-

A $28 billion agreement with the National Community Reinvestment Coalition could help win regulatory approval for the acquisition of Michigan-based Flagstar Bancorp. The deal was originally expected to close last year.

By Jon PriorJanuary 24 -

The Conference of State Bank Supervisors abandoned a lawsuit against the Office of the Comptroller of the Currency that had challenged the San Francisco fintech's effort to become a national bank without deposit insurance. The company recently amended its application to drop that controversial element.

By Jon PriorJanuary 14 -

The state Department of Financial Protection and Innovation issued a cease-and-desist order against Nano Banc, saying the troubled bank violated an earlier consent agreement when it replaced five board members and appointed a new CEO without the regulator’s permission.

By Jon PriorDecember 21 -

Alternative lenders, which often use aggressive underwriting tactics to generate high returns, were closing in on banks even before the pandemic. Now they've pulled ahead.

By Jon PriorNovember 18 -

Advocates negotiating with the Minneapolis bank also want commitments for mortgage assistance and payouts to financial nonprofits. The pressure for Federal Reserve hearings coincides with Biden administration calls for more scrutiny of big bank mergers.

By Jon PriorNovember 15 -

Companies using only a person’s name and not other identifiers to screen job and tenant applications can produce inaccurate information, according to the bureau. The agency's advisory opinion said such practices violate the Fair Credit Reporting Act.

By Jon PriorNovember 4 -

The Alabama company agreed to buy two nonbank lenders earlier this year. It’s still on the lookout for possible deals, potentially in corporate finance or wealth management, its chief financial officer told American Banker.

By Jon PriorOctober 22 -

An Indiana housing nonprofit wants the Fed to take a closer look at the proposed merger. Its latest move is a lawsuit that alleges racial discrimination by the regional bank.

By Jon PriorOctober 7 -

After exiting the business roughly 20 years ago, the San Antonio bank is working with tech consultant Infosys to help it build out a digital consumer lending business that will include home loans.

By Jon PriorSeptember 16 -

The Houston company has agreed to pay a $3 million penalty, provide $4 million in loan subsidies to new borrowers and make other investments aimed at improving home buying opportunities for Black and Hispanic households.

By Jon PriorAugust 30 -

The COVID-19 pandemic has exacerbated income inequality in America, and that has implications for banks and other lenders. Among those suffering most: renters, front-line workers and minority small-business owners.

By Kevin WackAugust 23 -

The acquisition of Florida-based Service Finance Co. would expand the North Carolina bank’s presence in the point-of-sale lending business.

By Jon PriorAugust 10 -

In late July, the Justice Department notified the Houston bank of a potential lawsuit alleging violations between 2013 and 2017, according to a securities filing. Cadence said that its prospective merger partner, BancorpSouth, supports the settlement discussions.

By Jon PriorAugust 2 -

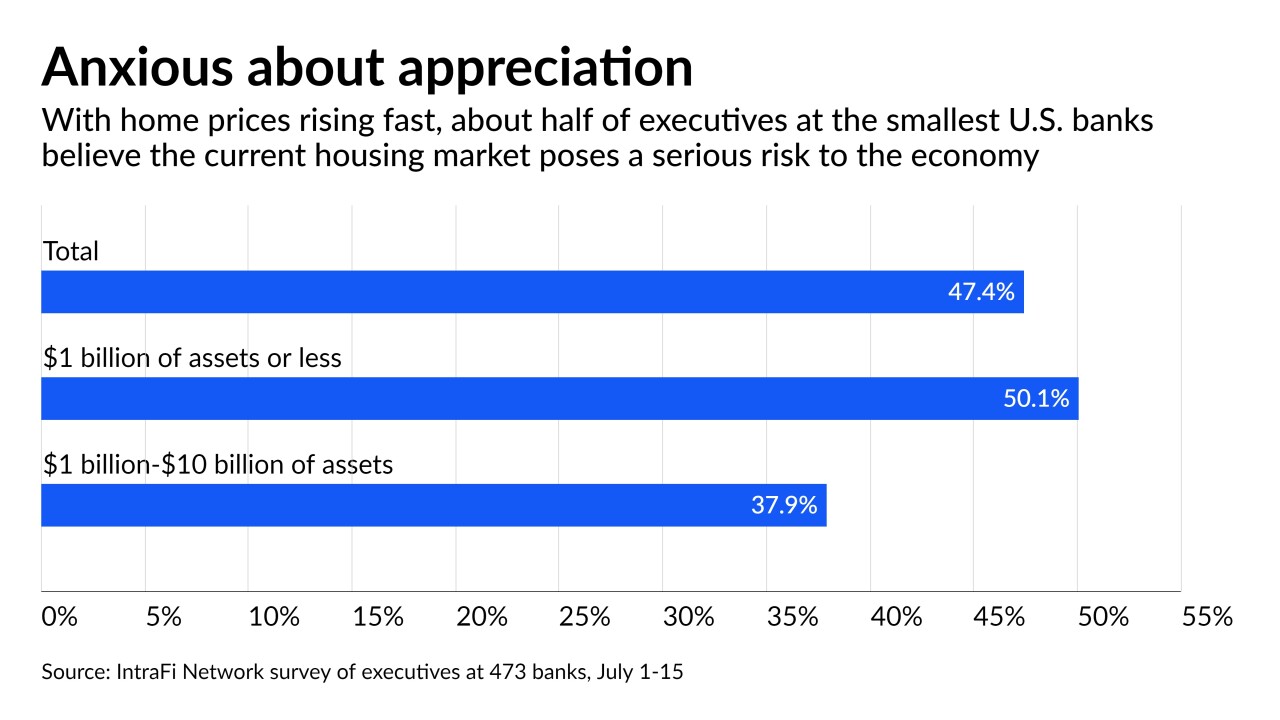

The very smallest banks, whose numbers shrank during the financial crisis, were most likely to express concern that the housing market will imperil the broader economy.

By Jon PriorJuly 27 -

The White House is calling on the Department of Justice and federal regulators to give bank deals more scrutiny as part of a broader executive order meant to encourage competition across the U.S. economy.

By Jon PriorJuly 9 -

The company expects loan growth in the “mid-teens” this year, despite concerns that a housing supply crunch could stymie new mortgage originations. “As soon as COVID fades into the background we'll pick up volume,” CEO and Chairman Jim Herbert said.

By Jon PriorApril 14 -

Already contending with stressed retail, hotel and restaurant loans, bankers are beginning to view office lending — historically a safe bet — as increasingly risky as companies of all types rethink their space needs.

By Jon PriorFebruary 28 -

The industry legend turned around a struggling Minneapolis company and even escaped a kidnapping to build the firm that is now the nation’s fifth-largest bank.

By Jon PriorJanuary 28 -

The recent stimulus law’s relief for renters and extension of the federal eviction ban were meant to ward off a housing crisis. But owners of 1- to 4-unit dwellings still face mounting mortgage and property tax debts, and delinquencies could start rising soon — followed by foreclosures.

By Jon PriorJanuary 4 -

Bank and credit union groups are pushing to include the industry’s front-line workers in the next priority group, but even as a recommendation is coming soon from a CDC advisory panel, the decision ultimately will be made state by state.

By Jon PriorDecember 18