But there could come a day when that will change, and growing awareness of this possibility as well as other shifts in the market are starting to spur servicers and others to invest more in customer service and systems.

From increased consumer engagement to new forms of payment, mortgage servicers are finding themselves faced with new trends in the market that they need to address.

Here's a look at five ways servicing conditions are evolving, according to industry professionals who attended the Mortgage Bankers Association's national servicing conference.

A shift in payment preferences is coming

"Gen Z trends are definitely something to plan for now. They are a unique group, the first generation who has been engaged with technology from a very early age. Much of that has been through mobile devices," he said. "Mortgage servicers have historically have not been on the forefront of technology yet Gen Z and Gen Y have strong technological preferences."

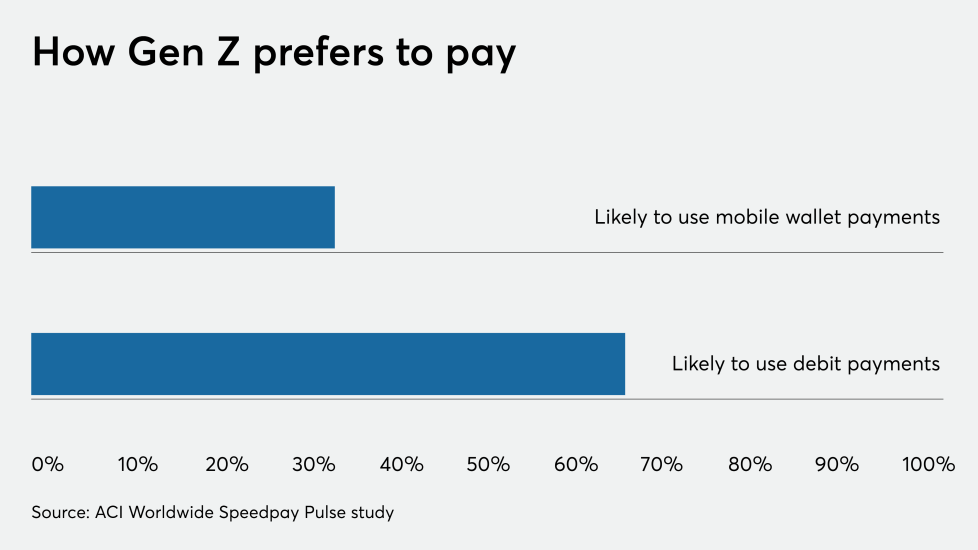

One way servicers can address the needs of these younger generations is to allow them to pay through their mobile wallet, Bandy added, noting that nearly 35% of Gen Z respondents surveyed prefer this method.

Another way to engage younger borrowers is to offer debit card payment processing, which more than two-thirds of Gen Z respondents showed a preference for.

While servicers tend to prefer processing electronic checks because they have a lower price point per transaction, in a broader context debit card payments may prove to be economical for some companies, Bandy said.

Customers are interacting more with their servicers

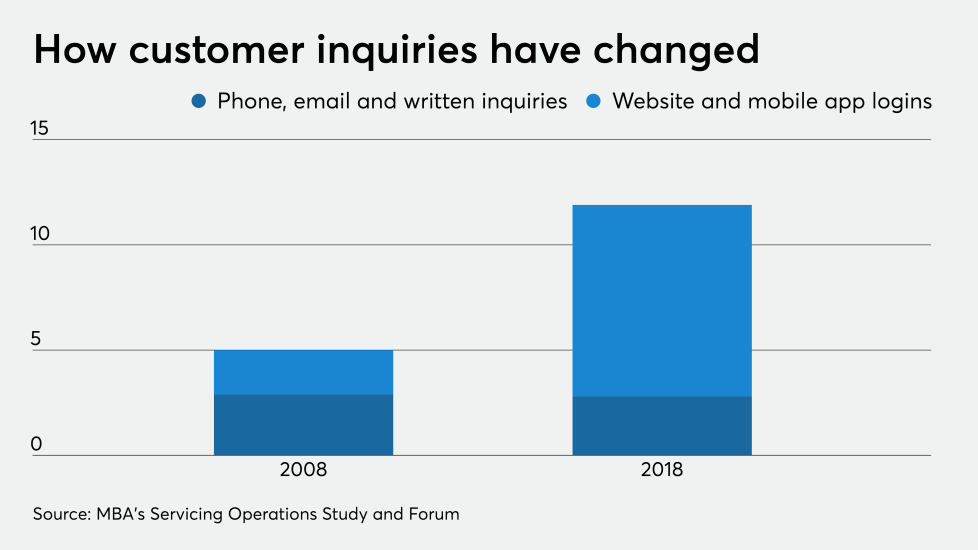

In 2018, there were on average more than nine website or mobile application logins per loan and almost three phone, email or written inquiries per loan, compared to more than two online logins per loan and nearly three phone, email or written inquiries in 2008.

The rise in digital touchpoints increases the need to ensure the security of customers' data. It also gives servicers more information about their borrowers that they can use to better address customer needs.

"In the servicing side of the business, I think the biggest trend is going to be how you engage with your customer," said Peter Pannes, head of servicing and capital markets at Covius.

Servicer productivity is improving

The average number of loans serviced per full-time employee was 969 in the first half of last year, up from 863 in full-year 2018, 759 in 2017 and 679 in 2016.

For distressed loans, the average number of loans per FTE was 107 in 1H19, up from 90 in 2018, 82 in 2017 and 80 in 2016.

While some of this increased productivity may be dependent on the market's current strong loan performance, it may also represent some relative efficiencies as a result of post-crisis operational advances that could make

The GSEs will deliver more advances in digital servicing

"Our servicers are investing a lot in digitization," said Kevin Palmer, senior vice president, single-family portfolio management, at Freddie Mac, noting that Freddie responded to this last year by launching a digital single sign-on to access dozens of servicing applications through its

This year, "the new mantra is, 'It's time to focus on servicing and default,'" said Andy Higginbotham, chief operating officer. "We have made great progress towards mitigating the risk on the front end of the business, but now we're asking, what about the back end? Isn't it the right time to get ready to deal with the next downturn in the market whenever it comes? We know enough now to say what the best loss mitigation answer is for a given situation in terms of the most economical approach and the best outcome for the borrower, and that can often be automated."

One example of loss mitigation technology Freddie Mac is working on, Higginbotham said, is an effort to take the same kind of advances in vendor-provided digital borrower-income data used to originate a loan in conjunction with Freddie's Loan Advisor Suite and apply them to the modification process.

Black Knight plans to offer new technology from an interesting source

As refinancing has surged, the mortgage market has been bedeviled by low customer retention rates and the technology may help servicers address that concern, said Shelley Leonard, an executive vice president at Black Knight.

The technology aims to give customer service agents fielding borrowers' calls access to information pertinent to loan management such as how much equity consumers have in ways that can help with retention and the marketing of additional products, she said.

The move is significant due to the wide scope of the use of Black Knight's system and Quicken's position as the company often credited for ushering in the digital mortgage era.

Not only does the move potentially give the market access to a new retention technology, it could broaden the potential for more technological collaboration between mortgage companies and their vendors.

"It hasn't been something we've done a lot but this is definitely not the first time we're doing it," said Leonard. "We're definitely open to it. It's creating interesting discussions with our customers."