-

A regulatory 2017 scorecard for Fannie Mae and Freddie Mac calls on the firms to transfer a significant portion of credit risk to third-party private investors on at least 90% of unpaid principal balance of newly acquired single-family mortgages.

December 15 -

Mortgage rates moved higher for the seventh consecutive week, a sign that the markets are still in flux after the presidential election, Freddie Mac said.

December 15 -

When Barack Obama leaves office on Jan. 20, Democratic appointees across the government are expected to follow him out the door, to be replaced by officials chosen by Donald Trump. Not Mel Watt he isn't planning to go anywhere.

December 15 -

Fannie Mae and Freddie Mac will replace the expiring Home Affordable Mortgage Program with a new loss mitigation option called the Flex Modification.

December 14 -

It is going take some time before it comes to fruition, but the Federal Housing Finance Agency got the ball rolling Tuesday on pushing Fannie Mae and Freddie Mac to begin purchasing manufactured housing loans.

December 13 -

One step the government can take to strengthening housing is to create a unified office dedicated to housing finance and policy, streamlining and making more efficient existing agencies and programs.

December 13 The Collingwood Group

The Collingwood Group -

The Federal Housing Finance Agency finalized a rule Tuesday that will create a "duty to serve" for Fannie Mae and Freddie Mac to help low- and moderate- income consumers, including encouraging a secondary market for manufactured housing loans.

December 13 -

When Donald Trump announced his choice for Treasury secretary last month, he called Steven Mnuchin a "world-class financier," citing business successes like his profitable turnaround of a California bank.

December 13 -

SoFi Lending Corp.'s securitization of its student loan refis for high net worth individuals is now a model for its recent expansion into super prime jumbo mortgages.

December 13 -

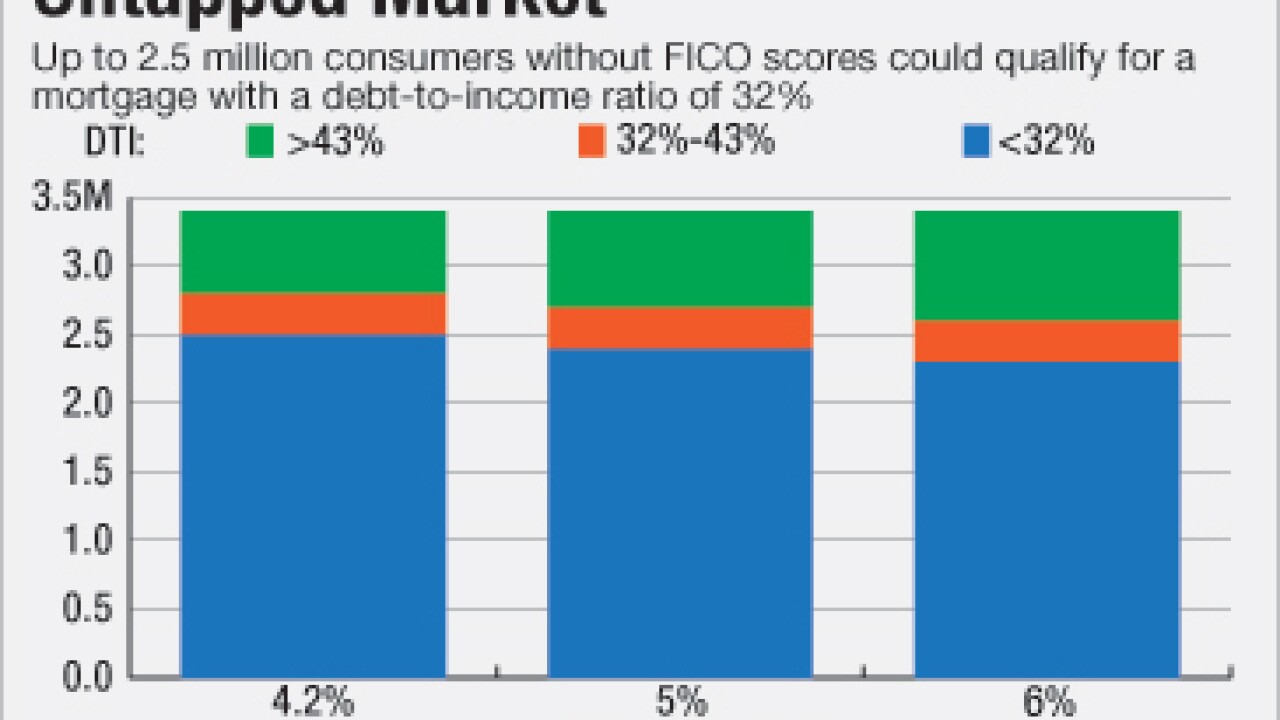

Many consumers without traditional credit scores have nearly identical risk profiles to those who can be assessed the conventional way, representing an untapped market, according to a report by VantageScore.

December 12 -

Rising mortgage interest rates affect the volume of refinance and purchase originations, but don't necessarily spell bad news for home prices, explains Fannie Mae Chief Economist Doug Duncan.

December 12 -

Fannie Mae and Freddie Mac will again halt evictions nationwide for foreclosed properties during the holiday season.

December 12 -

Manufactured housing advocates are "guardedly optimistic" that the Federal Housing Finance Agency will soon issue a long-awaited final rule that they hope will expand the secondary market for mobile homes.

December 12 -

A bipartisan duo of House lawmakers introduced a bill Thursday that would push Fannie Mae and Freddie Mac to engage in more credit risk-sharing transactions.

December 8 -

Digital mortgages are not an idea for the future; they are here to stay, and the mortgage industry must put aside its misplaced fear of technology and change and embrace them.

December 8 Pavaso

Pavaso -

Development on the Common Securitization Platform has reached a point where Fannie Mae and Freddie Mac may be able to issue a uniform mortgage-backed security sometime in 2018, the Federal Housing Finance Agency said Thursday.

December 8 -

Mortgage rates moved higher for the sixth consecutive week, according to Freddie Mac, even though yields on the 10-year Treasury are down from their post-election peak.

December 8 -

Two reports released Wednesday indicate mixed reactions to the presidential election where consumers' attitudes toward housing are concerned.

December 7 -

And that was only the beginning. Bank CEOs speaking in New York provided a long list of financial reforms that they would like to see under the incoming Trump administration.

December 6 -

The National Fair Housing Alliance and 20 local fair housing groups have filed a lawsuit in federal court against Fannie Mae over its maintenance and marketing of foreclosure properties.

December 6