-

According to presale reports, Ohana Real Estate Investors is sponsoring a $370 million bond sale backed by an interest-only, floating-rate loan financing its purchase of the Monarch Beach Resort in Dana Point, Calif.

December 4 -

According to presale reports, Ohana Real Estate Investors is sponsoring a $370 million bond sale backed by an interest-only, floating-rate loan financing its purchase of the Monarch Beach Resort in Dana Point, Calif.

December 4 -

The latest deal, WFCM 2019-C54, involves 44 loans secured by 88 properties, with a heavy exposure to office (32%), multifamily (21.1%) and retail (17.9%) properties.

December 3 -

The latest deal, WFCM 2019-C54, involves 44 loans secured by 88 properties, with a heavy exposure to office (32%), multifamily (21.1%) and retail (17.9%) properties.

December 3 -

Developer Stephen Ross' firm is among a trio of sponsors securitizing part of a $1.245 billion loan for another office tower development in New York's Hudson Yards submarket.

November 29 -

Blackstone Real Estate Partners is securitizing a new $343 million commercial mortgage that financed the parent firm’s recent acquisition of a portfolio of Southern California apartments.

November 21 -

The sponsors of the Class A structure, deemed a “trophy asset” by Kroll Bond Rating Agency, are placing $825 million of a $1.2 billion whole loan into a transaction dubbed CPTS 2019-CPT.

November 12 -

The outlook for hotels and suburban offices is still questionable, but the prognosis for other property types in the securitized commercial real estate market remains fairly strong, according to Moody's Investors Service.

October 23 -

GameStop's plan to shutter up to 200 stores could adversely affect commercial mortgage-backed securities loans with a combined allocated property balance of almost $42 million, according to Morningstar Credit Ratings.

October 21 -

The $50.4 million participation is the largest loan in UBS' next $807.3 million commercial mortgage securitization.

October 15 -

The developer of the newly constructed Washington, D.C., headquarters for Fannie Mae is securitizing part of its $525 million, 10-year mortgage through a single-asset, mortgage-backed transaction.

October 10 -

BX Commercial Mortgage Trust 2019-XL, via Citigroup, features 11 note classes backed by a floating-rate, first-lien mortgage on 406 Blackstone-owned properties with a tenant roster of over 2,000 lessees — including Home Depot, UPS, FedEx and Amazon.

October 7 -

The commercial mortgage-backed securities sector will weather the fourth quarter's slowing but steady growth in the U.S. economy, as better loan performance counters a continued decline in volume, Morningstar said.

October 2 -

The recent run of lower interest rates may bode well for today's commercial mortgage-backed securities, unless it's undermined by an increase in leverage, according to Fitch Ratings.

September 25 -

Commercial and multifamily mortgage delinquency rates should stay at historically low levels in the near future even as economic uncertainty over trade affects U.S. businesses, according to the Mortgage Bankers Association.

September 24 -

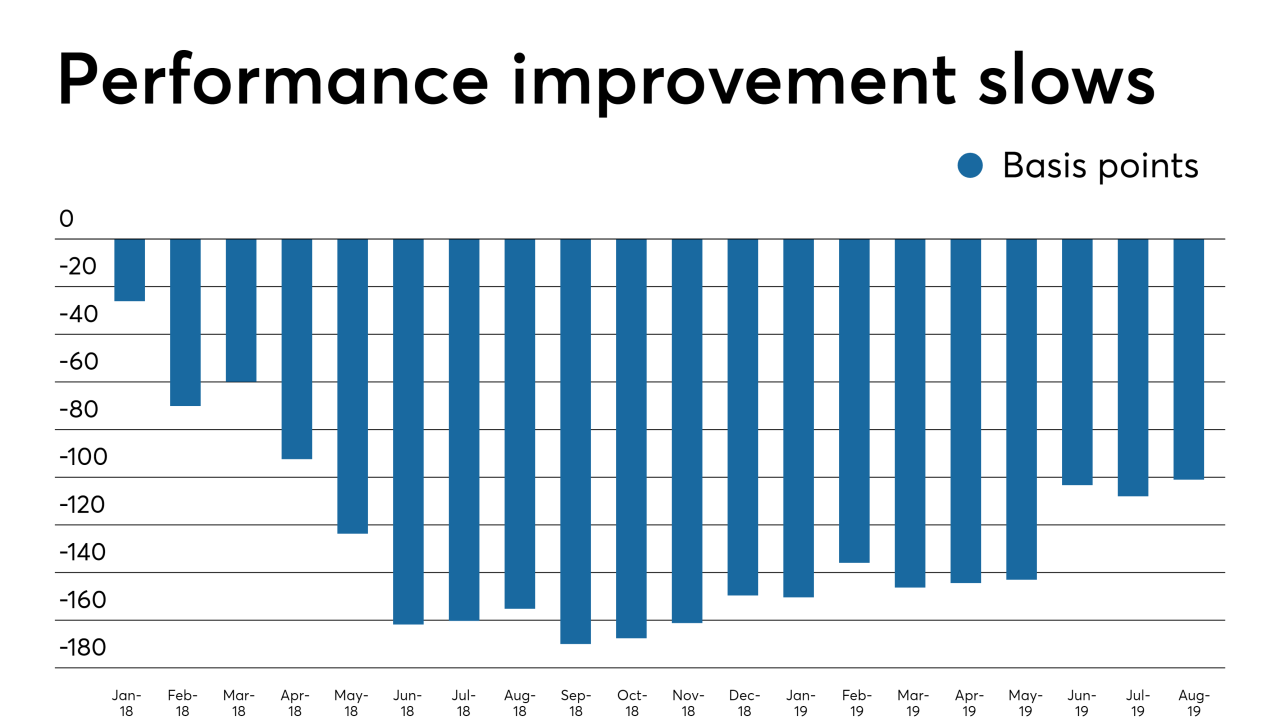

While delinquent loans in commercial mortgage-backed securities continued trending downward overall, there was an uptick in the rate for more recent originations, a Standard & Poor's report noted.

September 6 -

A Silicon Valley mega-office-tower complex that is home to both Amazon and Facebook corporate offices is making another appearance in a conduit commercial mortgage-loan securitization.

August 28 -

The collaborative workspace officer provider, which filed for its IPO last week, will be securitizing a $240 million loan used in the purchase of the San Francisco building where it leases space to member clients.

August 19 -

Bank of America is tapping the commercial mortgage-backed securities market to refinance the debt on its namesake Manhattan office building, providing BofA and building co-owner The Durst Company with a hefty cash-equity payout.

August 1 -

The incentives are stronger than ever to work toward standardizing the documentation, language and process for loans in commercial mortgage-backed securities to be combined with PACE financing.

July 23 Alston & Bird

Alston & Bird