-

Collaboration will allow buyers to tap state assistance for down payment, closing costs.

March 24 -

Changes in the housing market are creating new opportunities and challenges for credit unions, including how they market themselves to potential borrowers.

February 14 -

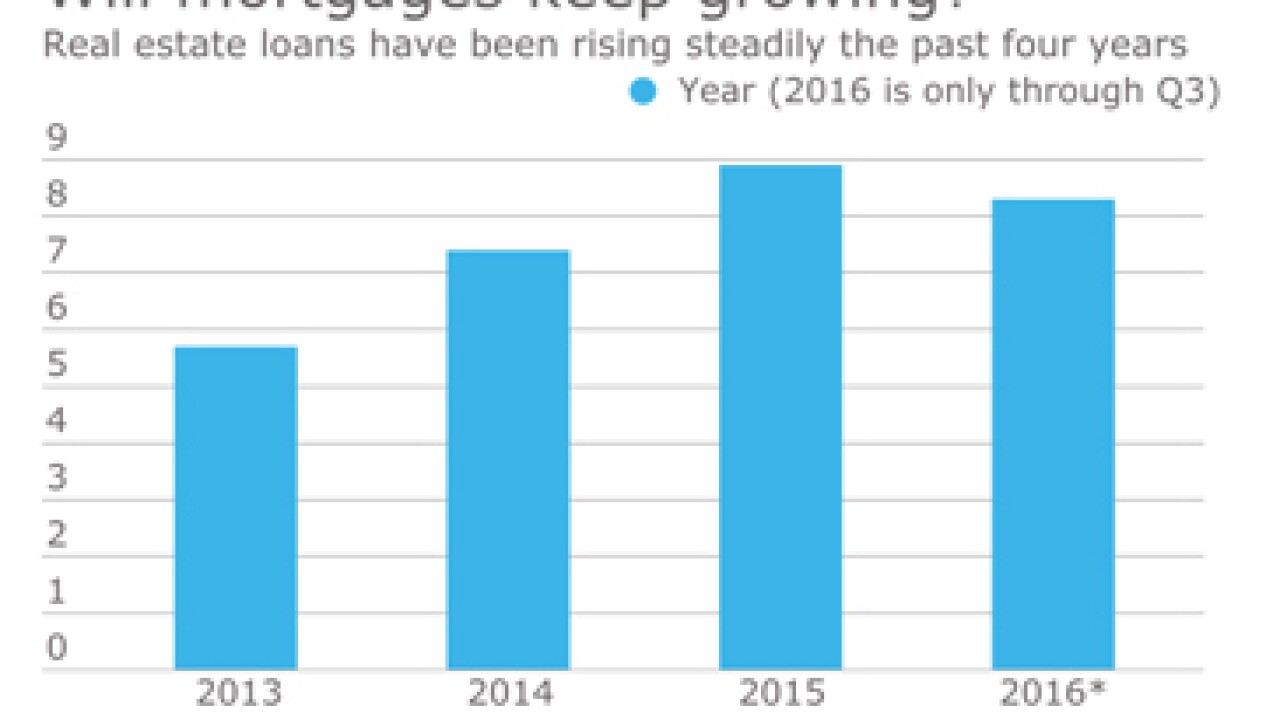

Real estate loans have been growing over the last few years despite a number of headwinds, but can credit unions build on that trend as interest rates rise?

February 13 -

Bethpage Federal Credit Union, Holston Methodist Federal Credit Union and United Heritage Credit Union have all selected the FirstClose Report for instant title search, flood certification, valuation and property information tied to mortgage and home equity loan products.

October 31 -

The National Credit Union Administration said it has accepted a $29 million offer of judgment from Credit Suisse to resolve claims arising from losses related to purchases of residential mortgage-backed securities by Members United and Southwest Corporate Credit Unions.

March 28 -

CU Companies on Monday said it finished 2015 with "significant growth" in its mortgage lending partnerships.

February 1 -

The Morgan Stanley settlement follows a similar agreement with Barclays Capital in October that resulted in a recovery of $325 million.

December 11 -

Mountain America Credit Union has partnered with Pavaso to implement a new digital collaborative closing process to provide a better experience to members applying for mortgages called QuickClose.

December 2 -

Credit union loan balances grew at an 11% annualized pace in June, while loan delinquency rates fell, according to the latest Credit Union Trends Report from CUNA Mutual Group.

August 25 -

CUNA and NAFCU each submitted comment letters to the Consumer Financial Protection Bureau regarding 2013 Regulation X (RESPA) and Regulation Z (TILA) mortgage servicing rules, urging the CFPB to adopt several changes and clarifications.

April 10 -

In less than four months, mortgage providers across the nation must be ready to meet new disclosure requirements.

April 9 -

When it comes to millennials, the $64,000 question is when will this generation be ready to start buying their first homes?

April 8 -

Credit unions as a whole will continue to grow their share of the mortgage market in 2015 and into 2016, say industry experts.

April 8 -

As the real estate market rebounds in the Grand Canyon State's capital, one credit union here reports that a new mortgage program is attracting significant new lending business.

February 18 -

Though the refinance boom is over and several mortgage giants are reeling as originations decline, some credit unions are thriving as they tap into a new source first-time homebuyers.

September 15 -

As a bill that could bring monumental changes to Fannie Mae and Freddie Mac works its way through the Senate, some credit union executives are concerned that larger players would have too many advantages at the expense of small lenders.

May 5 -

It took five years, but consumers finally are making their mortgage payments before credit card payments, according to recent analysis from TransUnion.

April 7 -

As the real estate market continues to make a comeback, CUs are turning to a credit union service organization to help them book more loans.

December 9 -

The primary drivers of loan growth continue to be first mortgages and vehicle loans.

November 13 -

As the Consumer Financial Protection Bureau wraps up implementing its voluminous mortgage rules in January, credit unions should not expect any respite from the compliance burden.

October 15