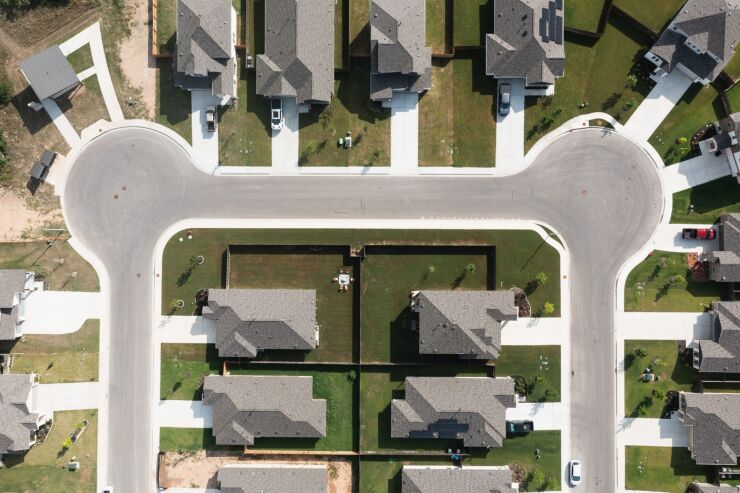

Austin, Texas, the hottest U.S. pandemic boomtown, is suddenly losing popularity with out-of-town home shoppers.

It’s a rapid shift, brought on by the spike in mortgage rates and a fear among buyers of overpaying in a slowing market.

In April and May, inbound interest in Austin homes — also factoring in residents seeking to leave the metropolitan area — fell to a fifth of its level a year earlier, according to an analysis of searches on the Redfin listings site. While the number of people looking to move into Austin still topped those seeking to leave, it had the biggest drop-off among the boomtowns, followed by Orlando, Florida, Atlanta and Dallas.

“There’s this sentiment that Austin was exuberant and grew too fast,” said Taylor Marr, the brokerage’s deputy chief economist. “Nobody wants to catch a falling knife.”

The Texas capital, where prices have skyrocketed throughout the pandemic, no longer looks like a bargain for house hunters from California and other high-cost areas, especially as higher mortgage rates cut into their buying power. It hasn’t helped that stock and cryptocurrency portfolios have gotten hammered.

With a population of more than 2 million, the Austin metro area is still a job magnet, with

Inventory in Austin, while still low, is climbing and home shoppers are pulling back, waiting for prices or mortgage rates to fall before jumping in again, said Patrick McGinley, broker associate at Keller Williams.

“I don’t have as many out-of-state buyers as I had,” McGinley said. “Some of them decided to just stay and rent because they’re worn out.”

Another Austin broker, Eric Bramlett, sees the slowdown as temporary — that buyers will come back as companies like Tesla Inc., Alphabet Inc.’s Google and Samsung Electronics Co. open new factories and offices. Texas remains attractive because of its business-friendly environment with no personal income tax, he said.

“People tend to overreact to things,” Bramlett said. “They’re frustrated and they’re not going to make a move now because rates went up.”

In Orlando, where a rebound in travel has brought crowds back to Disney World, out-of-town home searches have also slumped. But demand has cooled only slightly, with the supply thin and bidding wars still common, said Christine Elias, an agent with Coldwell Banker Realty in nearby Winter Park.

Locals who’ve gotten the green light from employers to work from home permanently are upgrading to larger houses, selling their existing homes and plowing the profits into buying the next one, she said.

It’s a different story for some investor clients from New York and New Jersey who were buying condos in the area until rates took off earlier this year. With borrowing costs now cutting into profits, some investors dependent on financing are pulling back, she said.

“Homes are sitting longer than they did a year ago because sellers are overpricing,” Elias said. "But there's huge demand."