-

Many Florida communities are experiencing a renewed clamor for affordable housing options as rising home prices and rents squeeze budgets.

May 15 -

John Krenitsky, who previously managed compliance for Discover Financial Services and various banks, is joining Freddie Mac as senior vice president and chief compliance officer on June 1.

May 15 -

Requiring solar panels for all newly constructed residences is good news for investors who finance these systems, if only because it will help keep developers afloat, according to Moody’s Investors Service.

May 15 -

After originating more than $1 billion in loans outside the ability-to-repay rule's Qualified Mortgage safe harbor last year, Angel Oak is planning to originate at least twice that in 2018.

May 14 -

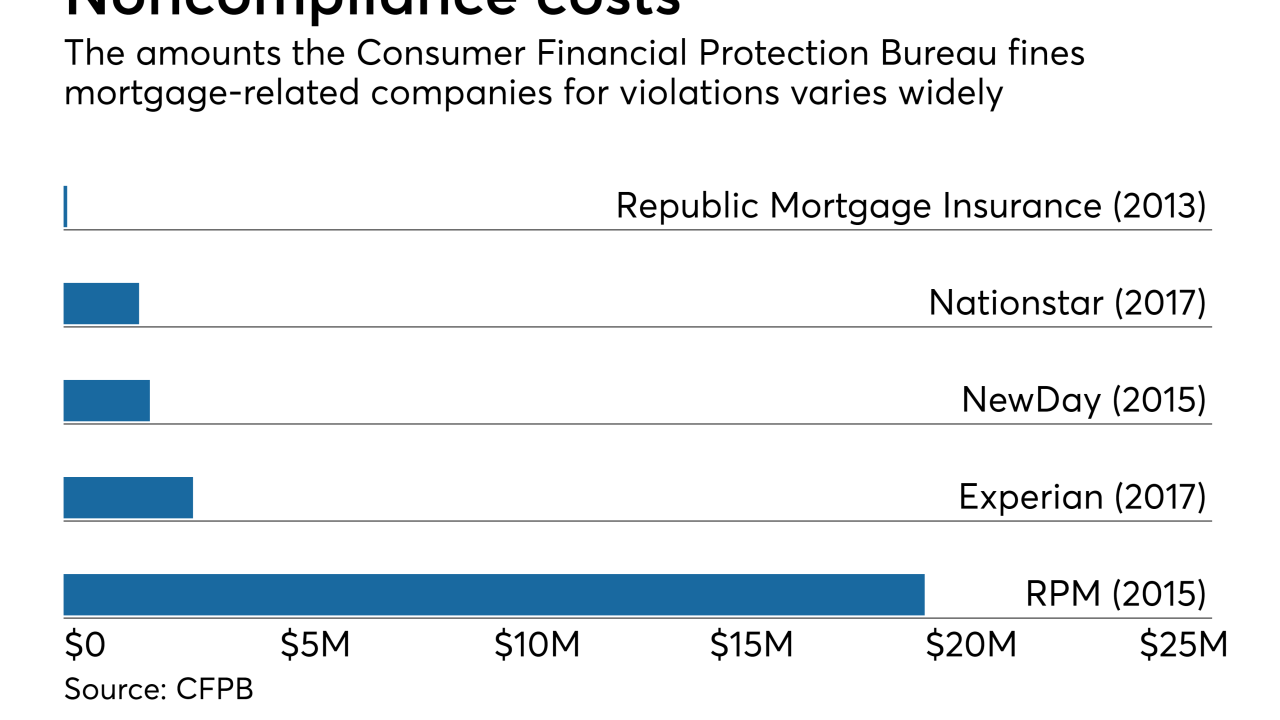

Nationstar Mortgage may face a Consumer Financial Protection Bureau enforcement action over alleged violations of the Real Estate Settlement Act and other regulations, the Mr. Cooper parent company said.

May 11 -

A ring of thieves illegally took ownership of more than 40 homes across South Florida in a multimillion-dollar plan — even stealing properties that belonged to the dead, authorities say.

May 11 -

Sonoma County supervisors have signed off on a wide-ranging suite of policy changes intended to encourage construction of more new homes seven months after nearly 5,300 residences were lost here in last year's devastating wildfires.

May 11 -

Banking and mortgage groups are asking the Federal Communications Commission to issue new Telephone Consumer Protection Act rules that would make consumer lawsuits over robocalls harder to win.

May 10 -

The union representing employees at the CFPB is already fighting acting Director Mick Mulvaney's efforts to restructure the agency, and readying for a potentially larger conflict as rumors of layoffs swirl.

May 10 -

Impac Mortgage Holdings generated almost $4 million in net income during the first quarter as it continued to downsize to adjust for origination declines and benefited from servicing gains.

May 10