-

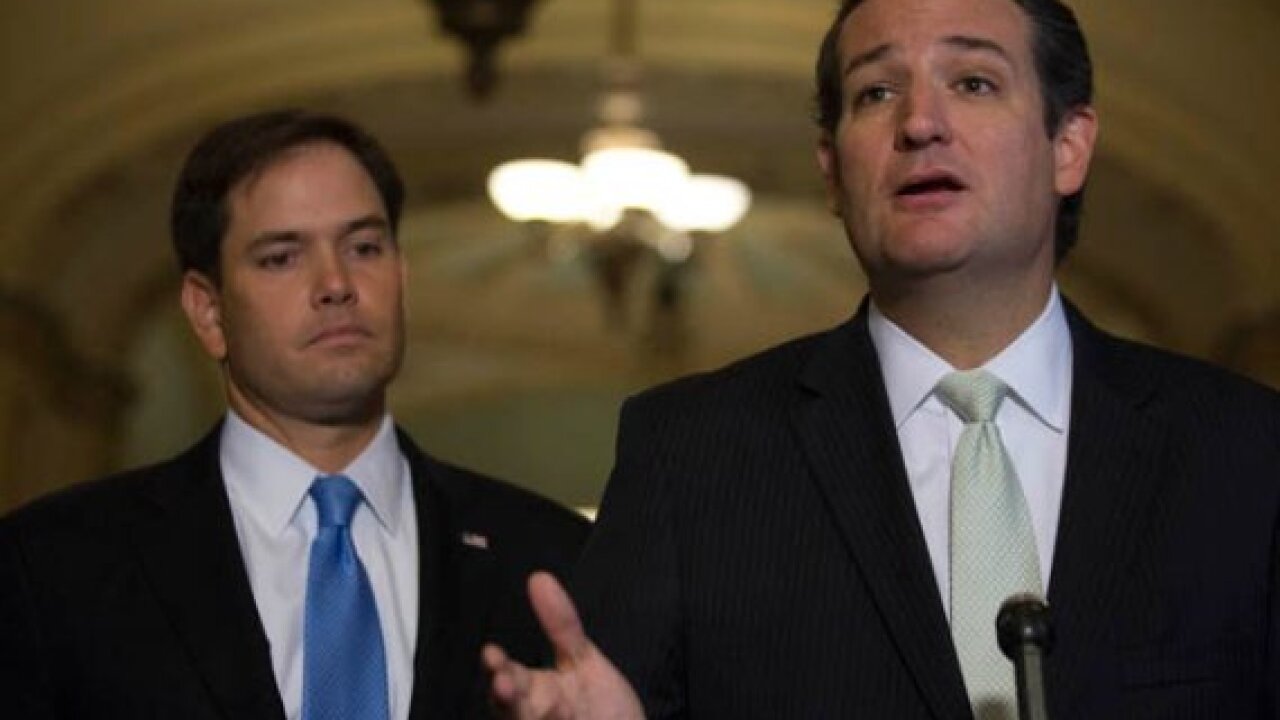

From the future of Dodd-Frank to GSE reform, the next Congress will make major decisions that will shape the mortgage industry's future. Here's a look at the Senate candidates who have received the most money in political donations from the mortgage industry.

October 21 -

From House Speaker Paul Ryan to Financial Services Committee Chairman Jeb Hensarling, these 10 candidates for the House of Representatives attracted the most in campaign donations from the mortgage industry.

October 21 -

The mortgage industry remains deeply uneasy with efforts by Fannie Mae, Freddie Mac and their regulator to experiment with front-end credit risk transfers, with some arguing it helps borrowers and lenders, while others fear it will cut out small institutions.

October 20 -

In a move designed to help further calm lender fears about mortgage repurchase liability, Fannie Mae is preparing to offer immediate representation and warranty relief to lenders that use its suite of automated quality assurance technology.

October 20 -

Heather Russell, who was fired earlier this year as Fifth Third Bancorp's chief legal officer, has re-emerged in a new role.

October 20 -

Rates for the 30-year conforming fixed-rate mortgage rose above 3.5% for the first-time since before the Brexit vote, according to Freddie Mac.

October 20 -

Black Knight Financial Services has integrated technology from Fannie Mae and Freddie Mac with its LoanSphere Empower and LendingSpace loan origination systems.

October 19 -

Upcoming look-backs of key Dodd-Frank provisions like the Qualified Mortgage rule are unlikely to result in new regulatory changes. But any effort to revisit already-implemented rules should give cause for concern, legal experts warn.

October 18 -

While compliance costs continue to increase for lenders, the rising age of company owners is what's prompting many independent mortgage bankers to sell their companies.

October 18 -

Independent mortgage bankers are concerned that if Congress votes to privatize the Common Securitization Platform, it could give large banks too much control over the real estate finance market.

October 18