San Francisco is making it easier to turn empty office buildings into homes, a move aimed at easing the city's

Voters

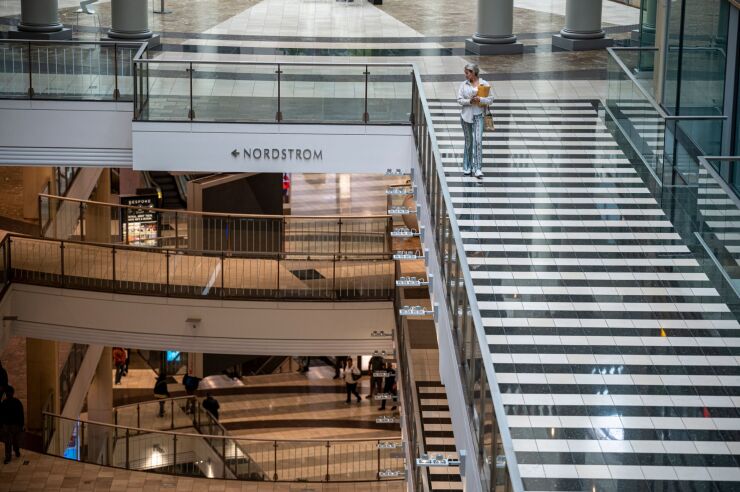

The measure comes as the tech sector, a key to San Francisco's economy, has scaled back its presence and workforce since the pandemic. Major companies, such as Meta Platforms Inc. and Salesforce Inc., have reduced their real estate footprint, allowing employees to work from home or relocate. San Francisco's commercial vacancy hit a record

Breed said the initiative would help transform the city's downtown from a 9-to-5 business district to an around-the-clock mixed-use neighborhood.

"San Francisco's downtown is undergoing a period of change — and there is a tremendous opportunity to attract investment and excitement in the future of what downtown can be," she said in a statement.

This month's announcement of Macy's Inc.'s plan to close its flagship Union Square store — part of the company's broader national downsizing — marked another significant departure from the city's retail landscape.

Breed has been a vocal advocate of finding innovative uses of spaces, even suggesting last year that a soccer stadium could

San Francisco stands out for its potential to convert office buildings to housing, compared with other cities, because of the buildings' shape and size, ceiling height and proximity to public transit, proponents say.

In a

However, San Francisco's stringent planning and building codes, along with high construction costs, pose significant hurdles to such projects, rendering many of them financially unfeasible.

Still, technical challenges abound in converting offices to homes and skeptics argue that the potential is overblown. According to a separate

Further complicating the matter, a

"Most of the job losses would be concentrated in office-using industries, which are major contributors to the city's GDP, while gains would be recorded in construction, government, and local-serving industries," according to the report.

To date, only a handful of office-to-housing conversions have materialized in the city, including a three-story building in the Tenderloin district that was recently transformed into 56 apartment units. One project to transform San Francisco's historic Warfield Building has recently been approved, with construction slated to begin early this year.