Earnings

Earnings

-

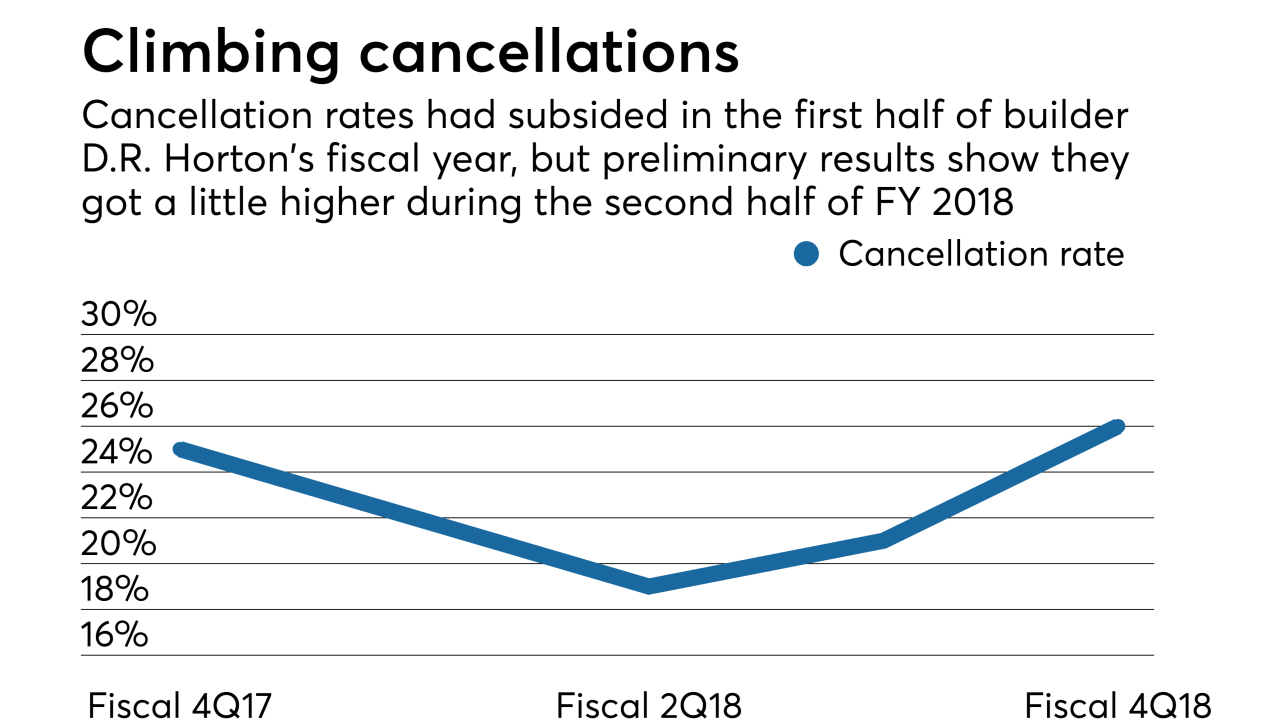

D.R. Horton is selling more homes, but its cancellation rates also are higher in the company's primary fiscal year results, a sign that rising mortgage rates may be affecting the market.

October 9 -

First Foundation sold loans to Freddie Mac to free up space for higher-yielding credits. It then bought the securities that were formed to replace other, lower-yielding assets through an often overlooked program.

October 1 -

A deceleration in mortgage balances ends CIBC's three-year streak of outpacing Canada's other large lenders on mortgage growth. Royal Bank of Canada said this week that mortgage balances were 5.9% higher than a year earlier.

August 23 -

Ditech will eliminate 450 positions when it closes its Rapid City, S.D., call center late next year, as the company seeks to regain profitability after emerging from bankruptcy.

August 17 -

Ditech Holding Corp. posted a net loss of $40.5 million in its first full operating quarter since emerging from bankruptcy protection in February.

August 9 -

Redwood Trust's net income was down 30% from the prior quarter as mortgage banking activities earnings fell by 60%.

August 8 -

PHH Corp. remained above the adjusted net worth and cash requirements for the company's proposed acquisition by Ocwen to take place, even though it lost $35 million in the second quarter.

August 3 -

National MI deliberately dropped some of its customers in the second quarter, resulting in flat new insurance growth compared with the first quarter and a lower increase versus one year prior.

August 3 -

Fannie Mae’s treatment of a reperforming loan package helped drive up earnings by almost 41% to $4.5 billion, delivering a stronger dividend to Treasury ahead of a leadership change.

August 2 -

Xome acquired Assurant's Mortgage Solutions unit one day after its parent company Nationstar was bought by the shell company of the former Washington Mutual.

August 2