Earnings

Earnings

-

But the business unit of Intercontinental Exchange lost money on an operating basis for the eighth time in the last nine quarters.

August 1 -

While the REIT still seeks to grow servicing, it's been willing to sell for the right price as it responds to new rate-related risks and opportunities.

July 31 -

The parent company of Newrez saw mortgage segment profits of over $200 million and the successful close of its merger with Specialized Loan Servicing in the second quarter.

July 31 -

The company earned about the same in the second quarter but less versus the prior period as it added to credit reserves due to loan acquisition activities and higher mortgage rates.

July 31 -

The Hammond, Louisiana, company, which announced changes to its business strategy, cut 71 jobs and reduced its dividend to 8 cents per share.

July 30 -

Election speculation about policy change at Fannie Mae has boosted its stock slightly this year. It's also profitable, but there's much more to consider.

July 30 -

The second quarter for the subsidiary of Waterstone Financial posted its highest net income since the same period in 2022, while its volume was the most in seven quarters.

July 26 -

First Foundation in Dallas recently got a $228 million capital injection led by Fortress Investment Group. Now it's announced plans to pivot away from its heavy focus on multifamily loans, which lost value as interest rates rose.

July 26 -

Third-party origination operations are also going to Mr. Cooper in the $1.4 billion deal, in which the seller cited interest in improving its capital position.

July 25 -

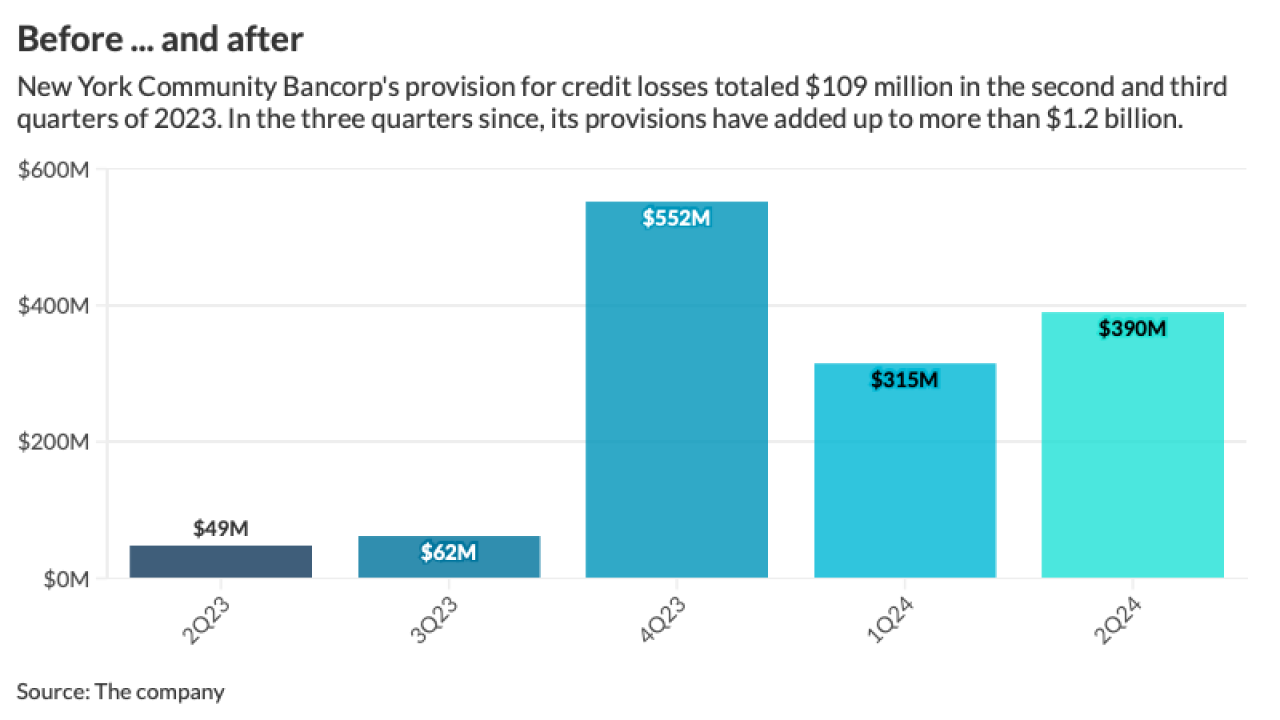

The parent company of Flagstar Bank reported a net loss of $323 million for the second quarter after boosting loan-loss provisions and recording a steep increase in net charge-offs. Still, it says it's making progress on a turnaround plan, including by agreeing to the sale of its mortgage servicing business.

July 25