Kate Berry has covered the Consumer Financial Protection Bureau for American Banker since 2016. She joined the publication in 2006 covering mortgage lending and the financial crisis. Berry also has covered big banks including Bank of America, J.P. Morgan Chase and Wells Fargo. She has won five awards from the Society of American Business Writers and Editors, and has worked at several news organizations including the Orange County Register, the Los Angeles Business Journal and the Associated Press. Berry began her career as a clerk at the New York Times.

-

To hear some former examiners tell it, companies that are hostile during the exam process may get dinged more often than those that show respect and professionalism. Following are tips to ensure bankers do better on their next exam.

By Kate BerryMarch 15 -

Oversight of the four largest mortgage servicers' compliance with the national mortgage settlement is officially over, the watchdog overseeing the process said Thursday.

By Kate BerryMarch 3 -

The Consumer Financial Protection Bureau has not named a permanent deputy director since July. Given the contentious political battle over Richard Cordray's recess appointment and ultimate confirmation by the Senate in 2013, some former officials say it may wait until after the election to make a choice. Here's why.

By Kate BerryFebruary 26 -

Bank of America on Monday will launch a 3% down payment home loan in partnership with Freddie Mac, but the bank will not retain any risk if the loans default. Thats because it will immediately will sell the loans and servicing rights to Self-Help Federal Credit Union, a Durham, N.C., community development lender that's on a mission to put more low- and moderate-income families into homes of their own.

By Kate BerryFebruary 22 -

The decision in Yvanova v. New Century Mortgage Corp. has the potential to radically increase the number of lawsuits brought by borrowers, particularly on loans that were pooled into securitized trusts.

By Kate BerryFebruary 18 -

Lenders are still holding on to scores of delinquent mortgages that date to the real estate crash, but a surge in home values across the country is motivating them to move the most troublesome loans off their books more quickly.

By Kate BerryFebruary 18 -

Freddie Mac on Thursday reported strong fourth quarter and year-end profits driven by a surge in demand for both home purchase and apartment loans.

By Kate BerryFebruary 18 -

Fannie and Freddie have been selling pools of delinquent mortgages at auction to the highest bidders. Community groups say the Federal Housing Finance Agency should be giving preferential treatment to nonprofits and community development financial institutions.

By Kate BerryFebruary 12 -

Many institutional investors are refusing to purchase mortgages loans until they get assurance from the CFPB that they won't have to pay for others' mistakes. Their pullback could further the slow the issuance of private-label mortgage bonds this year, a huge concern at a time when the majority of home loans are insured by Fannie, Freddie and the FHA.

By Kate BerryFebruary 9 -

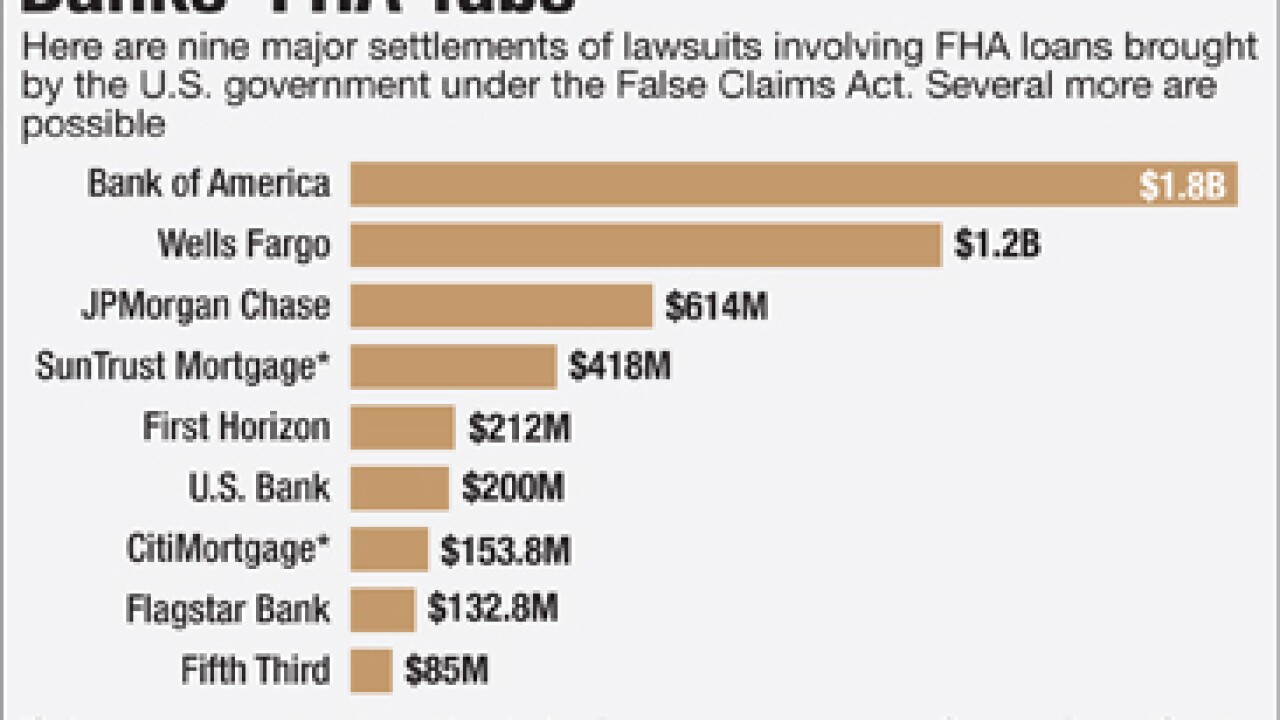

Wells Fargo's tentative agreement to pay $1.2 billion to resolve claims by the Justice Department that it made shoddy FHA loans is bad news for other banks that are the targets of similar probes.

By Kate BerryFebruary 3 -

Ocwen Financial Corp. will pay $2 million to settle charges that it misstated its financial results in valuing complex mortgage assets, said the Securities and Exchange Commission.

By Kate BerryJanuary 20 -

The Department of Housing and Urban Development has rejected a nonprofit housing group's allegations of racial discrimination against U.S. Bank. HUD found that the bank properly maintain foreclosed homes in predominantly black and Hispanic neighborhoods and in some cases spent more rehabilitating the homes than in white areas.

By Kate BerryJanuary 13 -

Independent mortgage lenders are expecting a wave of consolidation prompted by excessive compliance costs, a tepid housing recovery and the need for more capital to grow their businesses. Roughly 20% to 25% of independent companies could be eliminated or change hands in less than two years.

By Kate BerryJanuary 13 -

A recent tax change will provide more stability to banks and developers that use the low-income housing tax credit program, and the supply of below-market-rate apartments should increase as a result. But it's not enough to create the economic incentives needed to meet skyrocketing demand for affordable housing in the U.S.

By Kate BerryJanuary 8 -

Some lenders have asked whether the bureau would adjust its so-called resubmission guidelines which determine whether lenders have to refile data based on errors found in samples and it has responded with a request for further industry input.

By Kate BerryJanuary 8 -

The more aggressive nonbank lenders are attracting top producers by essentially allowing loan officers to set their own rate of pay. While so-called "pick-a-pay" compensation plans are not illegal, critics say they can encourage loan officers to steer consumers into more expensive loans in order to increase their own pay.

By Kate BerryJanuary 6 -

Fannie Mae and Freddie Mac are telling lenders that they are willing to retain loans with defects if they believe the defects are minor and can be fixed. But Freddie is one-upping Fannie by offering to retain such loans without charging lenders a fee.

By Kate BerryDecember 23 -

Existing-home sales plummeted in November confirming fears in the mortgage industry that a new consumer disclosure rule is delaying mortgage closings.

By Kate BerryDecember 22 -

Some mortgage investors are refusing to buy home loans that are at risk of violations of new consumer-disclosure rules. The problem appears to be worst among nonagency jumbo loans purchased by private investors.

By Kate BerryDecember 21 -

Rising rates could slow the runoff from refinancings and add stickier purchase loans to servicers' portfolios. That's the good news.

By Kate BerryDecember 21