The mortgage industry's digital transformation is revolutionizing the home buying experience and upending the status quo for lenders and servicers. The Digital Mortgage Conference is the premiere event exclusively dedicated to these developments, bringing over 1,500 professionals to Las Vegas on Sept. 17-18 for keynote speakers, panels and the main attraction: live product demos showcasing the latest mortgage innovations.

-

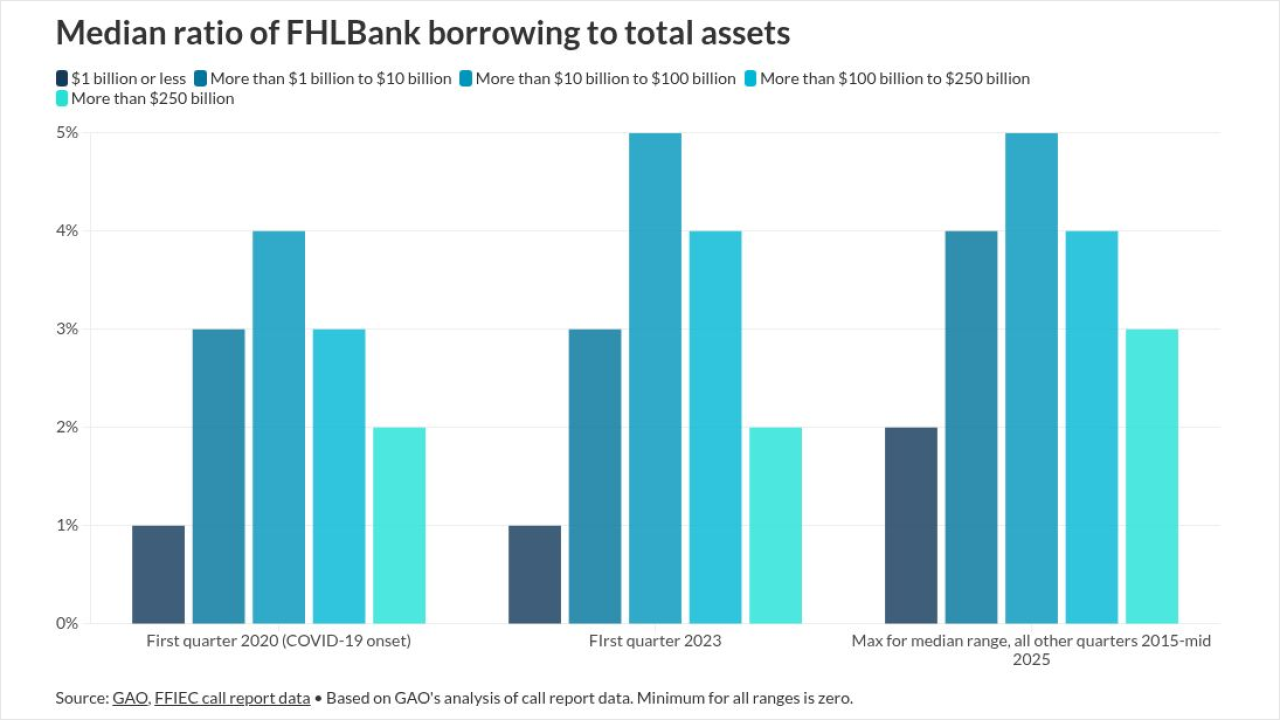

Fewer than 1% of members reported surges relative to total assets outside the normal range, making Silvergate's experience unusual, according to the GAO.

December 26 -

Mortgage lenders test crypto-backed mortgages as Fannie Mae and Freddie Mac review digital assets in underwriting, weighing risk, non-QM loans and access for nontraditional homebuyers.

December 26 -

The Consumer Financial Protection Bureau will face an existential crisis in 2026 between the Trump administration's efforts to shut down the agency and the employee union and consumer advocates who want to stop them.

December 25 -

-

Monetary policy remains the key to the markets. The Federal Open Market Committee predicts one rate cut in 2026, but the panel will get a lot of data before

-

CMBS originated between 2017 and 2021 are especially vulnerable. Brighton counsels CMBS lenders to expect clear workout memos.

December 24 -

The MBA's Market Composite Index, a measure of mortgage loan application volume, dropped 5% on a seasonally-adjusted basis and 6% on an unadjusted basis.

December 24 -

Fannie Mae sees growth in refinance activity pushing volumes upward, but flattening purchases will temper lender momentum, according to its December report.

December 24 -

The bank regulator is proposing to strengthen national preemption in the wake of conflicting decisions in related court cases.

December 24 -

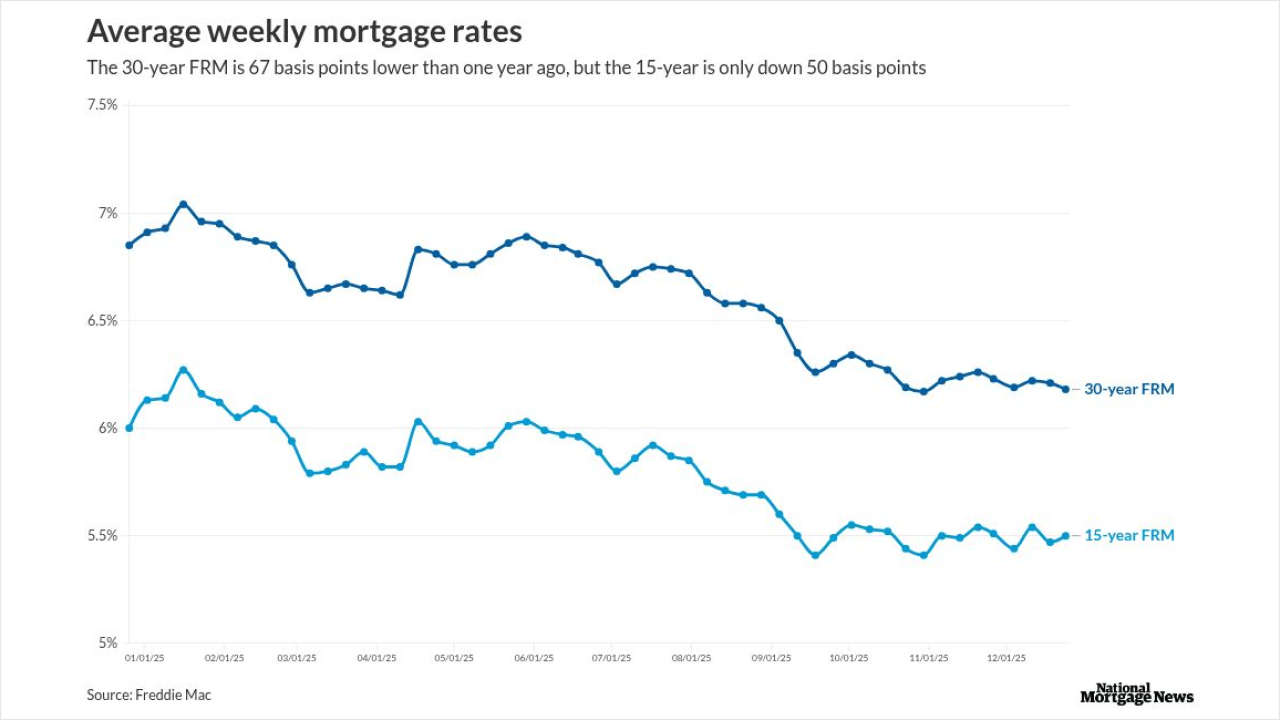

The 30-year fixed rate mortgage dropped 3 basis points this week, its lowest level since October and just over its 52-week bottom, Freddie Mac reported.

December 24