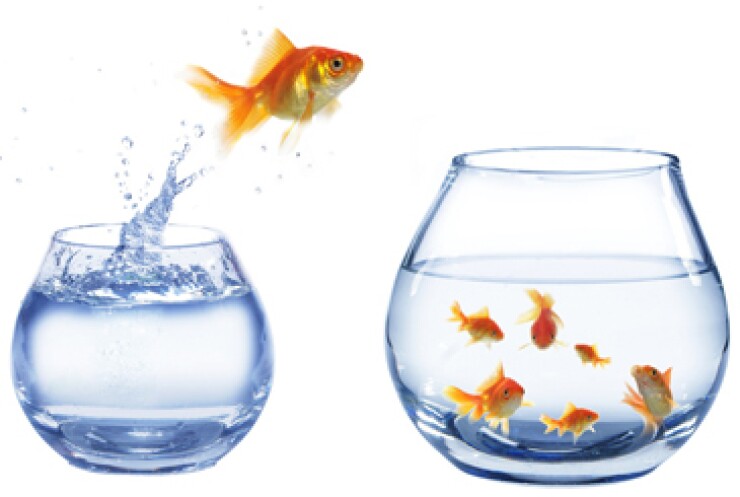

Today's MLOs operate in a dramatically different mortgage industry than that of yesteryear. As expensive investments in compliance infrastructure force many lenders to cut operations staff, the roles of many MLOs employed at mortgage brokers or smaller lenders have grown to include loan origination and processing. Additionally, the reality of decreased origination volume and aggressive pricing on loans has made closing speed crucial in a purchase market. However, many MLOs who have increased workloads and less support find that closing loans on time has become even more challenging. Earning potential has been affected and MLOs' personal growth has suffered.

Loan officers also face additional costs of doing business as a result of necessary compliance. Since 2010, when necessary changes to licensing requirements took effect, loan officers working at mortgage brokers or non-federally chartered mortgage lenders have felt the sting of time-consuming

All responsible lenders know that the requirements implemented by the Consumer Financial Protection Bureau are designed to protect consumers and to provide necessary regulatory control to prevent unscrupulous lending practices. Unfortunately, for mortgage loan officers whose employers lack supportive infrastructure and the flexibility to create competitive market-driven mortgage products, the burdens of compliance rest squarely on those MLOs' shoulders.

Kevin Gillen is a general manager of residential mortgage at TD Bank.