-

The House Financial Services Committee approved a bill Tuesday that would direct the Federal Housing Administration to relax restrictions on its condominium loan program.

December 9 -

Calvin Hagins, the Consumer Financial Protection Bureau's deputy assistant director for originations, warned mortgage lenders this week about four contentious areas that its examiners will zero in on next year.

December 9 -

Indications of fraud ebbed when refinancing was more prevalent, but now that home purchases are picking up, misrepresentations could increase, too.

December 8 -

A former Jefferies & Co. managing director accused of lying to customers about bond prices had his fraud conviction overturned in the latest blow to the governments effort to hold individuals accountable for alleged wrongdoing on Wall Street.

December 8 -

Seven years after the housing bubble collapsed, Wall Street's appetite for riskier mortgages is returning.

December 8 -

Fannie Mae just took out a potential chunk of private label CMBS supply. The government-sponsored enterprise said it's helping fund Blackstone's purchase of Stuyvesant Town.

December 7 -

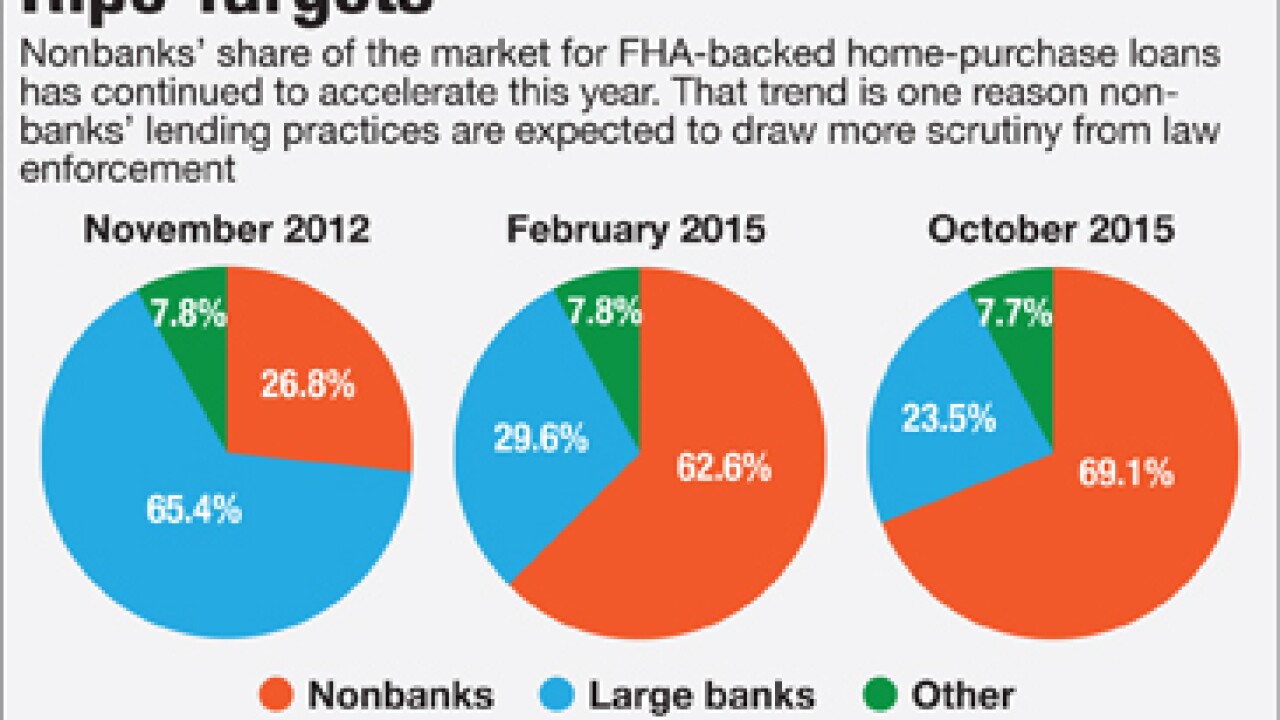

Two independent mortgage banks agreed to settlements in the past week with the Justice Department for failing to meet Federal Housing Administration guidelines. The cases are a warning to nonbank lenders that they need to beef up self-reporting of deficiencies, and they remind large banks about the legal risks associated with FHA lending.

December 7 -

There are no easy fixes to Nationstar's myriad problems including a plunging stock price and increased regulatory scrutiny but Chief Executive Jay Bray says the turnaround starts with a commitment to improving customer service.

December 7 -

Poppi Metaxas, the former chief executive of Gateway Bank in Oakland, Calif., was sentenced to 18 months in prison for perpetrating a scheme involving mortgages.

December 4 -

Over 20 mortgage and real estate-related trade groups are urging Congress to provide a hold harmless period till Feb. 1 for any errors regarding implementation of the integrated RESPA-TILA mortgage disclosures.

December 4