CFPB News & Analysis

CFPB News & Analysis

-

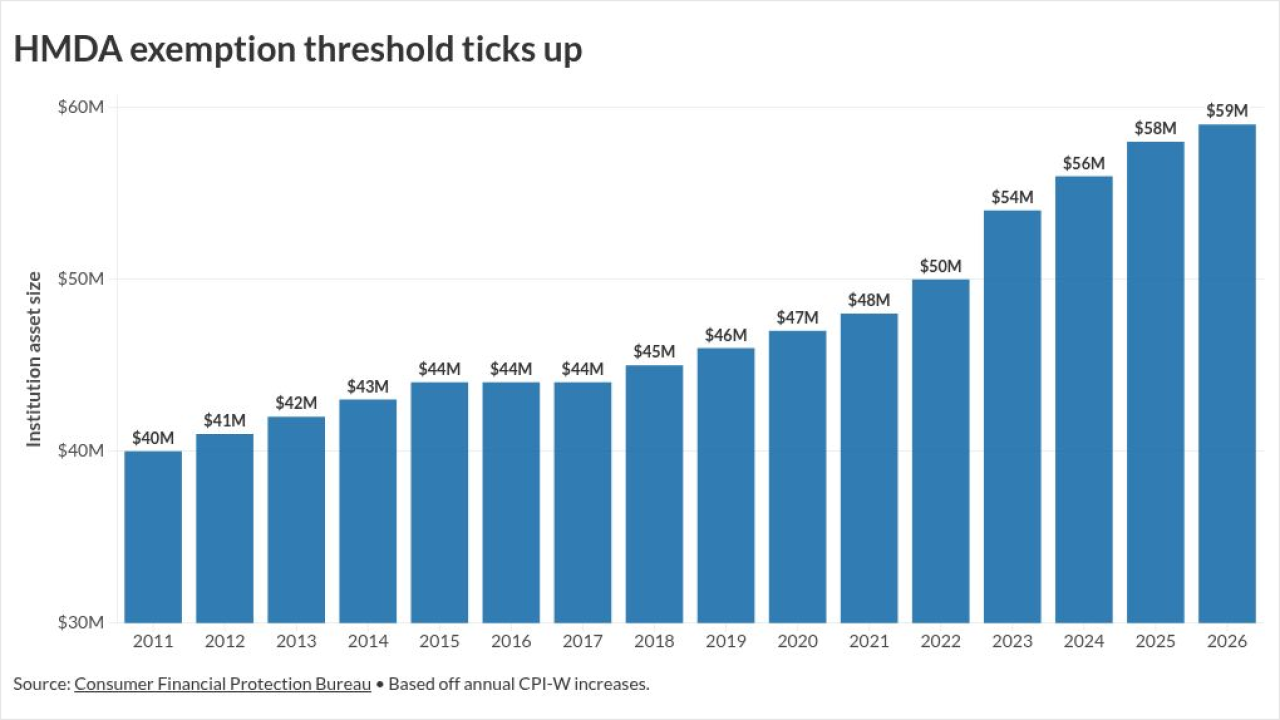

Originators with less than $59 million in assets don't have to share their loan data with CFPB, as the semi-shuttered regulator continues mortgage oversight.

January 8 -

U.S. District Judge Amy Berman Jackson said the administration must request funds from the Federal Reserve, rejecting a Trump DOJ legal theory.

December 30 -

Rohit Chopra is named senior advisor to the Democratic Attorneys General Association's working group on consumer protection and affordability; Flagstar Bank adds additional wealth-planning capabilities to its private banking division; Chime promotes three members of its executive leadership team; and more in this week's banking news roundup.

December 12 -

At issue is the CFPB's weekly publication of Average Prime Offer Rate tables, a key benchmark enabling the smooth operation of the $13 trillion residential mortgage market.

December 3 -

A trade group for participants in the clean energy loan program argues the upcoming regulations will be too burdensome and costly for participants.

November 7 -

The Consumer Financial Protection Bureau has seen a rapid drop in the effectiveness of its cybersecurity program, according to a new report from the Fed's Office of Inspector General.

November 3 -

A regulation requiring nonbanks to report violations of local and state orders to federal offices was redundant and offered no benefit, mortgage leaders said.

October 29 -

The Consumer Financial Protection Bureau is rescinding two rules issued under former CFPB Director Rohit Chopra that required nonbanks to register court orders, plus terms and conditions of contracts.

October 28 -

Washington Federal Bank and Planet Home Lending are both off the hook for the remainder of their consent orders, which the bureau quietly terminated.

September 29 -

The embattled regulator has dropped more than half its Biden-era docket, including cases against Apple and U.S. Bank. But insiders at the bureau say that's just the beginning.

September 24 -

Acting CFPB Director Russ Vought has managed to neuter the Consumer Financial Protection Bureau through a series of actions. Senate Banking Committee Chairman Tim Scott, R-S.C., played a major role by cutting funding in half.

September 18 -

By a 2-1 vote, a three-judge panel of the D.C. Circuit Court of Appeals ruled that the CFPB's union did not have a reviewable claim under the Administrative Procedure Act. The union is expected to appeal to the full D.C. Circuit.

August 15 -

The Consumer Financial Protection Bureau has proposed reducing supervision of all but the largest nonbanks in four key markets: auto financing, consumer credit reporting, debt collection and international money transfers.

August 8 -

Supreme Court rulings and provisions in the recently passed budget bill are bolstering the legality of the administration's effort to fire more than 1,000 employees at the Consumer Financial Protection Bureau.

July 16 -

House Financial Services Committee Chairman French Hill promised to begin combing through Dodd-Frank to find areas for deregulation, while the panel's ranking member made it clear that Democrats would fight for the Consumer Financial Protection Bureau.

July 15 -

States have passed new laws and hired ex-bureau staff, but some suggest the shift is more evolutionary than revolutionary.

July 15 -

The trade group outlines in a white paper that it wants more "flexibility" in the rule allowing mortgage lenders to pay their originators on a varying scale.

June 30 -

The Consumer Financial Protection Bureau cut short a five-year agreement with Bank of America Corp. over the bank's alleged submission of false mortgage data as the significantly curtailed government agency rolls back a bevy of settlements.

June 24 -

Prior to this development, the CFPB was the sole industry participant to publish an average prime offer rate index on a weekly basis.

June 17 -

The anti-evasion exception introduced during the Covid-19 pandemic provided servicing flexibility to help borrowers struggling for many reasons, ABA said.

June 17