-

Though there is still a year for mortgage lenders to get in compliance with the Consumer Financial Protection Bureau's document changes, the perils of missing that deadline are considerable.

By Mark FogartyAugust 13 -

Selling loans into the secondary market was a good strategy for housing finance agencies when rates were falling, but now they are said to be heading back to traditional bond financings to boost their balance sheets.

By Mark FogartyAugust 8 -

Another roundup of comments on our Editor at Large blog, from the best and brightest to the funniest.

By Mark FogartyAugust 5 -

The CFPB and other regulators are showing an increasing appetite for big data. The HMDA database may be the biggest in the mortgage business and a preview of the upcoming dataset may give lenders a chance to stay one step ahead of the feds.

By Mark FogartyJuly 28 -

Mentoring the newbies in the mortgage business may help them avoid boom-and-bust errors later in their careers. And it can be a personally satisfying thing to do as well.

By Mark FogartyJuly 22 -

A nonprofit housing group has found an ambitious middle ground between those who oppose any change to the mortgage interest deduction untouched and those who say it must go.

By Mark FogartyJuly 8 -

Though probably not endangered this year, low-income housing tax credits have been suggested for elimination often enough to alarm those who work with this important financing source for multifamily construction.

By Mark FogartyJuly 2 -

Unless the industry is content to be a boutique player with a hugely smaller pool of potential borrowers, it had better emulate the Fed and ease on down the road.

By Mark FogartyJune 26 -

Competition from site-built homes and distressed sales, the limited availability of conforming mortgages, and an underdeveloped secondary market have prolonged a slump in manufactured housing that started in 1998.

By Mark FogartyJune 23 -

Among the revelations: A large number of single-family homes built in 2013 weren't sold that year; single-family units, surprisingly, kept getting bigger; cash sales remain higher than before the recession.

By Mark FogartyJune 13 -

Though the bulk of the ambitious Housing New York plan is intended to build or rehabilitate rentals, there are several homeownership components as well.

By Mark FogartyJune 10 -

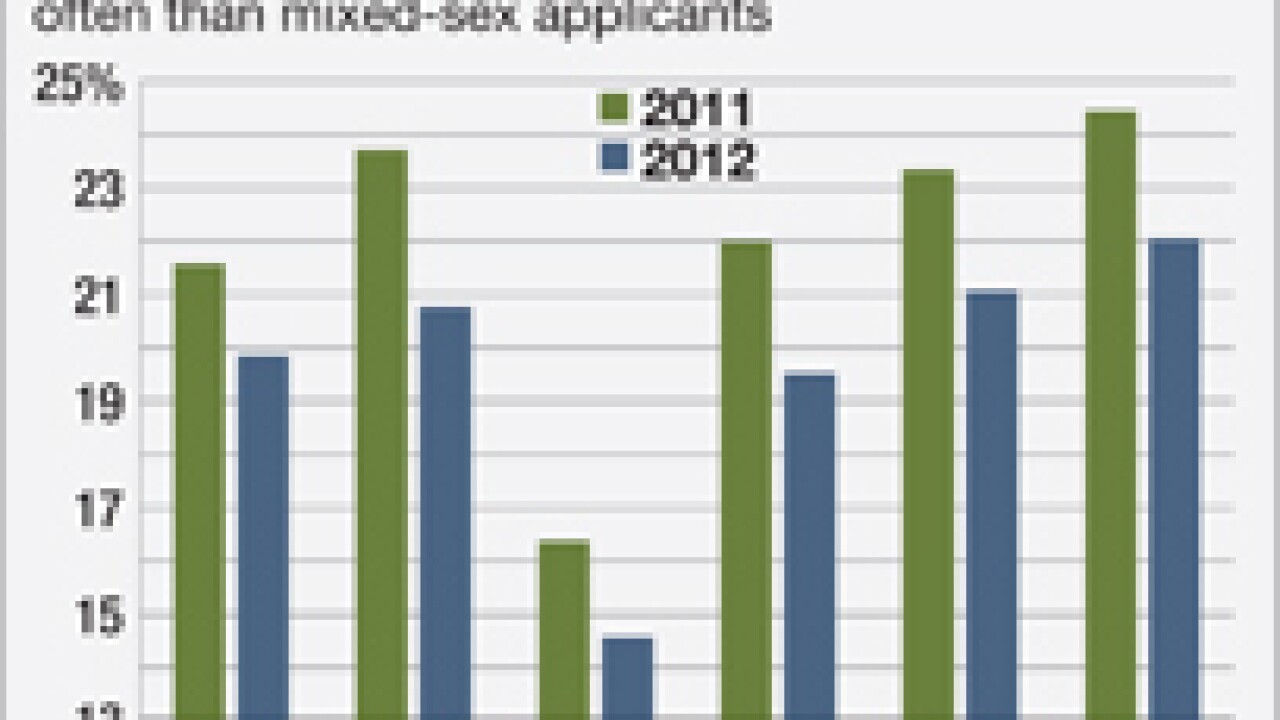

While lenders do not survey applicants on sexual orientation for their Home Mortgage Disclosure Act reports, a look at the data on same-sex couple applicants is intriguing.

By Mark FogartyJune 4 -

It could take quarters or years. It may require fatter yields to entice investors, or move-up homebuyers in need of jumbo loans. This much is agreed upon: Nobody really knows.

By Mark FogartyMay 27 -

Mortgage lenders may have managed to learn about hashtags and followers, but streaming audio and podcasts are still pretty mysterious to them.

By Mark FogartyMay 23 -

The mortgage life support provided by the federal government since the crash is ebbing. It will be interesting to see if the industry can breathe on its own now.

By Mark FogartyMay 19 -

There will be enough grist for the NPL mill for at least three more years, industry insiders say.

By Mark FogartyMay 13 -

Proposed reforms for Freddie Mac and Fannie Mae seem to be bogged down in the House and Senate. It might be time for legislators to start thinking about different solutions.

By Mark FogartyMay 8 -

A roundup of comments on our Editor at Large blog, from the best and brightest to the not-so-bright.

By Mark FogartyMay 2 -

The proposed federal mortgage guarantor in the Senate reform bill needs 5% hard equity to protect taxpayers, but 10% capital to pass Congress, the Housing Policy Council's John Dalton reckons.

By Mark FogartyApril 30 -

As servicers began modifying staggering numbers of mortgages, they took control and implemented stringent underwriting practices that will serve as a model for all mortgage underwriting in the future.

By Mark FogartyApril 23