Want unlimited access to top ideas and insights?

Qualify More Borrowers: Updated AMI Limits Issued

The Federal Housing Finance Agency (FHFA) recently issued updated area median income (AMI) limits which we use to determine whether a borrower’s annual qualifying income meets the income eligibility requirements for Home Possible® or Refi PossibleSM mortgages. These AMI limits are also used to determine whether a super conforming mortgage with a first-time homebuyer is exempt from the Super Conforming Mortgage Credit Fee in Price described in Single-Family Seller/Servicer Guide

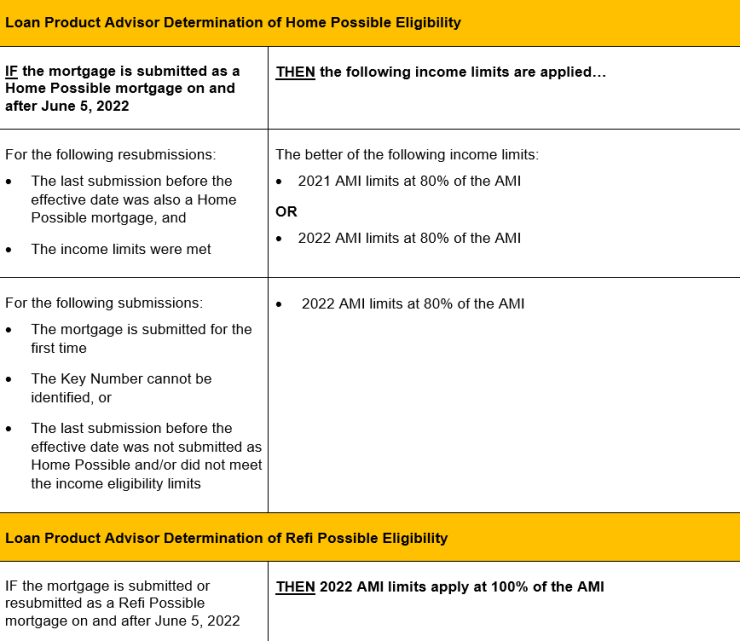

As a reminder, the borrower’s annual qualifying income must be less than or equal to 80% of the AMI for the location of the mortgaged premises for the loan to be eligible under Home Possible. For Refi Possible mortgages, the borrower’s annual qualifying income must be less than or equal to 100% of the AMI for the location of the mortgaged premises for the loan to be eligible. Lenders who participate in a housing finance agency (HFA) program are advised to consult the HFA’s website for income eligibility and associated pricing of their HFA Advantage offerings.

To support the updated AMI limits the

- If the mortgaged premises is located in a county where the AMI has declined and you submitted the loan before June 5, Loan Product Advisor will apply the higher 2021 AMI. This means the loan will remain eligible if there are no changes in the borrower’s circumstance, no changes in the property condition and the loan was originally an income-eligible Home Possible mortgage.

- If the mortgaged premises is located in a county where the AMI has increased and you submitted the loan before June 5, Loan Product Advisor will apply the higher 2022 AMI in determining possible income eligibility for Home Possible or Refi Possible mortgages.

The submission guidelines described above for Home Possible will also apply to HFA Advantage borrowers; consult HFAs’ websites to determine income eligibility and associated pricing. For manually underwritten mortgages, the updated borrower income limits will be effective for mortgages with application received dates on and after June 5, 2022.

Loan Product Advisor will apply the updated AMI limits for Home Possible and Refi Possible mortgages as follows: