-

The Consumer Financial Protection Bureau will face an existential crisis in 2026 between the Trump administration's efforts to shut down the agency and the employee union and consumer advocates who want to stop them.

December 25 -

CMBS originated between 2017 and 2021 are especially vulnerable. Brighton counsels CMBS lenders to expect clear workout memos.

December 24 -

The MBA's Market Composite Index, a measure of mortgage loan application volume, dropped 5% on a seasonally-adjusted basis and 6% on an unadjusted basis.

December 24 -

Fannie Mae sees growth in refinance activity pushing volumes upward, but flattening purchases will temper lender momentum, according to its December report.

December 24 -

The bank regulator is proposing to strengthen national preemption in the wake of conflicting decisions in related court cases.

December 24 -

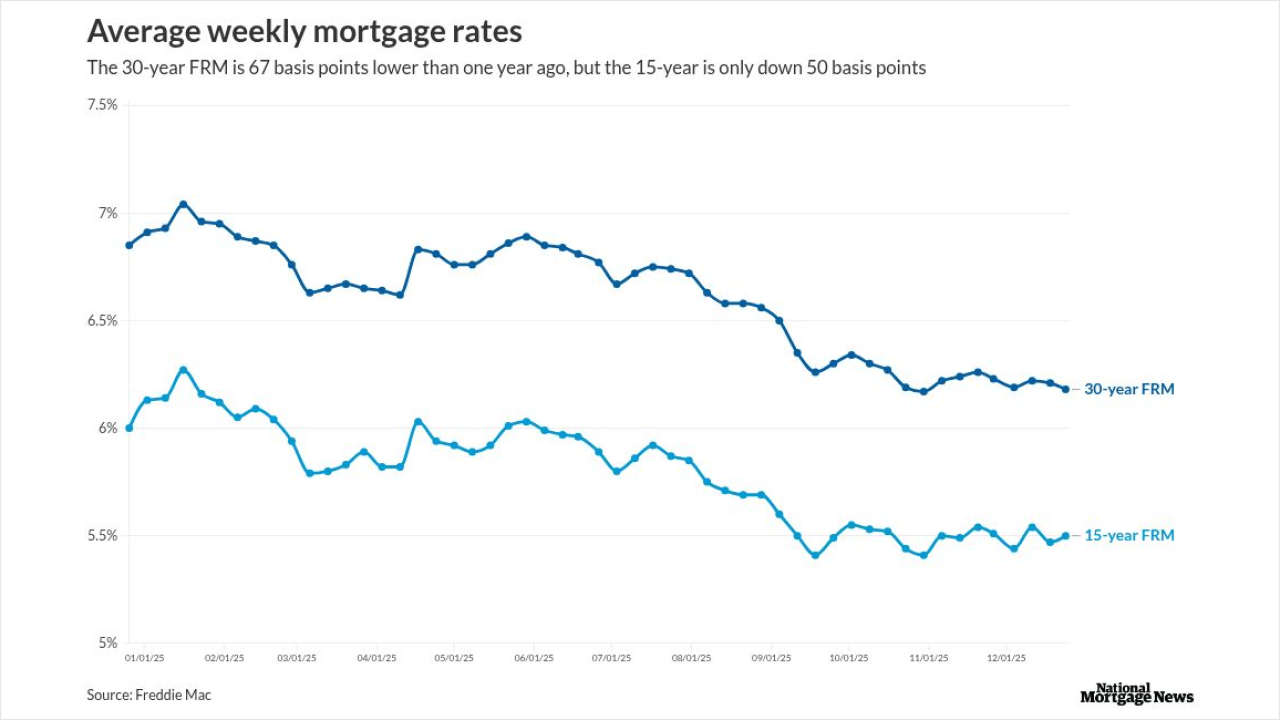

The 30-year fixed rate mortgage dropped 3 basis points this week, its lowest level since October and just over its 52-week bottom, Freddie Mac reported.

December 24 -

Wellness rooms, thoughtful sensory inputs and layouts that boost functionality can reduce workplace stress.

December 24 -

Despite certain pronouncements otherwise, rumors of email's demise have been gravely exaggerated, as recent data shows it's not only still around, it's ubiquitous.

December 24 -

A rise in issuance of nonqualified mortgages and seconds is in the forecast but home prices, credit and the GSEs may impact private-label bonds' trajectory.

December 24 -

The regulator lowered benchmarks for acquisitions of certain single-family loans including low-income refinances, and left multifamily targets intact.

December 23