-

The administration is prolonging a decision on a permanent director for the agency to keep the interim chief in place until year-end or longer.

May 8 -

The New Jersey mortgage lender and servicer won a huge victory in January when an appeals court threw out its fine levied by the consumer agency, but the court ruled against the claim that the agency's structure is unconstitutional.

May 3 -

House Republicans are continuing to push the Senate to add more measures to a bill to give regulatory relief to community banks.

April 24 -

Acting Consumer Financial Protection Bureau Director Mick Mulvaney announced a trio of significant changes to the CFPB.

April 24 -

A panel of judges remained skeptical of claims by Leandra English, deputy director of the Consumer Financial Protection Bureau, that she is the rightful head of the agency. But they didn’t sound convinced that current acting Director Mick Mulvaney is, either.

April 12 -

In his first of two Capitol Hill hearings this week, Democrats hammered the acting director of the Consumer Financial Protection Bureau for ignoring what they view as the agency's core purpose.

April 11 -

House Speaker Paul Ryan's decision not to seek re-election is another sign of the difficulties Republicans will likely face holding the chamber in November, heightening pressure to move a pending regulatory relief bill as soon as possible.

April 11 -

Questions about the CFPB’s structure, high-profile enforcement actions and the acting director’s rift with Elizabeth Warren could dominate two days of hearings on Capitol Hill.

April 10 -

The acting head of the Consumer Financial Protection Bureau said he is “pleasantly surprised” with most personnel but raised concerns about those who lean toward the regulatory philosophy of Sen. Elizabeth Warren.

April 9 -

As lawmakers consider reforms to the Dodd-Frank Act, fresh data shows a dramatic reduction in new items issued by the regulatory agencies.

April 6 -

The latest salvo by the acting director of the Consumer Financial Protection Bureau — proposing in the agency's semiannual report that all CFPB rules be subject to congressional approval — left many observers stumped if not outraged.

April 2 -

As part of a larger regulatory relief effort, regulators have raised the dollar-amount threshold for commercial real estate transactions that require a formal appraisal.

April 2 -

Acting Consumer Financial Protection Bureau Director Mick Mulvaney proposed dramatic curbs to his agency's power in a report Monday, including a recommendation that all CFPB rules must be approved by Congress.

April 2 -

One purpose of the Senate bill was for small banks to rein in skyrocketing costs, but some bankers question whether the changes will save them money, and adapting to the reforms may even increase spending.

March 28 -

The biggest legacy of the current regulatory relief effort may be the increasing focus on whether organizing banks in supervisory buckets by asset size makes sense. Yet the bill deals with just one of the two big asset thresholds in the law.

March 26 -

The information collection effort is consistent with acting CFPB Director Mick Mulvaney's efforts to set the agency on a more pro-industry, anti-enforcement course.

March 22 -

While regulatory relief legislation would raise the asset threshold for “systemically important” banks, Federal Reserve Chairman Jerome Powell said the central bank could still apply prudential scrutiny to banks below that new cutoff.

March 21 -

Critics of the Consumer Financial Protection Bureau have long sought to convert its leadership structure from a single director to a five-member commission. Here’s why the idea is dead on arrival.

March 20 -

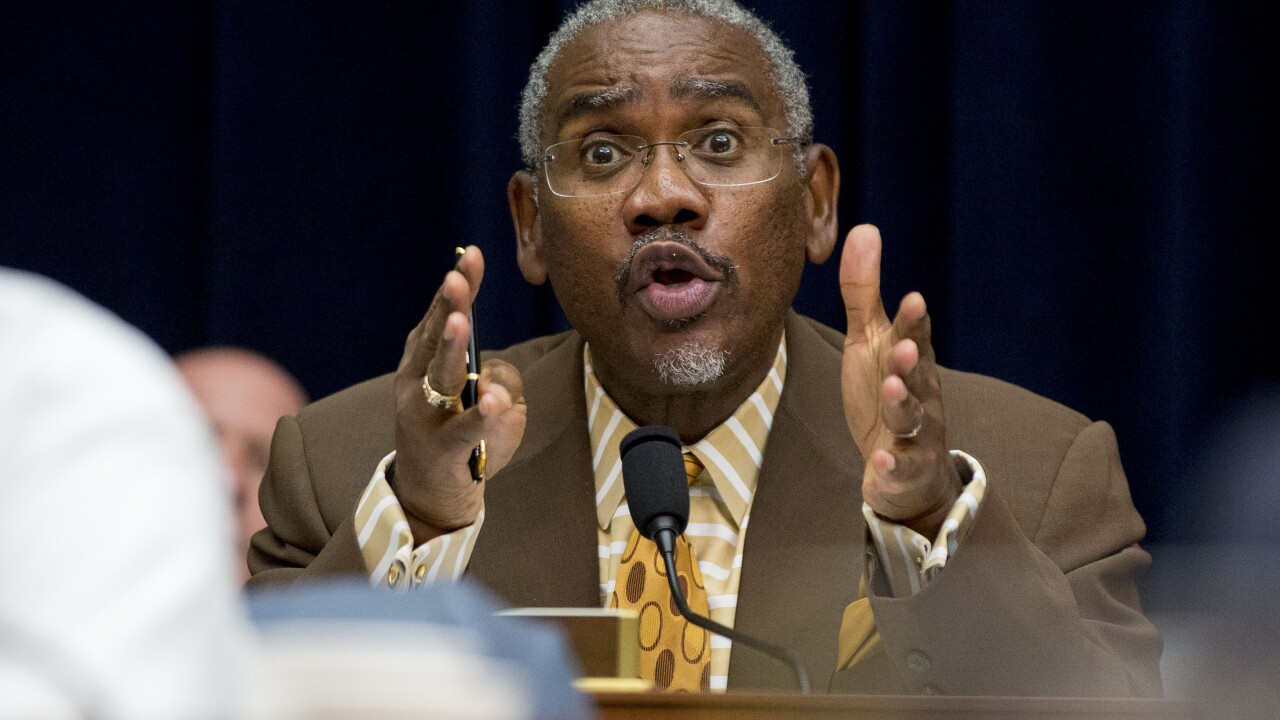

The House Financial Services Committee chairman's effort to make changes to a Dodd-Frank revision bill could either give him a defining victory or extend his losing streak.

March 19 -

A day after the Senate passed regulatory relief, top House Republicans vowed to have a big say in the final version before the bill heads to the White House. That raised fresh questions about how quickly the Dodd-Frank reforms will become law.

March 15