-

Fannie Mae and Freddie Mac will add loan-level buydown data to MBS this spring, giving investors clearer insight into prepayment risk tied to temporary rate incentives.

February 13 -

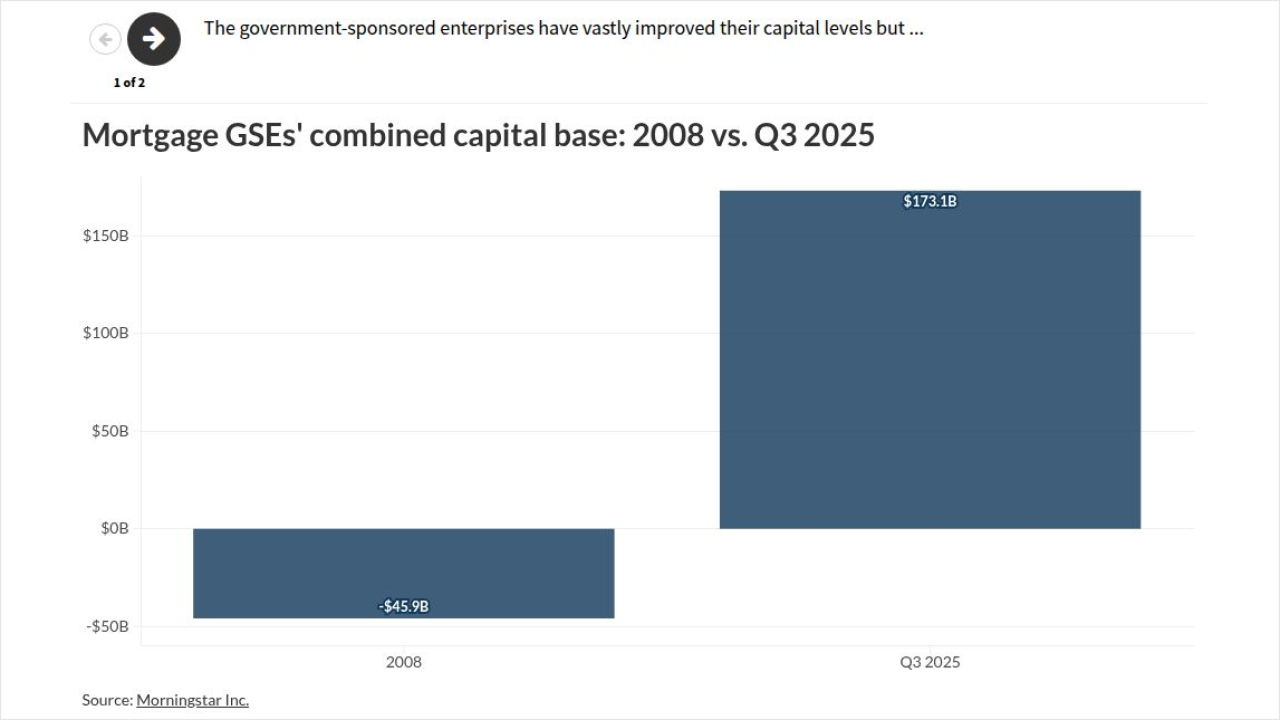

A House subcommittee hearing discussing the future of the government-sponsored enterprises, noted both are still severely undercapitalized.

February 12 -

-

The company formerly known as Ocwen confirmed that a deferred tax asset valuation helped boost net income to common shareholders despite servicing challenges.

February 12 -

The Federal Housing Finance Agency and Ginnie Mae agreed to look more closely at credit line use, according to the Government Accountability Office.

February 12 -

Adjustments related to higher credit risk weights for new acquisitions and rate shifts offset increases in the government-sponsored enterprise's core earnings.

February 11 -

Zillow Group Inc. forecast first-quarter profit that falls short of analyst estimates as the home-search site balances legal costs from ongoing litigation and expenses from the company's partnership with Redfin.

February 11 -

Federal Housing Finance Agency Director Bill Pulte said in a social media post that action was imminent amid Trump administration antitrust investigations.

February 11 -

As mortgage rates sank to near 6% in January, consumers looked to do rate-and-term refinances, while originators offered more ARMs and cash-out loans.

February 10 -

The rate impact has been real, but the capital implications do little to change all the "moving parts" in plans for the government-sponsored enterprises.

February 10