-

The California company acquired Civic Financial Services, which makes loans to residential real estate investors.

February 3 -

The struggling movie-theater chain is among once-risky debt investments reaping big gains after day traders helped fuel the sudden stock surge.

January 29 -

The firm will invest in loans in health care, real estate, equipment and transportation, as well as corporate sectors backed by contractual cash flows, according to a statement Tuesday.

January 26 -

Commercial real estate portfolios have held up better than expected during the pandemic. But rising delinquencies and fears of a delayed economic recovery are renewing questions about credit quality.

January 12 -

The recent stimulus law’s relief for renters and extension of the federal eviction ban were meant to ward off a housing crisis. But owners of 1- to 4-unit dwellings still face mounting mortgage and property tax debts, and delinquencies could start rising soon — followed by foreclosures.

January 4 -

Reports indicate distressed owners would rather surrender their hotel or retail properties instead of negotiate workouts on delinquent loans as the pandemic spread carries on.

January 4 -

The river of red ink will likely begin to flow in the new year, due not only to the pandemic itself, but also to longer-term secular trends that have been accelerated by COVID-induced changes in the economy, says DebtX President and CEO Kingsley Greenland.

December 30DebtX -

The architects of two major loan deals featuring Black banks, one involving multiple lenders and a pro sports franchise and another backed by Citigroup, say more transactions like these are in the works.

December 13 -

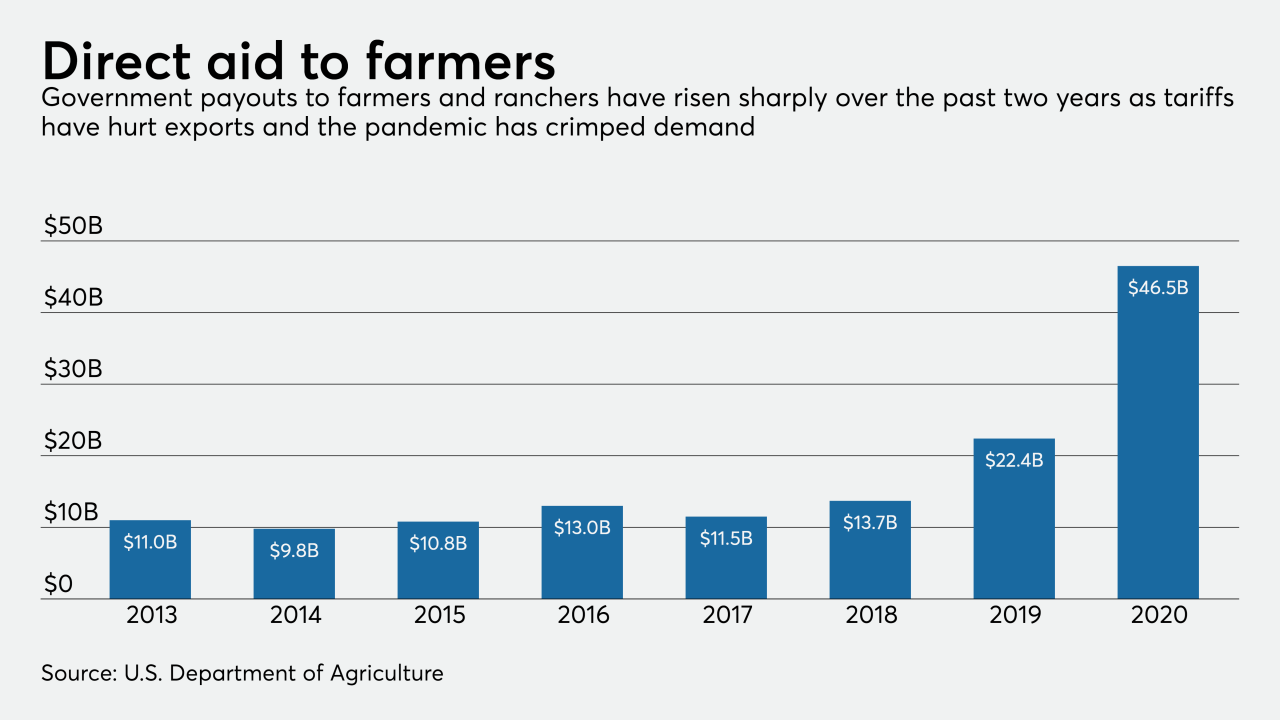

The Biden administration could curtail federal support for farmers, even with bankruptcies and requests for loan workouts on the rise. Banks are hoping that increases in crop prices and exports to China could help avert a credit crisis.

December 10 -

People with scores below 500 are often in communities that suffer the most from economic hardship and violence. Banks and regulators can do more to qualify them for financing, ultimately creating healthier local economies.

December 2 Operation HOPE Inc.

Operation HOPE Inc.