Earnings

Earnings

-

Title insurers benefited from the increase in origination volume — especially refinancings — during the second quarter, as open order counts increased compared with one year prior.

July 25 -

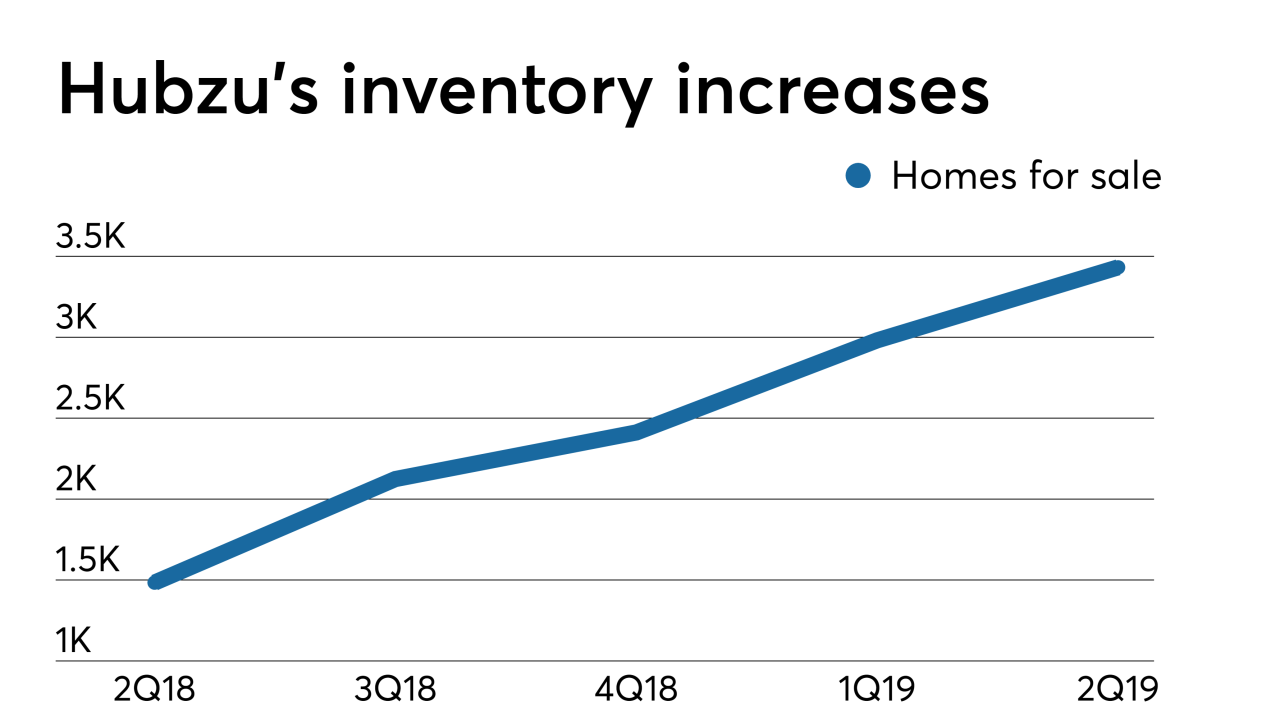

Altisource Portfolio Solutions cut its previous-quarter net loss by 49% in its most recent fiscal period, when property maintenance revenue and new Hubzu real estate auction site inventory increased.

July 25 -

MGIC reported higher-than-expected earnings, seen as a positive for the other mortgage insurers, plus Flagstar and KeyCorp had strong quarters for their mortgage businesses.

July 23 -

Pretax mortgage income at NVR Inc. surged 37% year-over-year in the second quarter while originations rose 1%, contrasting more tepid home-loan earnings results relative to originations at big banks.

July 19 -

Bank of America says rate cuts could reinvigorate mortgages and that its digital and cards strategies will help it grab more market share to offset shrinking margins.

July 17 -

The second quarter continues to shape up as a good one for bank mortgage lenders — and one ancillary service provider — that are benefiting from a spike in volume.

July 17 -

The Minneapolis bank reported growth across several lending and noninterest income categories in the second quarter, which offset net interest margin pressures and declining deposit service fees.

July 17 -

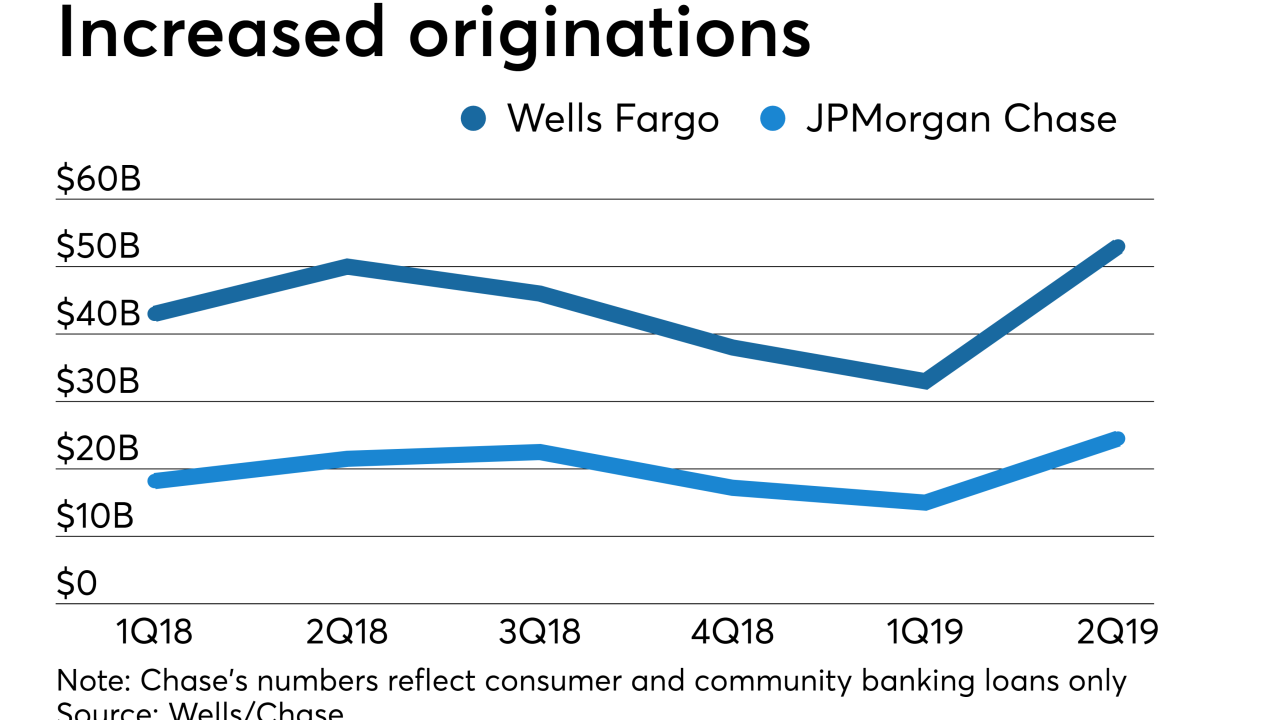

Wells Fargo and JPMorgan Chase recorded stronger mortgage originations in the second quarter as rates fell, but profits from single-family loans were lower than a year ago due to decreased servicing revenue.

July 16 -

Despite a significant rise in first-mortgage production due to lower interest rates, profits from home lending in Citigroup's retail banking division fell slightly in the second quarter.

July 15 -

Builder MDC Holdings' preliminary numbers for net new home orders registered their highest quarterly increase in years, adding to signs of growing demand for housing.

July 8