Earnings

Earnings

-

The company reported net income of $5.6 million in 2025, up 61.9% from the year prior, while mortgage banking revenue decreased by $120,000, or 39.5%.

January 21 -

The San Francisco-based banking giant reported solid gains in credit card and auto lending as credit remained in check and quarterly operating costs declined from a year ago.

January 14 -

The megabank's net income declined by 13% during the fourth quarter as a result of a $1.2 billion pretax loss on sale related to the divestiture of its remaining operations in Russia.

January 14 -

In the fourth quarter of 2025, America's second-largest bank posted earnings that came in just above Wall Street's forecasts.

January 14 -

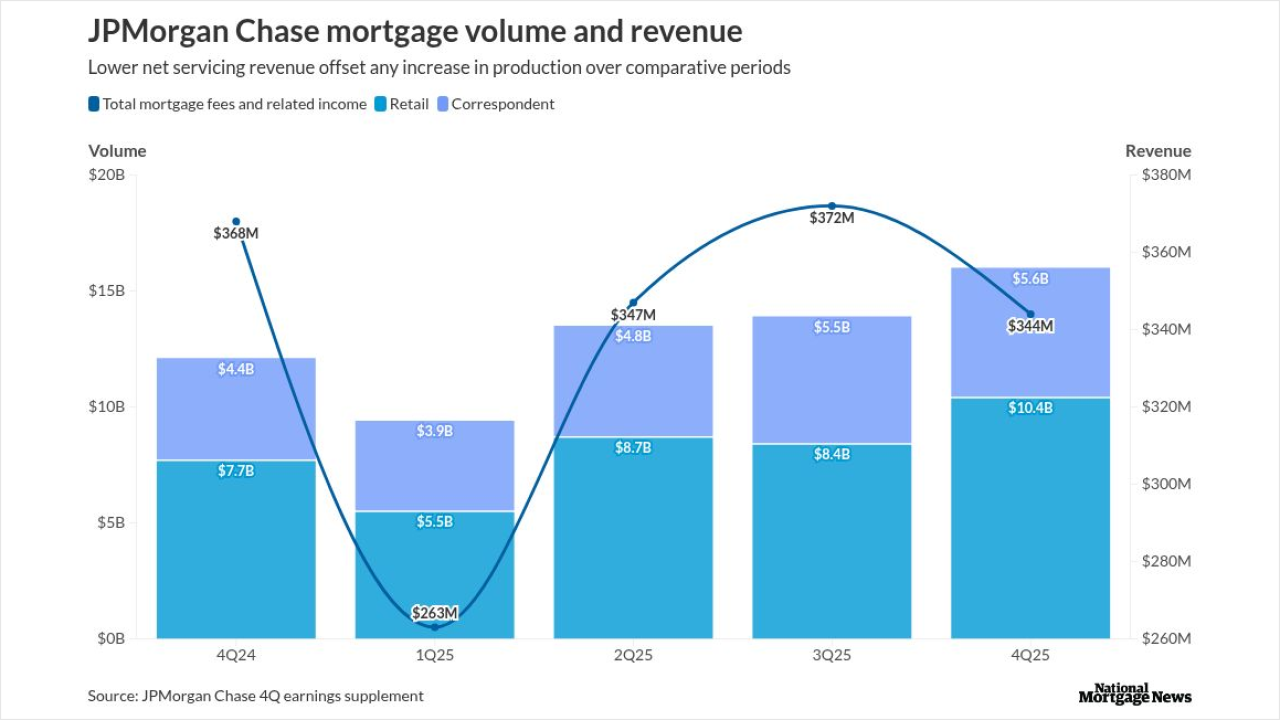

The bank did $16 billion of originations during the final three months of 2025, with the quarter-to-quarter increase beating industry-wide growth forecasts.

January 13 -

For 2026, the mortgage industry operating environment will improve, while nonbank financial metrics should be within Fitch's rating criteria sensitivities.

December 12 -

BTIG is waiting with "baited breath" for Fannie Mae and Freddie Mac to relist their common stocks, but if spreads widen, it could derail it from happening.

December 5 -

Non-banks tracked by Morningstar DBRS reported combined net income of $367 million for the third quarter, down from $807 million three months prior.

November 26 -

Independent mortgage bankers were in the black for each loan originated during the third quarter, as low rates brought an application surge in September.

November 18 -

The fintech had over $2 billion in home equity line of credit volume in the third quarter and reported growing production in its crypto and non-QM offerings.

November 14 -

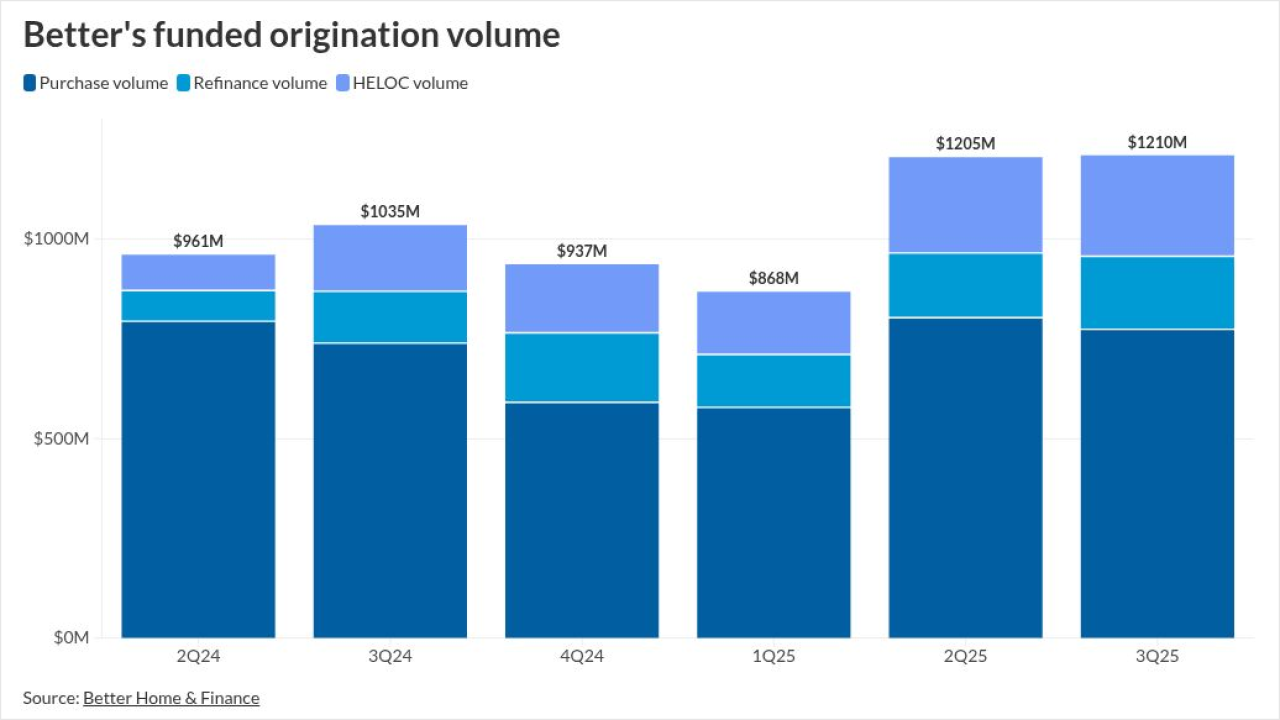

The lender, which crossed the $1 billion origination mark for the second consecutive quarter, is bullish on several new mortgage partnerships.

November 13 -

While all six companies were profitable in the third quarter, most had earnings which were down from the prior periods, with MGIC setting a milestone.

November 11 -

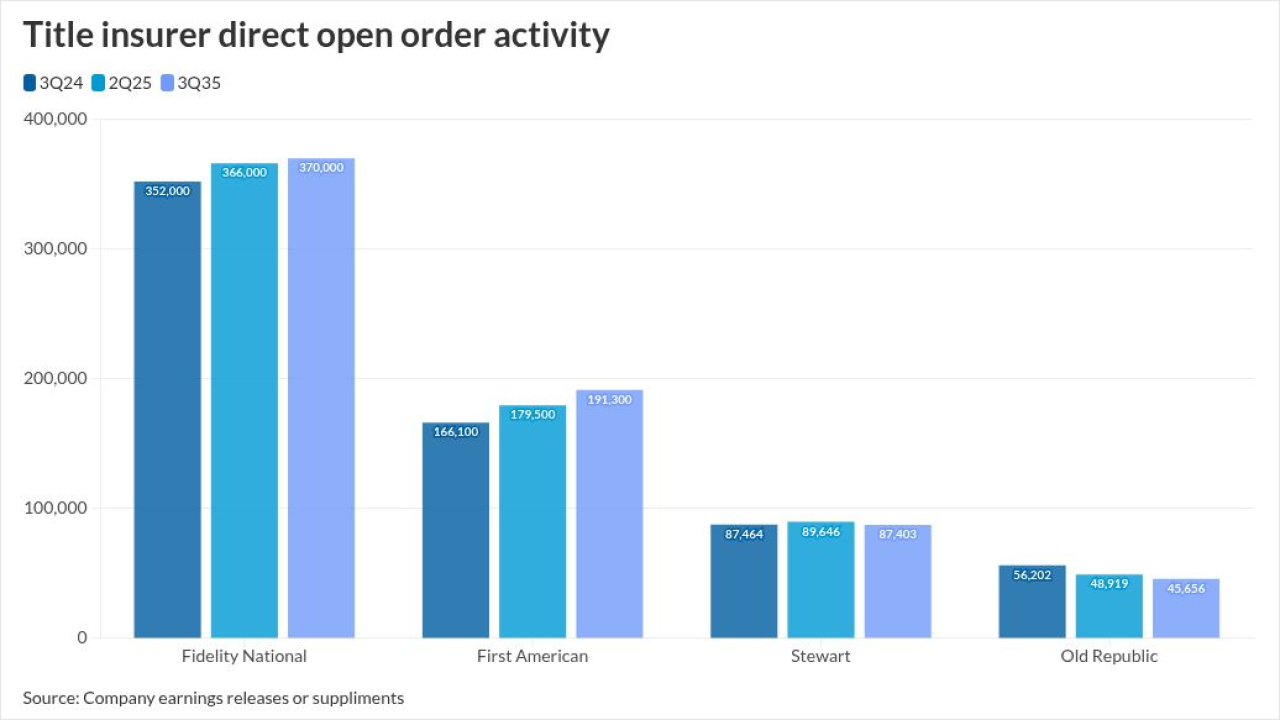

All five publicly traded title insurance companies reported a year-over-year increase in earnings during the third quarter, but only two had higher orders.

November 10 -

Company leaders said current strategy sets it up to profit and compete against its rivals as the mortgage market improves in the coming months.

November 6 -

UWM Holdings set a single-day record for rate locks in September at $4.8 billion, taking advantage of the window of opportunity leading up to the FOMC meeting.

November 6 -

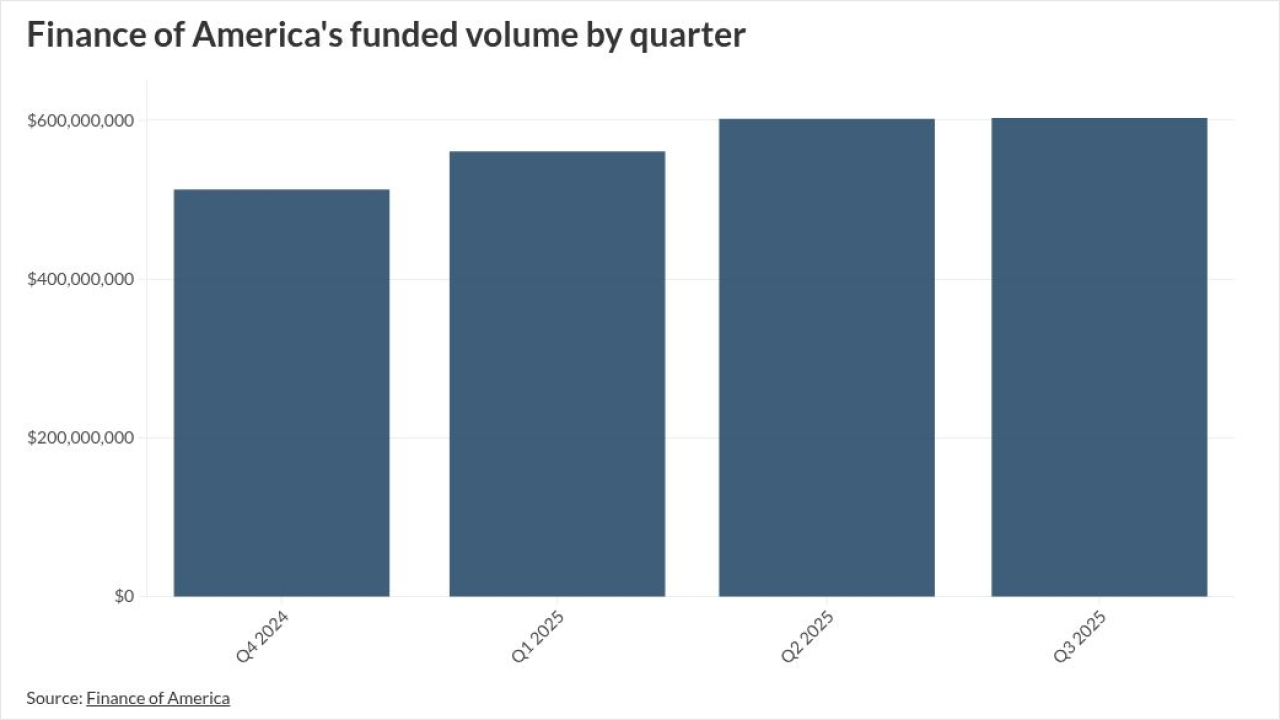

The company posted its best quarter for funded loan volume and shared other green shoots including greater margins on less reverse mortgage business.

November 6 -

The lender reported $33.3 million in net income in the third quarter this year, up from the second quarter and same period a year earlier.

November 5 -

Home price modeling changes hurt FOA's third-quarter interim results but it was in the black between January and September on a continuing operations basis.

November 4 -

Vic Lombardo, new head of mortgage services, has identified growth ideas and new revenue streams for Motto Mortgage and Wemlo, Remax CEO Erik Carlson said.

October 31 -

Zillow Home Loans originated 57% more purchase mortgages versus the third quarter of 2024, with production and segment revenue growth beating estimates.

October 31