Kate Berry has covered the Consumer Financial Protection Bureau for American Banker since 2016. She joined the publication in 2006 covering mortgage lending and the financial crisis. Berry also has covered big banks including Bank of America, J.P. Morgan Chase and Wells Fargo. She has won five awards from the Society of American Business Writers and Editors, and has worked at several news organizations including the Orange County Register, the Los Angeles Business Journal and the Associated Press. Berry began her career as a clerk at the New York Times.

-

Mortgage servicers have failed to make significant investments in technology and compliance systems, resulting in substantial harm to consumers, according to a report issued Wednesday by the Consumer Financial Protection Bureau.

By Kate BerryJune 22 -

Mortgage lenders, debt collectors and credit card companies have borne the brunt of the Consumer Financial Protection Bureau's public enforcement actions over the past four years, yet banks have paid the most in penalties and restitution, according to a new study released by an agency insider.

By Kate BerryJune 14 -

The Consumer Financial Protection Bureau will propose changes in late July to its mortgage disclosure rule to provide "greater certainty and clarity" to the mortgage industry.

By Kate BerryApril 28 -

Consumer Financial Protection Bureau Director Richard Cordray sent a four-page response to Sen. Bob Corker, R-Tenn., about new mortgage disclosures but fell short of providing any new official guidance to address industry concerns.

By Kate BerryApril 27 -

The Consumer Financial Protection Bureau is expected to finalize its second round of mortgage servicing rules in July, a top agency official said. Laurie Maggiano, a program manager for servicing and secondary markets at the CFPB, also offered insights into the bureau's long-anticipated rulemaking on debt collection.

By Kate BerryApril 21 -

A federal appeals panel appeared receptive to striking two works from the Dodd-Frank Act that says the CFPBs director can be removed for cause. Heres what that would mean.

By Kate BerryApril 19 -

Congress should consider giving direct authority over nonbank mortgage servicers to the Federal Housing Finance Agency, according to a report released Monday by the Government Accountability Office. The report said there should be "parity" among financial regulators in the oversight of regulated entities and third parties they do business with.

By Kate BerryApril 11 -

The U.S. Court of Appeals for the D.C. Circuit will hear oral arguments Tuesday about the Consumer Financial Protection Bureau's structure, in a case that has national implications. Even though a ruling isn't expected until the end of the year, legal experts say there are four major legal issues involved.

By Kate BerryApril 11 -

Two appeals court judges raised constitutional questions Monday about the structure of the Consumer Financial Protection Bureau in the agency's case alleging that PHH Corp. accepted illegal kickbacks.

By Kate BerryApril 5 -

Debt collection, credit reporting and mortgages topped the list of complaints to the Consumer Financial Protection Bureau last year, the agency said Friday.

By Kate BerryApril 1 -

To hear some former examiners tell it, companies that are hostile during the exam process may get dinged more often than those that show respect and professionalism. Following are tips to ensure bankers do better on their next exam.

By Kate BerryMarch 15 -

Oversight of the four largest mortgage servicers' compliance with the national mortgage settlement is officially over, the watchdog overseeing the process said Thursday.

By Kate BerryMarch 3 -

The Consumer Financial Protection Bureau has not named a permanent deputy director since July. Given the contentious political battle over Richard Cordray's recess appointment and ultimate confirmation by the Senate in 2013, some former officials say it may wait until after the election to make a choice. Here's why.

By Kate BerryFebruary 26 -

Bank of America on Monday will launch a 3% down payment home loan in partnership with Freddie Mac, but the bank will not retain any risk if the loans default. Thats because it will immediately will sell the loans and servicing rights to Self-Help Federal Credit Union, a Durham, N.C., community development lender that's on a mission to put more low- and moderate-income families into homes of their own.

By Kate BerryFebruary 22 -

The decision in Yvanova v. New Century Mortgage Corp. has the potential to radically increase the number of lawsuits brought by borrowers, particularly on loans that were pooled into securitized trusts.

By Kate BerryFebruary 18 -

Lenders are still holding on to scores of delinquent mortgages that date to the real estate crash, but a surge in home values across the country is motivating them to move the most troublesome loans off their books more quickly.

By Kate BerryFebruary 18 -

Freddie Mac on Thursday reported strong fourth quarter and year-end profits driven by a surge in demand for both home purchase and apartment loans.

By Kate BerryFebruary 18 -

Fannie and Freddie have been selling pools of delinquent mortgages at auction to the highest bidders. Community groups say the Federal Housing Finance Agency should be giving preferential treatment to nonprofits and community development financial institutions.

By Kate BerryFebruary 12 -

Many institutional investors are refusing to purchase mortgages loans until they get assurance from the CFPB that they won't have to pay for others' mistakes. Their pullback could further the slow the issuance of private-label mortgage bonds this year, a huge concern at a time when the majority of home loans are insured by Fannie, Freddie and the FHA.

By Kate BerryFebruary 9 -

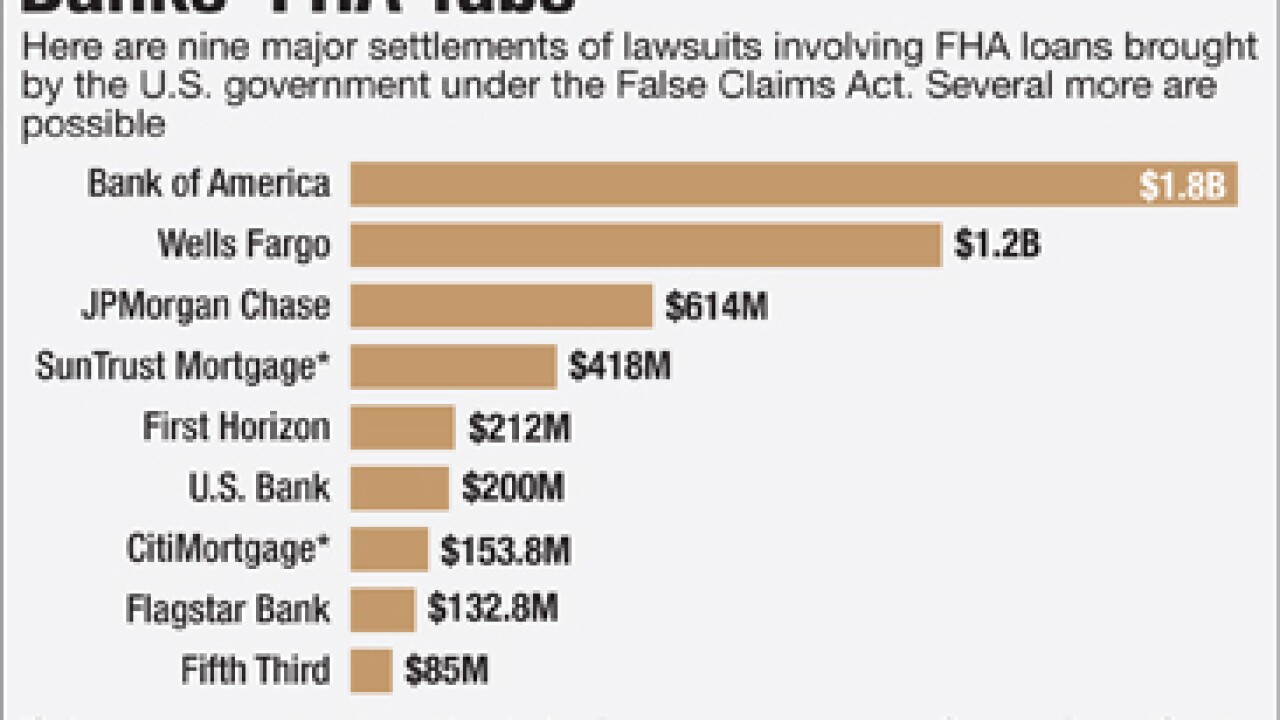

Wells Fargo's tentative agreement to pay $1.2 billion to resolve claims by the Justice Department that it made shoddy FHA loans is bad news for other banks that are the targets of similar probes.

By Kate BerryFebruary 3