-

When it comes to possible new competitors in the secondary market, the heads of the two current outlets more than welcomed the possibility of additional players in their space because of housing finance reform.

October 28 -

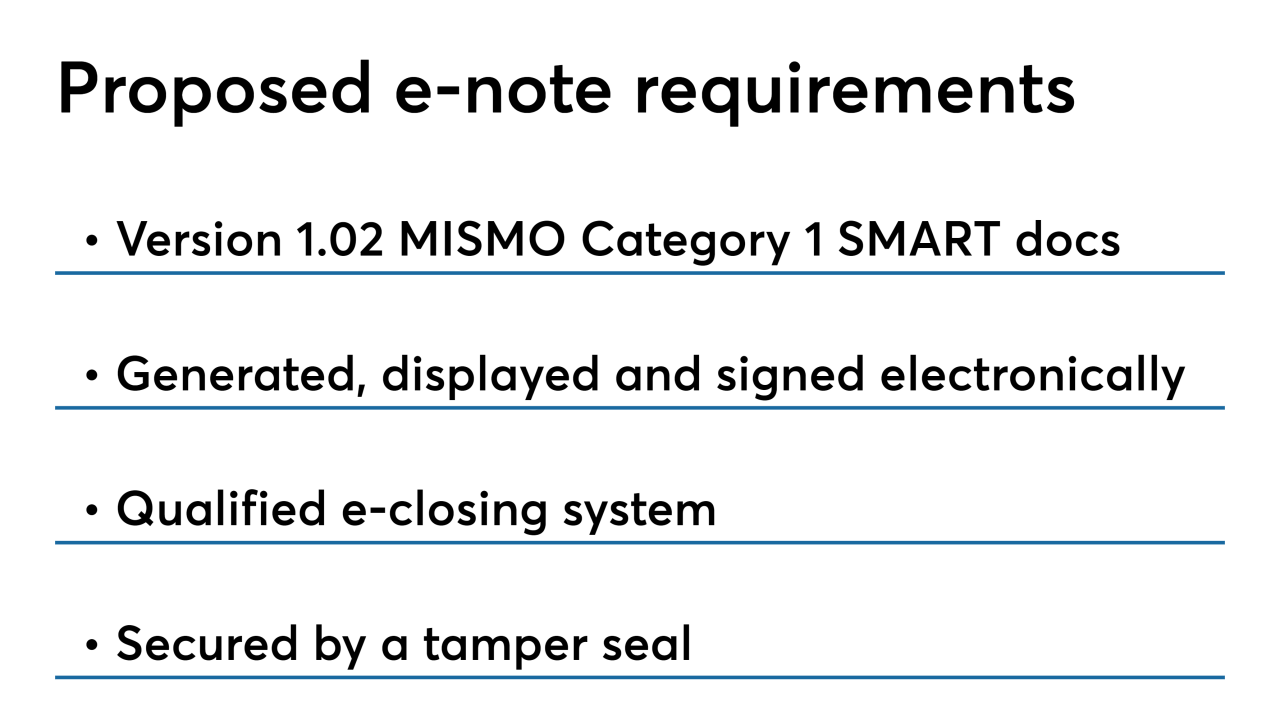

Ginnie Mae is looking for input on its proposed guidelines for electronic promissory notes and other mortgage documents that it plans to test through a digital collateral pilot.

October 28 -

The regulator of Fannie Mae and Freddie Mac discussed steps the companies have already taken to limit their risk, as well as efforts to prevent housing market “overlap” with the FHA.

October 28 -

The government-sponsored enterprises are moving ahead with a new mortgage application that omits a previously planned language question, but are looking to serve limited English proficiency borrowers in another way.

October 24 -

At a House hearing covering a whole host of housing finance reform topics, Fannie Mae and Freddie Mac's regulator said "if the circumstances" call for eliminating investors, "we will."

October 22 -

Renovation spending is decelerating faster than expected this year, but could slow with more deliberation than previously anticipated next year, according to Harvard University's Joint Center for Housing Studies.

October 18 -

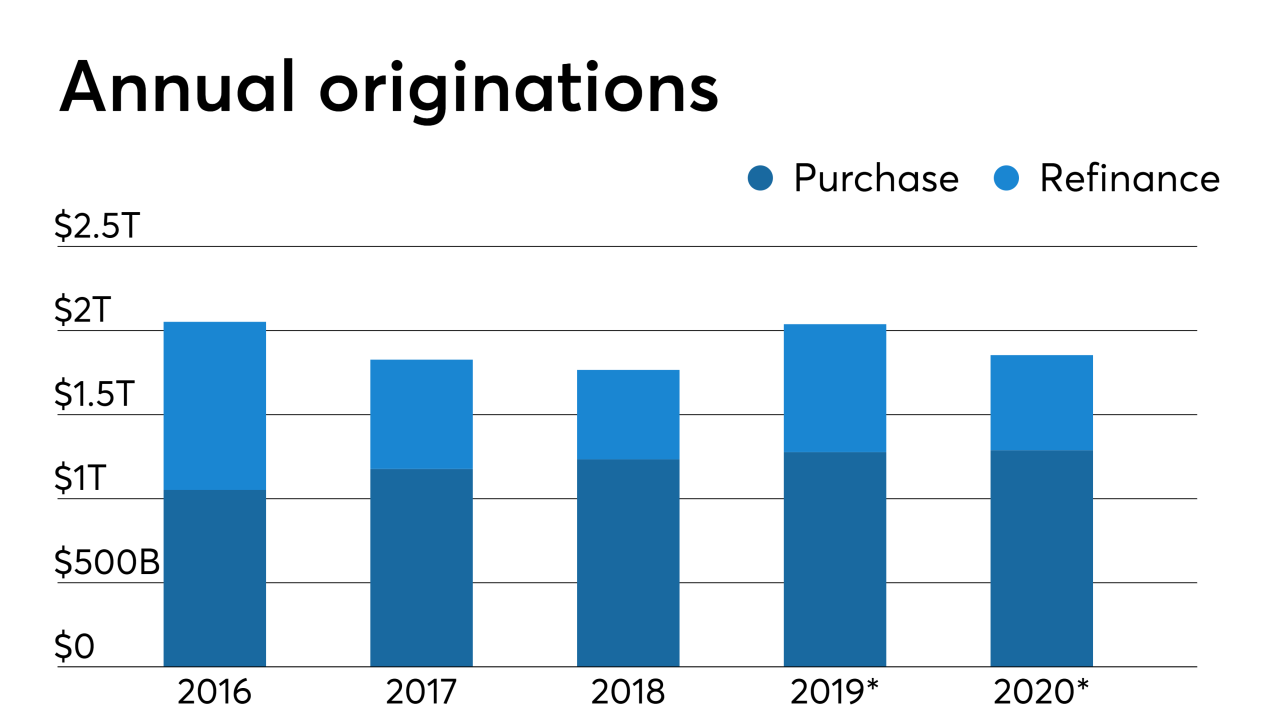

Single-family mortgage production this year is expected to be 3% higher than anticipated last month, according to Fannie Mae, which revised its estimates based partly on a stronger housing outlook.

October 17 -

A year after Fannie Mae launched its first credit-risk transfer securitization using a real estate mortgage investment conduit, Freddie is now electing to also opt for a REMIC format in offloading the credit risk to private investors.

October 10 -

The developer of the newly constructed Washington, D.C., headquarters for Fannie Mae is securitizing part of its $525 million, 10-year mortgage through a single-asset, mortgage-backed transaction.

October 10 -

David Lowman, executive vice president of the single-family business at Freddie Mac, has informed the company he will be stepping down from his position on or about Nov. 1.

October 8