-

Lenders would have a lighter data-reporting burden, but they may end up deciding to collect the data anyway.

May 25 -

As President Trump signed the regulatory relief bill into law on Thursday, most of the attention was on a provision to help regional banks with more than $50 billion of assets. But a majority of the new law is aimed at helping institutions below $10 billion. Here's how.

May 24 -

The industry’s biggest legislative victory in a decade made it to the finish line Thursday.

May 24 -

The bill passed by the House took a more cautious approach to relief than prior legislative proposals but has still been hailed by banking industry groups.

May 22 -

Attorney General Peter F. Kilmartin joined housing advocates — as well as the mayors of Providence, Pawtucket and Warwick — to urge the General Assembly to extend the state's Foreclosure Mediation Act, set to expire on July 1.

May 22 -

The increased regulatory burden created by the Dodd-Frank Act restricted bank residential lending in 2017, especially when it came to non-qualified mortgages, according to an American Bankers Association survey.

May 18 -

A provision to remove new mortgage recordkeeping requirements would help overburdened community banks lend without disrupting data collection that is used to police discrimination.

May 18 Industrial Bank

Industrial Bank -

The soon-to-be-retiring chair of the House Financial Services Committee said Senate leaders have made a "commitment" to consider more changes.

May 17 -

After months of delay, the House is planning to vote on legislation next week that would amend the Dodd-Frank Act.

May 15 -

Acting CFPB Director Mick Mulvaney suggested that digital mortgages should be held to different standards than ones originated by credit unions and banks.

May 15 -

The administration is prolonging a decision on a permanent director for the agency to keep the interim chief in place until year-end or longer.

May 8 -

The New Jersey mortgage lender and servicer won a huge victory in January when an appeals court threw out its fine levied by the consumer agency, but the court ruled against the claim that the agency's structure is unconstitutional.

May 3 -

House Republicans are continuing to push the Senate to add more measures to a bill to give regulatory relief to community banks.

April 24 -

Acting Consumer Financial Protection Bureau Director Mick Mulvaney announced a trio of significant changes to the CFPB.

April 24 -

A panel of judges remained skeptical of claims by Leandra English, deputy director of the Consumer Financial Protection Bureau, that she is the rightful head of the agency. But they didn’t sound convinced that current acting Director Mick Mulvaney is, either.

April 12 -

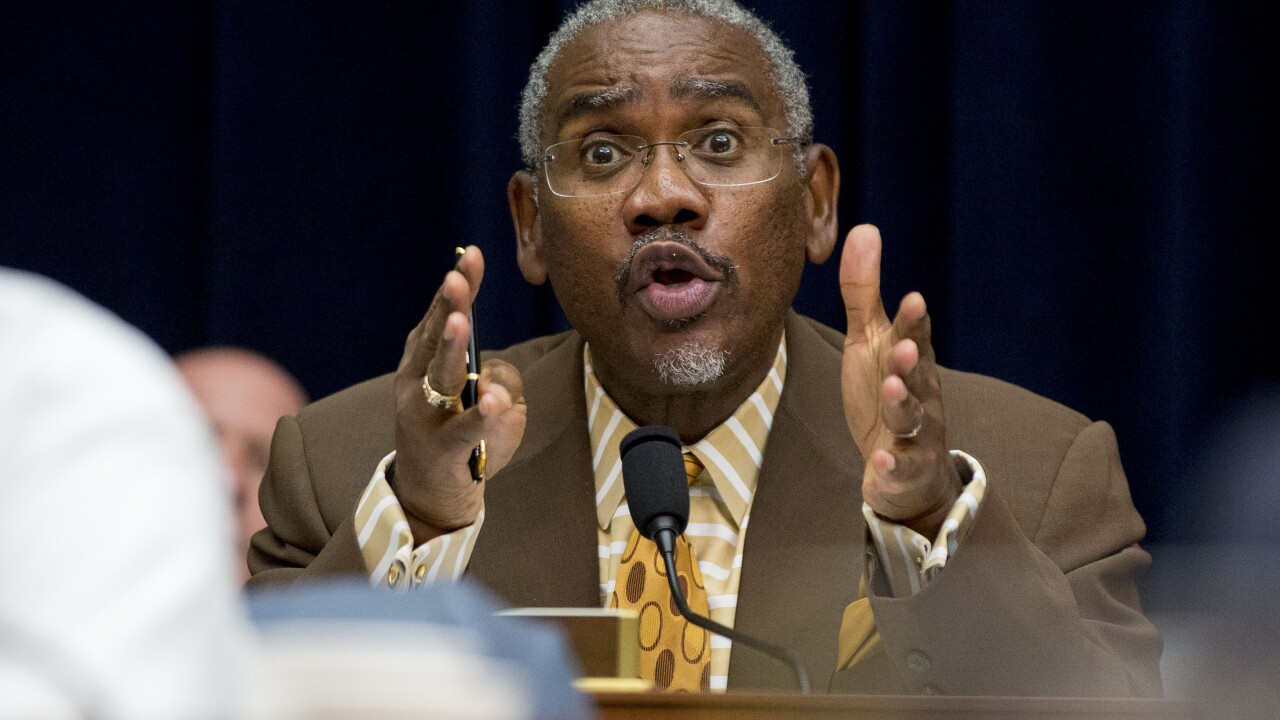

In his first of two Capitol Hill hearings this week, Democrats hammered the acting director of the Consumer Financial Protection Bureau for ignoring what they view as the agency's core purpose.

April 11 -

House Speaker Paul Ryan's decision not to seek re-election is another sign of the difficulties Republicans will likely face holding the chamber in November, heightening pressure to move a pending regulatory relief bill as soon as possible.

April 11 -

Questions about the CFPB’s structure, high-profile enforcement actions and the acting director’s rift with Elizabeth Warren could dominate two days of hearings on Capitol Hill.

April 10 -

The acting head of the Consumer Financial Protection Bureau said he is “pleasantly surprised” with most personnel but raised concerns about those who lean toward the regulatory philosophy of Sen. Elizabeth Warren.

April 9 -

As lawmakers consider reforms to the Dodd-Frank Act, fresh data shows a dramatic reduction in new items issued by the regulatory agencies.

April 6