Want unlimited access to top ideas and insights?

As

Saving for a down payment is one of the largest barriers to homeownership, and borrowers source these funds in a variety of ways, including personal savings accounts or gifts or loans from family and friends. A family member or friend can support a homebuyer by co-signing for a mortgage or listing themselves as a co-borrower. Combining income with a co-borrower allows borrowers to qualify for a higher loan amount.

To understand co-borrowing trends overtime, our researchers identified all Freddie Mac purchase loans with a co-borrower between 1994 and 2022, current through April. Then, we analyzed the age profiles of the borrowers and co-borrowers and identified young adult borrowers (defined as age 25-34) who listed an individual age 55 or older as a co-borrower on their application.

Through this analysis, we found that

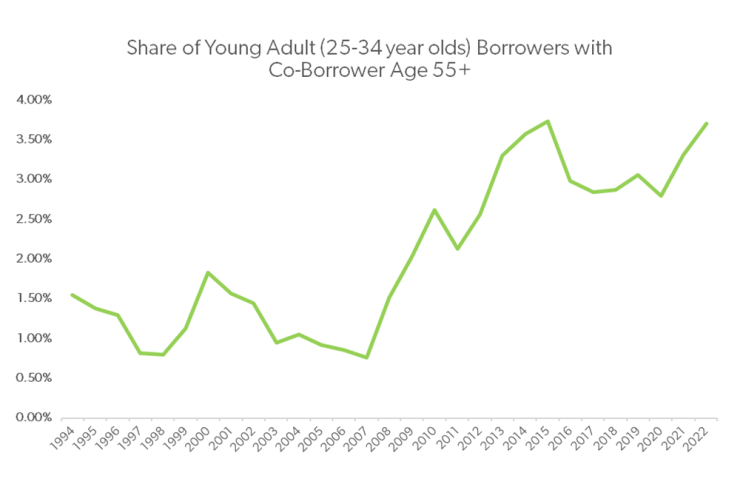

The below chart shows the percentages of young adult first-time homebuyers with a co-borrower age 55 or older since 1994.

In 1994, 1.3% of young adults who were first-time homebuyers listed co-borrowers age 55 or older, and the share has not fallen below 2.5% since 2012. In the past two years, the share has increased one percentage point. More expensive metro areas, such as Los Angeles, San Diego and Miami, tend to have a higher share of young adult first-time homebuyers who receive assistance from older co-borrowers.

The timing of this jump is notable. Since 2020, home prices have increased significantly. Perhaps to help them qualify for higher-cost homes or to make their applications more competitive, these young adult first-time homebuyers have been turning to co-borrowing to make buying a home possible.

Opinions, estimates, forecasts, and other views contained in this document are those of Freddie Mac's economists and other researchers, do not necessarily represent the views of Freddie Mac or its management, and should not be construed as indicating Freddie Mac's business prospects or expected results. Although the authors attempt to provide reliable, useful information, they do not guarantee that the information or other content in this document is accurate, current or suitable for any particular purpose. All content is subject to change without notice. All content is provided on an "as is" basis, with no warranties of any kind whatsoever. Information from this document may be used with proper attribution. Alteration of this document or its content is strictly prohibited. ©2022 by Freddie Mac.