-

Loans originated in the third quarter were among the highest in credit quality since 2000, according to CoreLogic.

December 20 -

While depository mortgage lenders should exercise some caution before welcoming trended data and alternative credit scoring into their process, they must become inclusive or face losing market share to newer industry players like SoFi.

December 16 Sapient Global Markets

Sapient Global Markets -

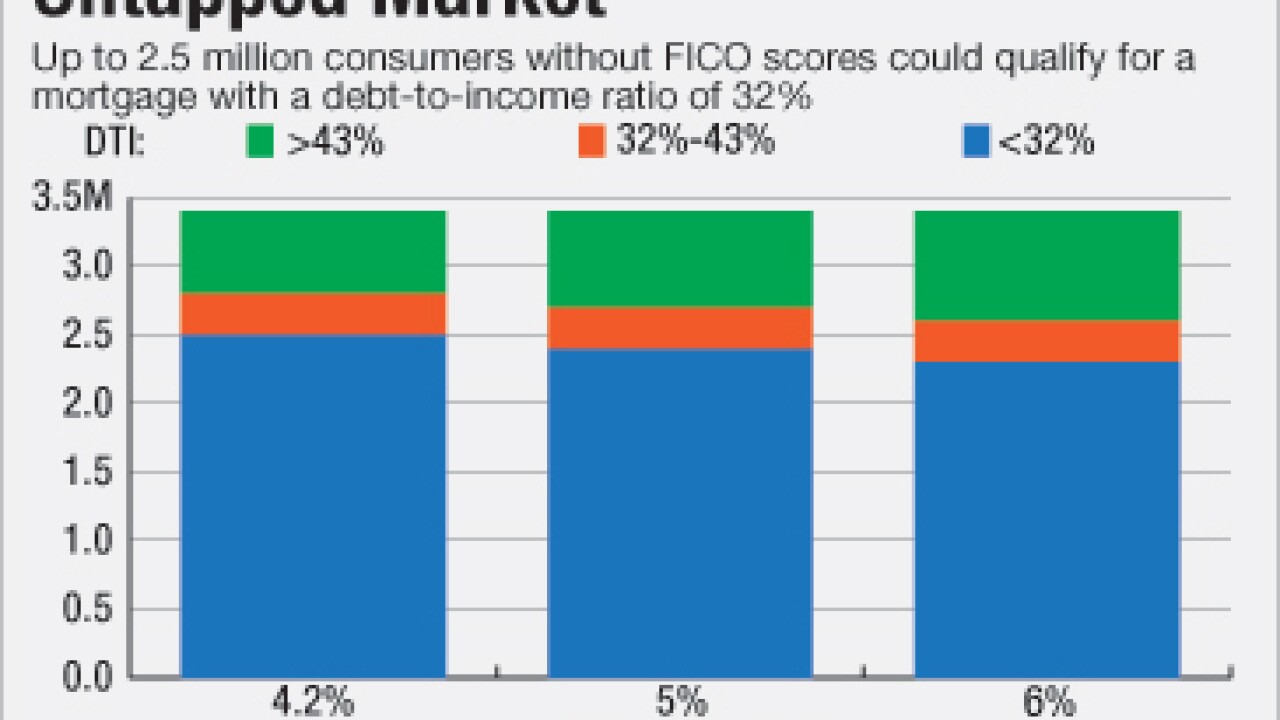

Many consumers without traditional credit scores have nearly identical risk profiles to those who can be assessed the conventional way, representing an untapped market, according to a report by VantageScore.

December 12 -

Data aggregation and analytics platform provider Envestnet-Yodlee has created a new automated mortgage asset verification product.

December 9 -

The Mortgage Industry Standards Maintenance Organization is proposing a standard for the maintenance and sharing of commercial and multifamily real estate rent-roll information.

December 9 -

Donald Trumps stunning upset in the presidential race is likely to embolden his followers to push for changes to Internet law that could significantly alter how financial technology is conceived, built and delivered to market.

November 9 -

Equifax Workforce Solutions has been selected as a designated vendor for Fannie Mae's Desktop Underwriter validation service.

October 24 -

Roostify plans to connect its automated mortgage decisioning platform with employment and income data from Equifax.

October 21 -

ClosingCorp has rebranded its Loan Estimate and Good Faith Estimate products as a single service, SmartFees.

October 20 -

Lenders and servicers haven't faced the same scrutiny over data security as their peers in retail and other financial services sectors. But mortgage companies must remain vigilant, as the extensive data they collect can expose consumers to identity theft if it got in the wrong hands.

October 18 -

First American Financial Corp. has acquired post-closing services and document management technology provider TD Service Financial Corp.

October 11 -

Automated underwriting and compliance services provider LoanScorecard has released a new product and pricing engine for portfolio lenders and originators.

October 6 -

With the myriad home price indices available to the mortgage industry, it's difficult to determine which offers the most cost-effective insights about a particular market. Granularity is a key selling point, but not a one-size-fits-all solution.

October 6 -

The jury is still out on whether new sports stadiums are economic engines for their communities. But when it comes to housing alone, new stadiums are a boon for local home sales, but don't always contribute to home price appreciation.

September 27 -

Sperlonga Data & Analytics has begun reporting homeowner and condominium association payments and account statuses to Equifax.

September 27 -

Now that Fannie Mae requires trended data credit reports for its automated underwriting system, will other secondary market players follow suit? If so, how soon?

September 26 -

The granular data and quick decisions that can help field a winning fantasy football team have a lot in common with the analytics tools that mortgage lenders use to monitor and evaluate their operations.

September 23 -

First American Financial Services has reached an agreement to acquire RedVision Systems, one of the largest independent providers of title and property research nationwide.

September 6 -

Appraisal management software company Mercury Network has entered into an agreement to acquire valuation data and analytics services provider Platinum Data Solutions.

August 25 -

Mortgage portfolio retention strategies typically focus on proactively approaching borrowers who can benefit from refinancing. But companies are increasingly using enhanced analytics to further segment their customer base and identify borrowers on the cusp of buying a new home.

August 15