CFPB News & Analysis

CFPB News & Analysis

-

Groups representing banks, credit unions, the housing industry and others argue in favor of a bill requiring the CFPB to issue timely guidance on its rules.

June 12 -

The acting director cited the size of advisory boards and some members’ reticence among reasons for his decision.

June 8 -

Acting CFPB Director Mick Mulvaney wrote in a two-paragraph filing that the Mount Laurel, N.J., company did not violate the Real Estate Settlement Procedures Act.

June 7 -

The Consumer Financial Protection Bureau fired all 25 members of the agency's Consumer Advisory Board during a conference call Wednesday, saying it wanted to bring in more diverse views.

June 6 -

Acting Consumer Financial Protection Bureau Director Mick Mulvaney is poised to dismiss its administrative proceeding against the mortgage lender, following a four-year battle over the agency's structure.

June 6 -

Since its inception, the qualified mortgage rule has been synonymous with loans purchased by Fannie Mae and Freddie Mac or guaranteed by government agencies. But a broader QM definition could change that by creating more competitive private-label options.

June 5 -

Anticipated changes to the qualified mortgage rule will give lenders more options and force them to rethink their views on risk.

June 4 -

Lenders would have a lighter data-reporting burden, but they may end up deciding to collect the data anyway.

May 25 -

The CFPB is looking to rescind Obama-era policy that allowed it to punish banks and financial firms for unintentional discrimination.

May 21 -

Reducing unnecessary compliance burdens will pave the way for economic growth, larger job creation and wage increases, and re-evaluating technology will play an important role in doing so, according to Craig Phillips, counselor to the secretary at the Department of the Treasury.

May 21 -

The increased regulatory burden created by the Dodd-Frank Act restricted bank residential lending in 2017, especially when it came to non-qualified mortgages, according to an American Bankers Association survey.

May 18 -

Although the Consumer Financial Protection Bureau is loosening certain mortgage rules, others such as restrictions on loan officer compensation and state-level regulation will likely persist, according to industry attorneys.

May 18 -

Mick Mulvaney’s recent comments about the CFPB Qualified Mortgage rule have triggered a debate over whether regulators should take into account more than one underwriting model.

May 17 -

Acting CFPB Director Mick Mulvaney has dropped agency plans to crack down on overdraft programs and large marketplace lenders. Here's what else he's changing.

May 16 -

Acting CFPB Director Mick Mulvaney suggested that digital mortgages should be held to different standards than ones originated by credit unions and banks.

May 15 -

After originating more than $1 billion in loans outside the ability-to-repay rule's Qualified Mortgage safe harbor last year, Angel Oak is planning to originate at least twice that in 2018.

May 14 -

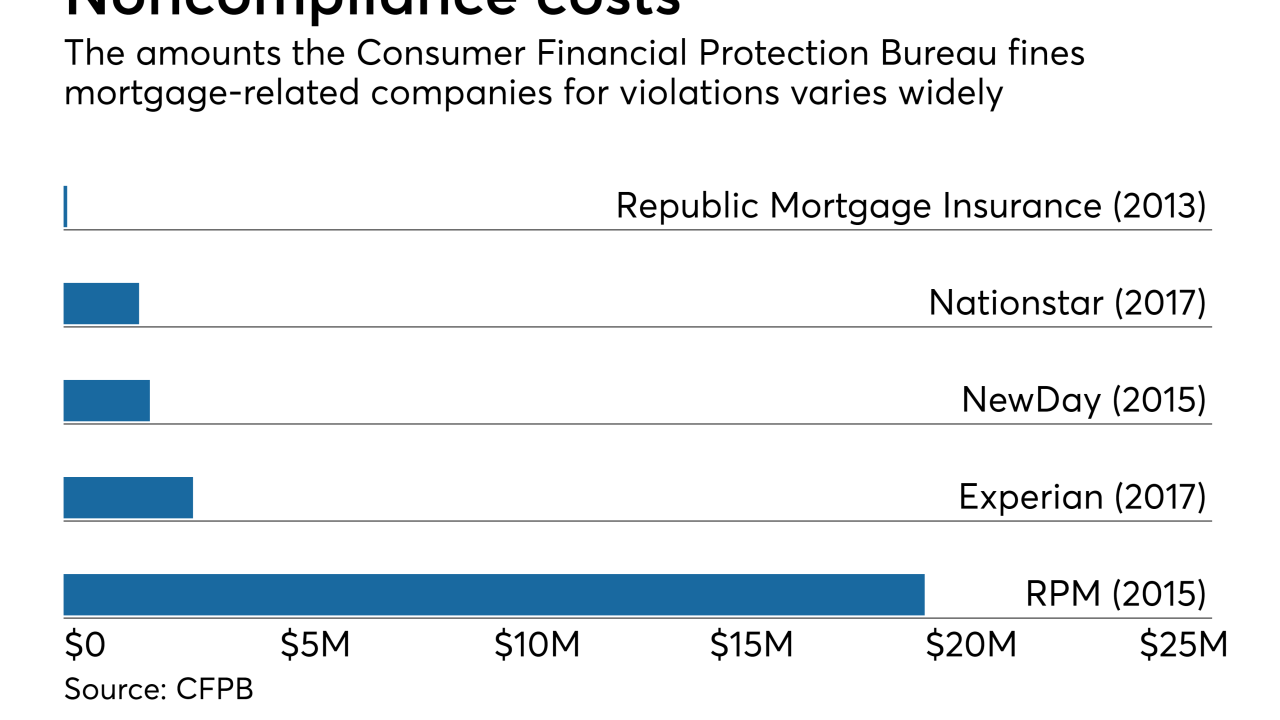

Nationstar Mortgage may face a Consumer Financial Protection Bureau enforcement action over alleged violations of the Real Estate Settlement Act and other regulations, the Mr. Cooper parent company said.

May 11 -

The union representing employees at the CFPB is already fighting acting Director Mick Mulvaney's efforts to restructure the agency, and readying for a potentially larger conflict as rumors of layoffs swirl.

May 10 -

The administration is prolonging a decision on a permanent director for the agency to keep the interim chief in place until year-end or longer.

May 8 -

From falling originations to market share shifts for nonbanks and government loans, here's a look at eight key findings from the just-released 2017 Home Mortgage Disclosure Act data.

May 8