-

As the mortgage industry begins the New Year, National Mortgage News takes a look at the biggest trends and topics that will shape 2016.

January 5 -

Tech-enabled shortcuts that borrowers might assume are harmless or what loan officers, real estate agents and borrowers consider good customer service may in fact lead to very risky, or even illegal, habits.

January 5 Mortgage Quality Management & Research

Mortgage Quality Management & Research -

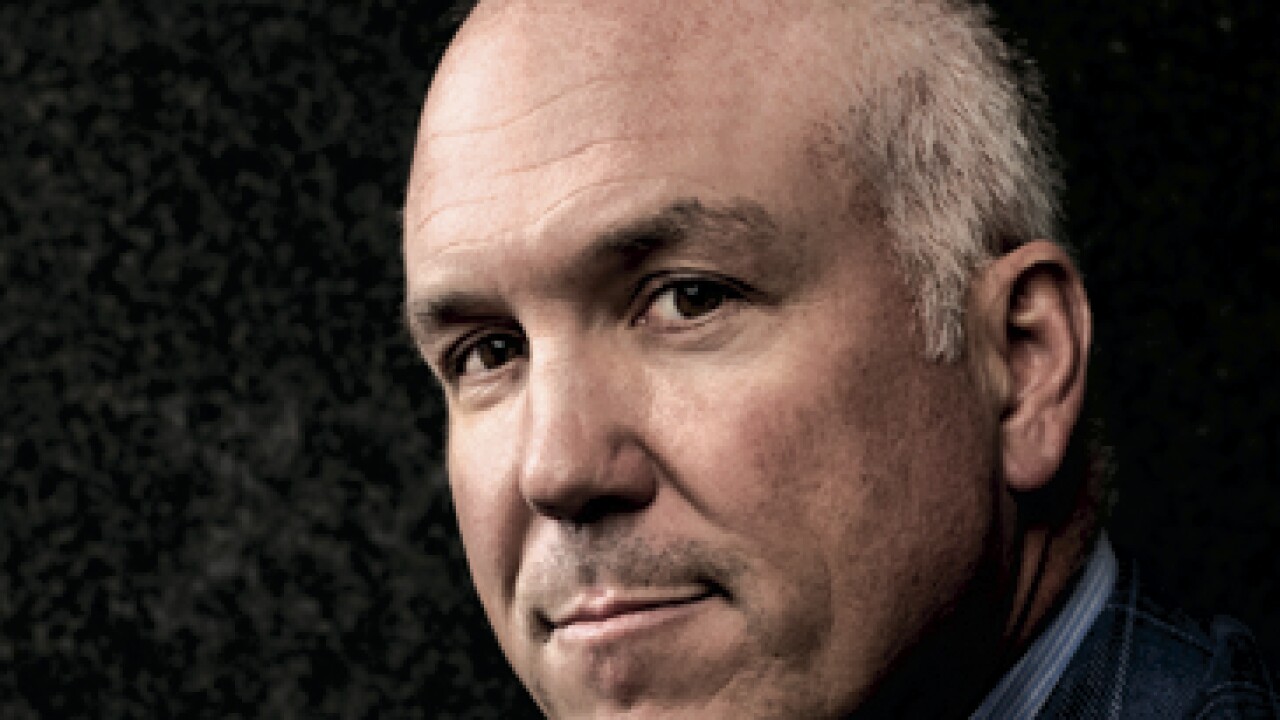

The Sarbanes-Oxley Act of 2002 is important, but it barely scratches the surface of former House Financial Services Committee Chairman Michael Oxley's impact on banking.

January 4 -

U.S. judge rejects Quicken Loans' effort to move FHA loan case to Detroit courtroom.

January 4 -

After defeating an expert in Japanese chess, this computer program's next task is to figure out if you can make the payments on a new mortgage.

January 4 -

Rather than relying on a formal marketing services agreement to get business, loan officers now have to prove that they can provide realty agents and consumers the best mortgage experience.

January 4 -

The Dodd-Frank Act is a burden on community banks and credit unions but regulators are struggling to quantify the costs, according to a report released Wednesday by the Government Accountability Office.

December 31 -

From the rollercoaster ride toward the TILA-RESPA implementation deadline to concerns about other areas the Consumer Financial Protection Bureau would zero in on for scrutiny, these seven stories dominated National Mortgage News during 2015. Following are both the stories and an update on where the situation stands now.

December 30 -

"The allegations of discrimination and predatory practices raised by the reporting are obviously very concerning to the bureau," a CFPB official said Tuesday.

December 30 -

Mortgage application defects reached a record low in November, according to First American Financial Corp.

December 29