-

Rialto Capital allegedly engineered a way to keep it in default so that the company could win extra fees over time, according to a lawsuit filed Tuesday.

December 26 -

Three Democratic Senators say Demotech's assessments "raise profound governance and reliability concerns" in letters to Fannie Mae and Freddie Mac.

December 26 -

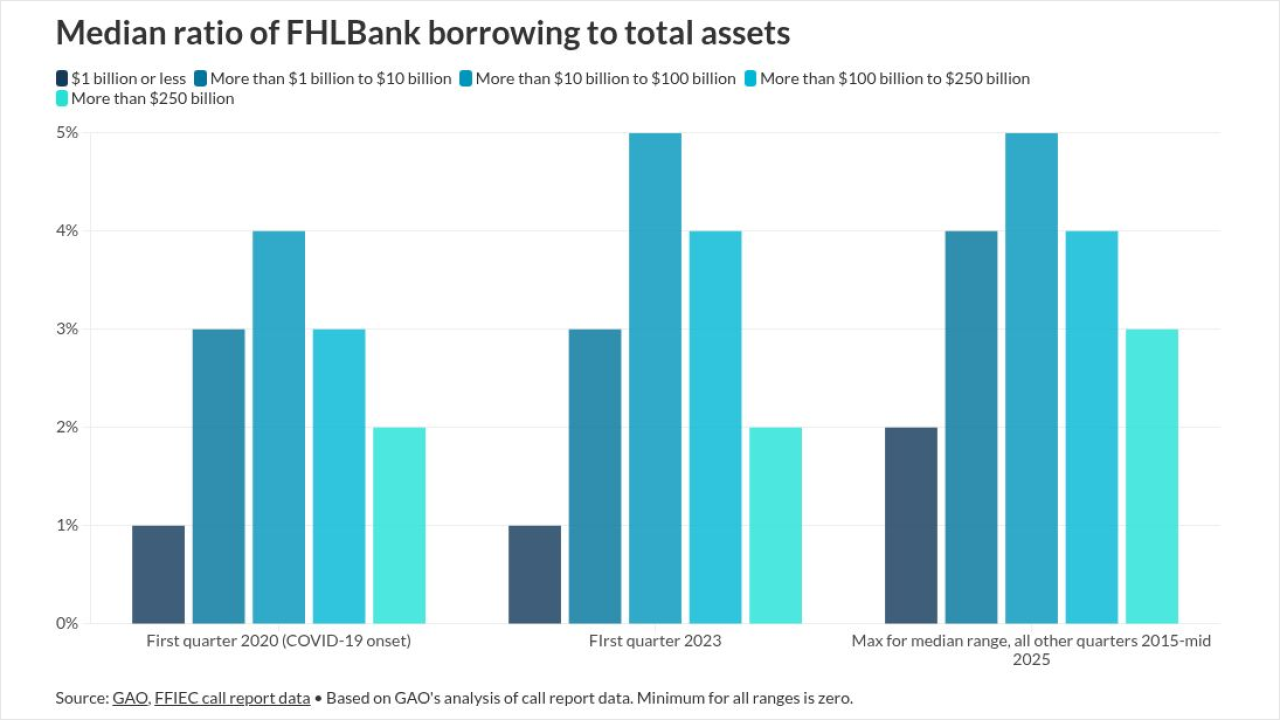

Fewer than 1% of members reported surges relative to total assets outside the normal range, making Silvergate's experience unusual, according to the GAO.

December 26 -

Fannie Mae sees growth in refinance activity pushing volumes upward, but flattening purchases will temper lender momentum, according to its December report.

December 24 -

A rise in issuance of nonqualified mortgages and seconds is in the forecast but home prices, credit and the GSEs may impact private-label bonds' trajectory.

December 24 -

Principal will be distributed pro rata among the senior A1 through A3 certificates, and subordinate bonds will not receive any principal until all senior classes are reduced to zero.

December 19 -

The move formalizes acting leadership roles both have had in different segments of the government-backed mortgage market serving many first-time homebuyers.

December 19 -

Monthly excess spread will confer credit enhancement to the notes, KBRA said, and while it will be released it will not be available as credit enhancement in future payment periods.

December 18 -

The option for holders of older government-sponsored enterprise bonds that predated the move to uniform mortgage-backed securities now has a deadline.

December 18 -

A coalition of mortgagees said the zombie seconds law negatively impacts 1.2 million junior liens statewide, despite just over 500 potential "zombie" loans.

December 18 -

Further mortgage payment reductions and other "aggressive" changes to federal policy impacting homeowners are on the roadmap for the coming year.

December 18 -

The latest data offered some relief to traders worried about more pronounced inflation that could keep a lid on rate cuts.

December 18 -

Bloomberg Intelligence puts odds on a release from conservatorship and issuing new shares. Its study estimates critical steps would take "months if not years."

December 18 -

The Treasury official renewed a pledge to avoid hurting how mortgages trade in a Fox Business News interview as a new study highlighted one way to do that.

December 17 -

Michael Hutchins, the two-time interim chief executive at the government-sponsored enterprise, will remain with the company in his role as president.

December 16 -

Fannie Mae and Freddie Mac have added billions of dollars of mortgage-backed securities and home loans to their balance sheets in recent months, fueling speculation that they're trying to push down lending rates and boost their profitability ahead of a potential public offering.

December 15 -

For 2026, the mortgage industry operating environment will improve, while nonbank financial metrics should be within Fitch's rating criteria sensitivities.

December 12 -

Kansas City Federal Reserve President Jeffrey Schmid and Chicago Fed President Austan Goolsbee said in statements Friday that their dissents from this week's interest rate decision were spurred by inflation concerns and a lack of sufficient economic data.

December 12 -

The new monthly reporting rule lists improved accuracy and timeliness of MBS payments among its goals, with implementation planned for February 2026.

December 12 -

Treasury Secretary Bessent said FSOC is readjusting its approach to avoid stifling growth in moves with implications for capital, technology and mortgages.

December 11