-

The Federal Reserve Friday issued a set of proposed changes to its stress testing program for the largest banks that would disclose the central bank's back-end stress testing models, a move that the Fed had long opposed out of fear of making the tests easier for banks to pass.

October 24 -

The largest U.S. banks took less of a capital hit under the Federal Reserve's hypothetical stress scenario than they did last year, but averaging the two sets of results could impact next year's regulatory requirements.

June 27 -

Analysts are predicting stronger results this year after a disappointing outcome in 2024.

June 23 -

With the Federal Reserve eyeing changes to its annual examination of large bank resilience, this year's test could be the last of its kind.

February 5 -

The Bank Policy Institute, the American Bankers Association and others said proposed changes would address "some if not all" of banks' concerns about stress tests, but they are filing the lawsuit to preserve their legal right to do so.

December 24 -

The Federal Reserve vice chair for supervision says the failure of Silicon Valley Bank showed the shortcomings of the current stress testing regime.

October 19 -

A significant divergence between the FHFA and the Ginnie Mae issuer rules could greatly disrupt the secondary market — and that is precisely the outcome that now faces the mortgage industry, writes the chairman of Whalen Global Advisors.

August 15 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

On a combined basis, the GSEs performed better under this year's scenario than they did in 2021, but the Federal Housing Finance Agency said changes were still needed.

August 11 -

The proposed best practices would be modeled after federal servicing standards and be used to supervise nonbanks firms subject to state regimes.

October 1 -

Policymakers have eased some rules and the Supreme Court recently dealt a blow to the Consumer Financial Protection Bureau. But as the landmark legislation approaches its 10th anniversary, the post-crisis regulatory regime has stayed largely intact.

July 13 -

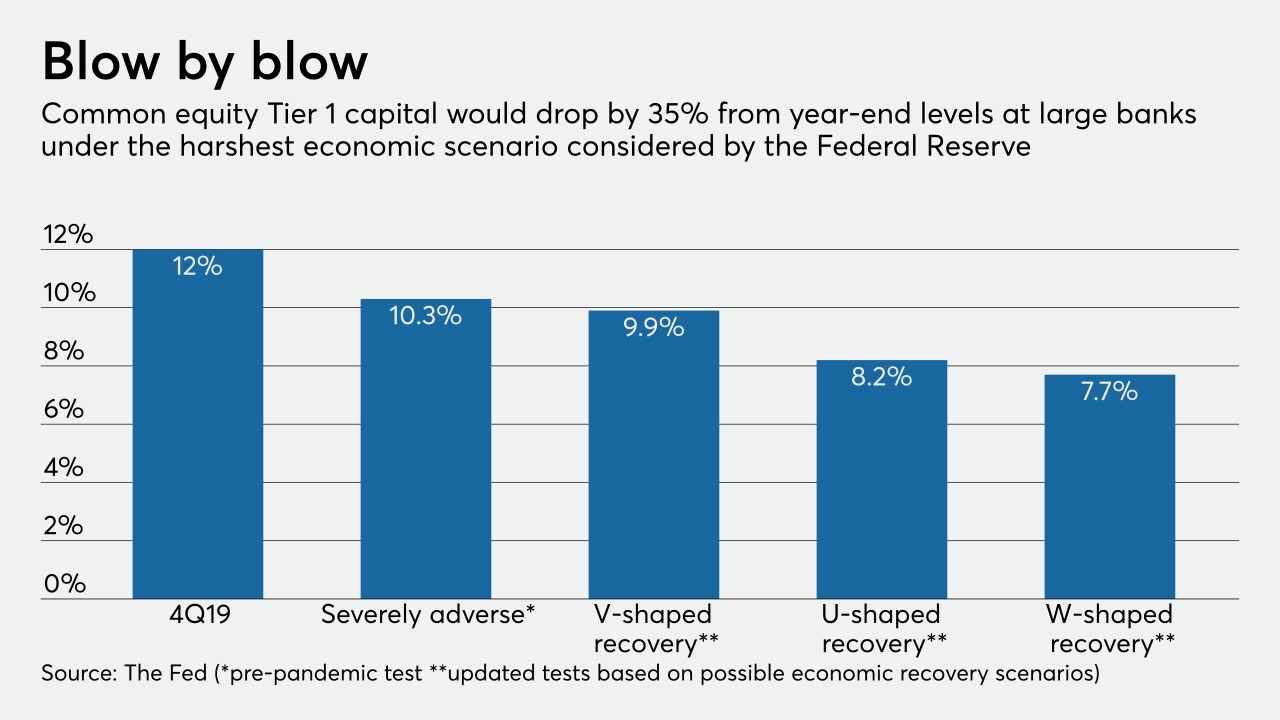

Some observers said the central bank should have suspended dividends entirely in response to an unprecedented economic emergency caused by the pandemic. Others said its more cautious moves were appropriate because big banks' capital is strong and the economy could bounce back.

June 26 -

In the most sweeping capital distribution order since the financial crisis, the Federal Reserve says it will prohibit big banks from buying back their stock in the third quarter and limit dividend payments to second-quarter levels.

June 25 -

The Federal Housing Finance Agency has proposed a plan that would exempt the Federal Home Loan Banks from conducting stress tests.

December 16 -

Tighter mortgage regulations are making Canada's housing market less risky, according to the government agency responsible for its oversight.

November 6 -

Ginnie Mae's stress testing model was based on large issuers, and does not appear to adequately reflect important qualitative differences between larger and smaller issuers.

October 1 Hallmark Home Mortgage

Hallmark Home Mortgage -

The regulators have yet to complete rules on regional bank supervision, community bank capital and other provisions meant to ease institutions' burden.

August 1 -

The combined bank will move into a more demanding supervisory class under the Fed’s regime, but analysts also see a regulatory upside from the deal.

February 7 -

A top official at the Office of the Superintendent of Financial Institutions defended tougher underwriting rules blamed recently for a slump in the nation’s housing market, but left open the possibility that regulations could ease if conditions change.

February 5 -

The mortgage giants Fannie Mae and Freddie Mac would have to draw as much as $78 billion in the event of a serious economic crisis, according to stress test results released Tuesday by the housing regulator.

August 7 -

The federal bank regulators are considering roughly a dozen new rulemakings in response to the bill rolling back certain sections of Dodd-Frank.

July 20