Want unlimited access to top ideas and insights?

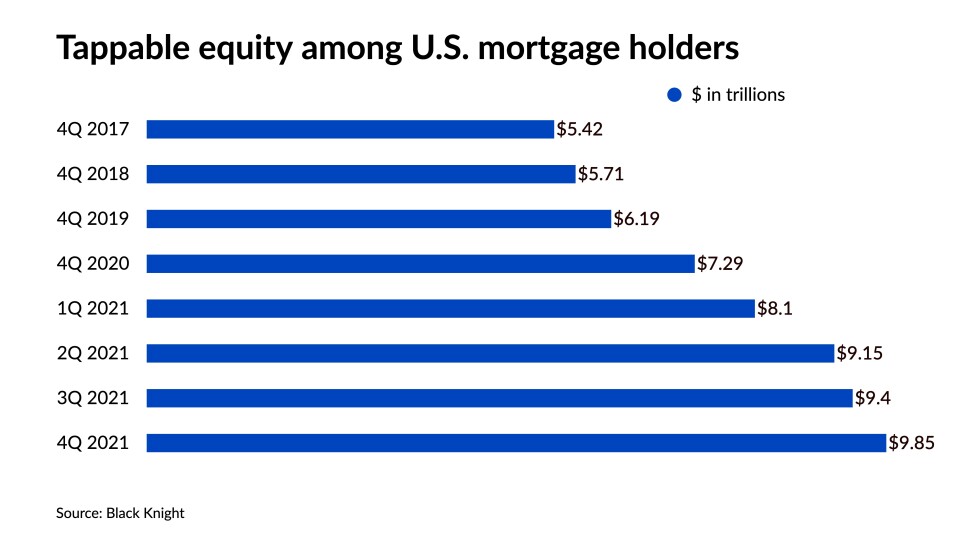

Many lenders have launched home equity products to make up for declines in other loan types. At the same time, borrowers still need to be sold on the advantages of home equity lines of credit (HELOCs) and reverse home equity conversion mortgages (HECMs).

Below we round up new home equity product launches and studies on their use in the industry.