-

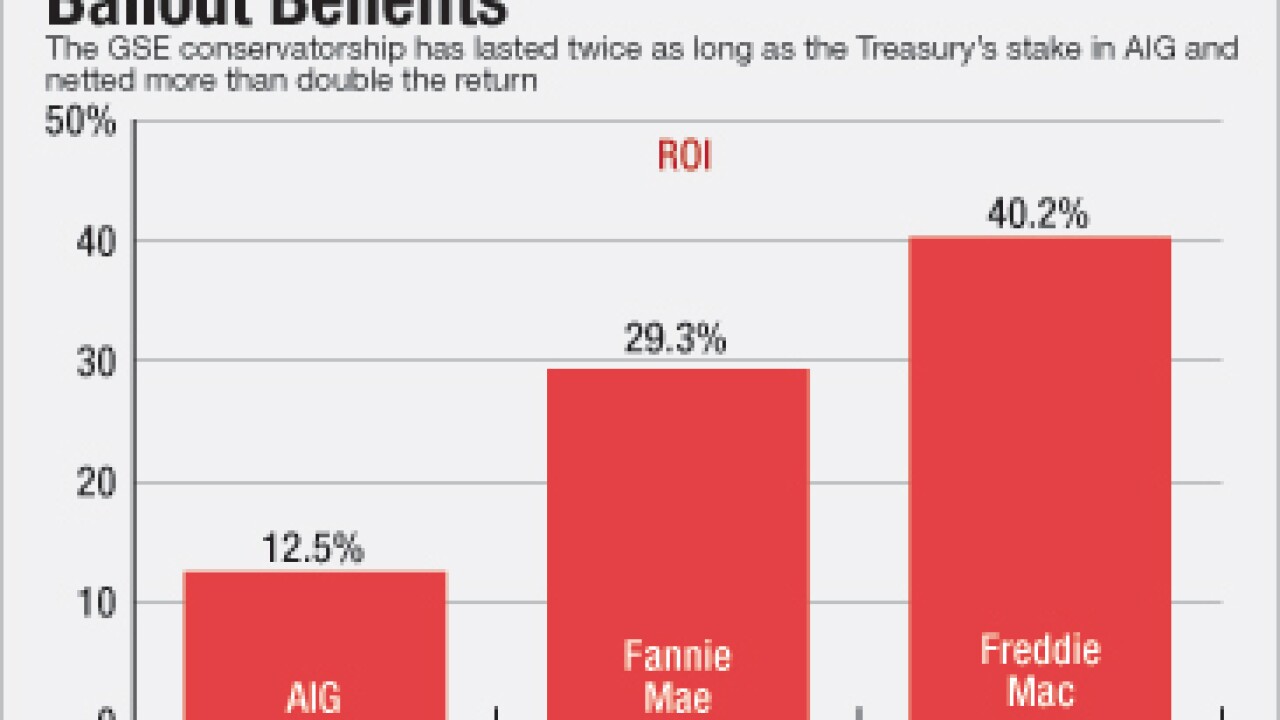

Privatizing the government-sponsored enterprises is a priority for Treasury Secretary-designate Steven Mnuchin. Here's a look at what it will take to pull off and the potential implications for the mortgage industry of unwinding the conservatorship.

December 1 -

Bank of America has conditionally completed 97% of the $7 billion in consumer relief it agreed to provide as part of its 2014 settlement with the Department of Justice and six states.

December 1 -

Treasury Secretary-designate Steven Mnuchin's plan to remove Fannie Mae and Freddie Mac from government control could mean increased competition for lenders' loans. But it could also prompt a rise in mortgage rates.

November 30 -

Even before taking office, Treasury Secretary-designate Steven Mnuchin has said he wants to return Fannie Mae and Freddie Mac to the private sector, a radically different vision of housing finance reform than that pushed by other Republicans.

November 30 -

Some banks are set to get a fourth-quarter earnings boost from their MSR portfolios, thanks to a sudden spike in yields on Treasury bonds. Add to that the prospect of further rate hikes and the potential dismantling of Basel III, and more banks could be encouraged to re-enter the servicing business.

November 30 -

President-elect Donald Trump has named Quicken Loans Executive Vice President Shawn Krause to the team that will direct the transition at the Department of Housing and Urban Development.

November 30 -

President-elect Donald Trump recognizes that full repeal of the Dodd-Frank Act is unlikely, though he supports a House effort to make significant changes, according to a former banker who was on the shortlist to be Treasury secretary.

November 30 -

President-elect Donald Trump's imminent choice for Commerce secretary is a billionaire investor who swooped in to prop up troubled banks after the financial meltdown. Some members of the banking world, including regulators, may be glad he was picked for Commerce chief instead of Treasury secretary.

November 30 -

Treasury Secretary-designate Steven Mnuchin wasted no time Wednesday wading into one of the thorniest debates in the financial services arena, saying the Trump administration would seek to end government control of Fannie Mae and Freddie Mac.

November 30 -

Much like President-elect Donald Trump himself, expected Treasury Secretary-designate Steven Mnuchin represents something of a question mark for bankers when it comes to his agenda.

November 29