-

Ginnie Mae is looking to start a pilot program to securitize digital mortgages as early as 2019, but issuers would not be able to commingle loans using traditional paper files in those deals.

June 20 -

The groups applauded a proposal to establish minimum GSE capital requirements, but called for more immediate steps to release the companies from conservatorship.

June 19 -

Risk management and technology systems at the Federal Housing Administration lag decades behind Fannie Mae and Freddie Mac and desperately need to be revamped, according to a top official at HUD.

June 18 -

The bill aimed at helping struggling homeowners also requires documentation of servicer behavior and FHFA evaluation of the services provided to borrowers.

June 18 -

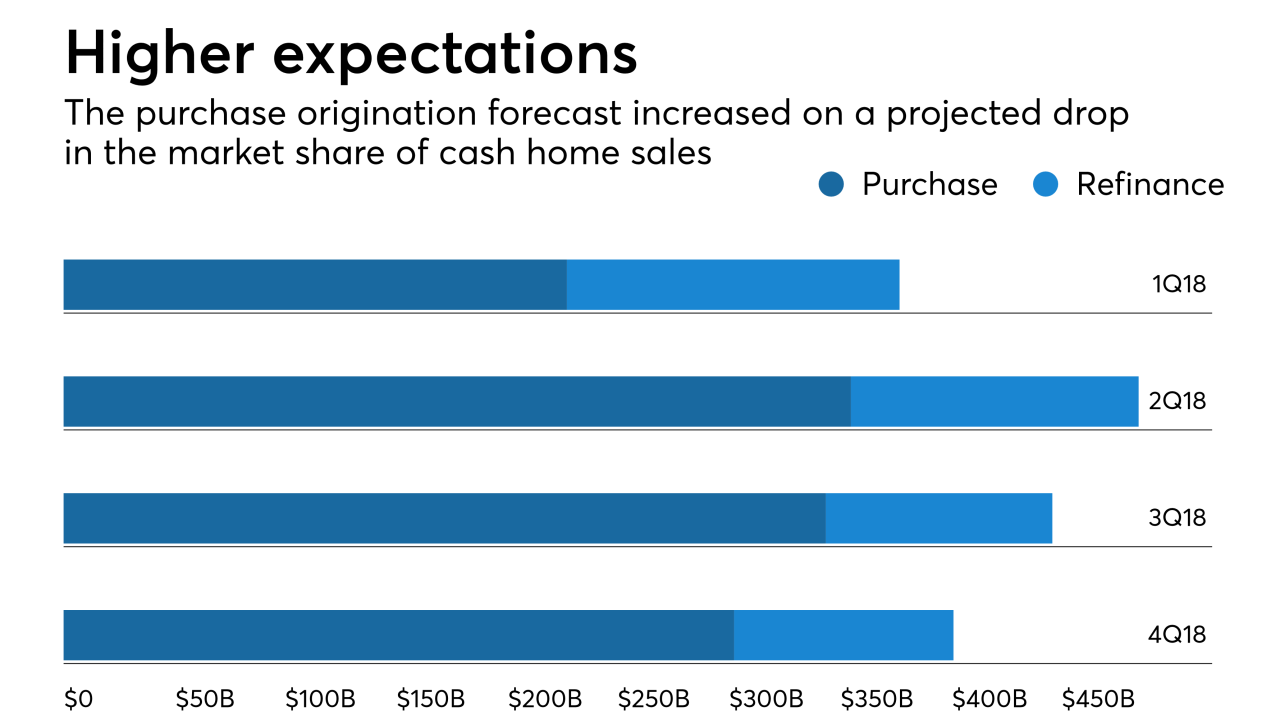

A declining share of cash home sales will drive purchase home originations higher than previously expected through 2019, according to Fannie Mae.

June 18 -

Sales of nonperforming loans by Fannie Mae and Freddie Mac slowed during the past year as the number of delinquent loans on their books continued to drop.

June 14 -

Freddie Mac hit the $1 trillion mark on credit risk sharing for single-family mortgage loans with its second lower LTV deal of the year.

June 13 -

Goldman Sachs affiliate MTGLQ Investors won another bid for Fannie Mae's nonperforming loans, persisting as a buyer for the product even as Fannie keeps working to diversify the investor base.

June 13 -

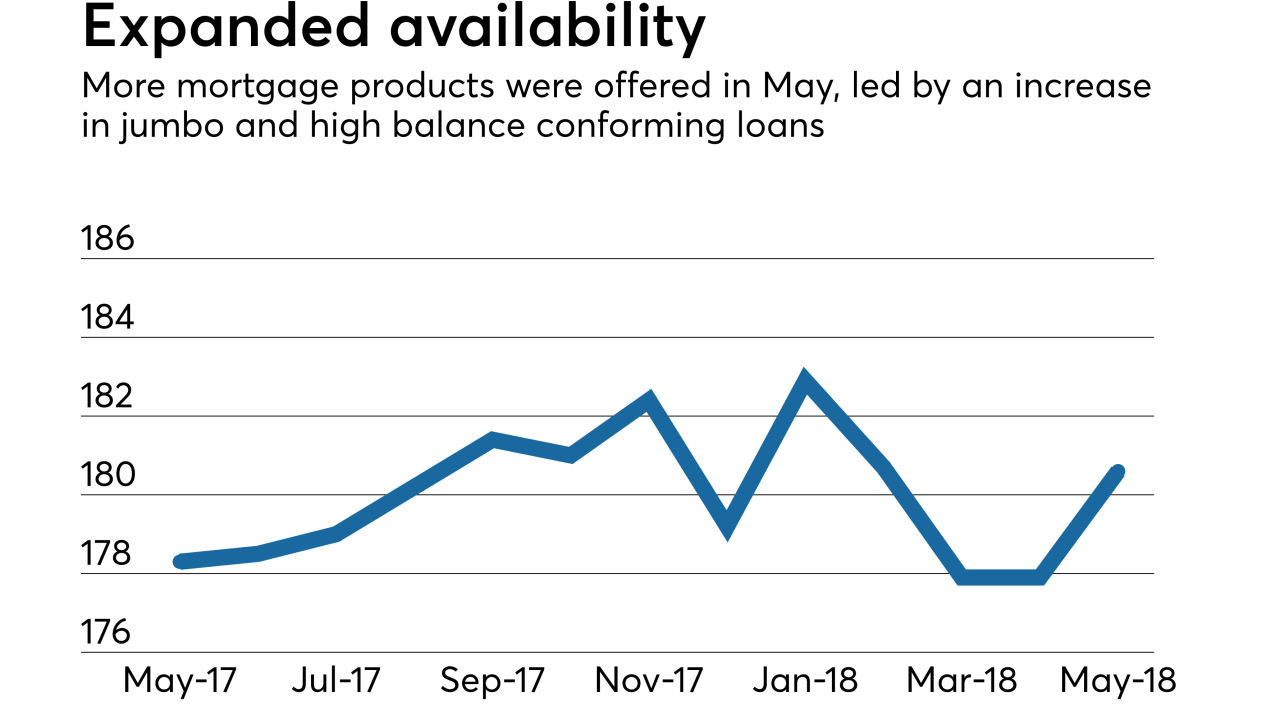

Mortgage credit availability increased in May by 1.5% as more jumbo and high-balance conforming loan products came on the market, the Mortgage Bankers Association said.

June 13 -

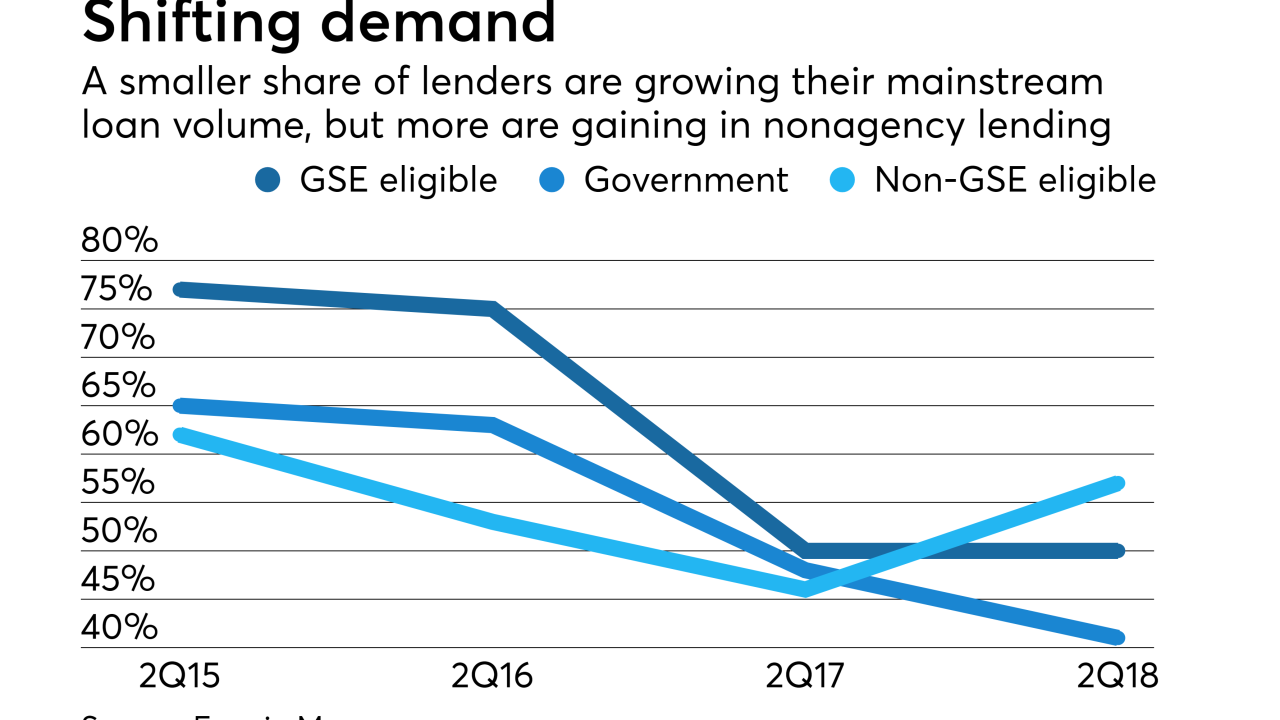

The net share of government and agency mortgage lenders who found spring homebuyer demand to be strong enough to drive purchase loan growth is considerably lower than three years ago.

June 12 -

Fannie Mae is lowering down payment requirements and lender fees on manufactured housing loans to improve affordable housing access.

June 6 -

Since its inception, the qualified mortgage rule has been synonymous with loans purchased by Fannie Mae and Freddie Mac or guaranteed by government agencies. But a broader QM definition could change that by creating more competitive private-label options.

June 5 -

Anticipated changes to the qualified mortgage rule will give lenders more options and force them to rethink their views on risk.

June 4 -

MountainView is brokering a $3.6 billion nonrecourse package of Fannie Mae mortgage servicing rights with a high refinance loan concentration.

June 4 -

The federal government has opened a criminal investigation into whether traders manipulated prices in the $550 billion market for corporate bonds issued by Fannie Mae and Freddie Mac, according to people familiar with the matter.

June 1 -

Fannie Mae is warning mortgage lenders and servicers about possible fraud schemes in Los Angeles County involving "34 apparently fictitious employers being used on loan applications."

May 30 -

To make its technology more relevant to the mortgage industry, Fannie Mae is taking a new approach to developing tools that engages lenders earlier in the process and makes lending more efficient.

May 29 Fannie Mae

Fannie Mae -

Freddie Mac's economists took a more bullish outlook than others on the 2018 mortgage market, raising its forecast by $30 billion citing higher-than-projected refinance activity.

May 25 -

A group of low- and moderate-income first-time homebuyers tracked in a Fannie Mae study did not properly prepare to get a mortgage, which created a prolonged and complicated purchase process.

May 24 -

From the latest economic news to the latest developments in digital mortgages, here's a look at six things we learned at the MBA Secondary Conference 2018.

May 23