Fannie Mae, Freddie Mac launch plans to close racial homeownership gap

Better.com CEO Garg misled investors, fired exec claims

Mortgage origination activity drops to a 22-year low

Fed delivers fuzzier rate message as it gauges impact of hikes

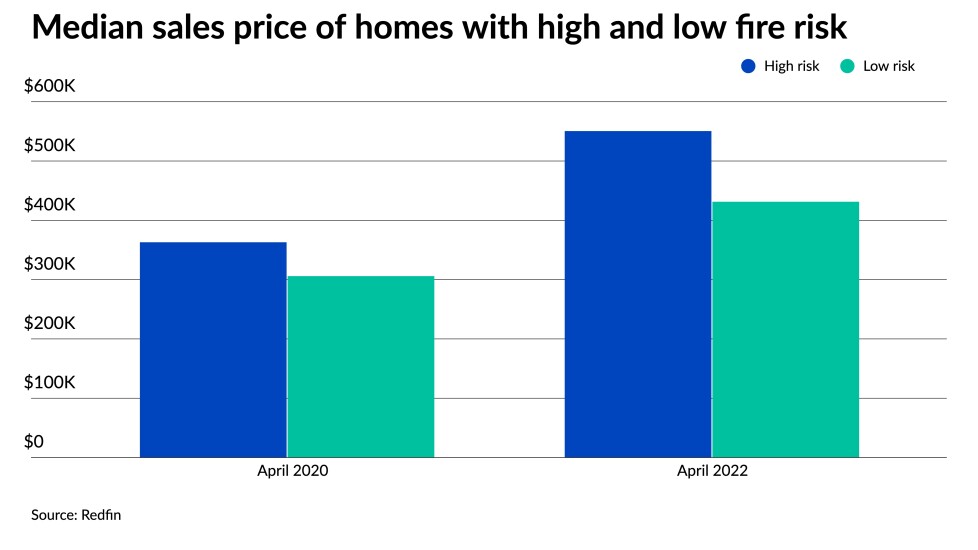

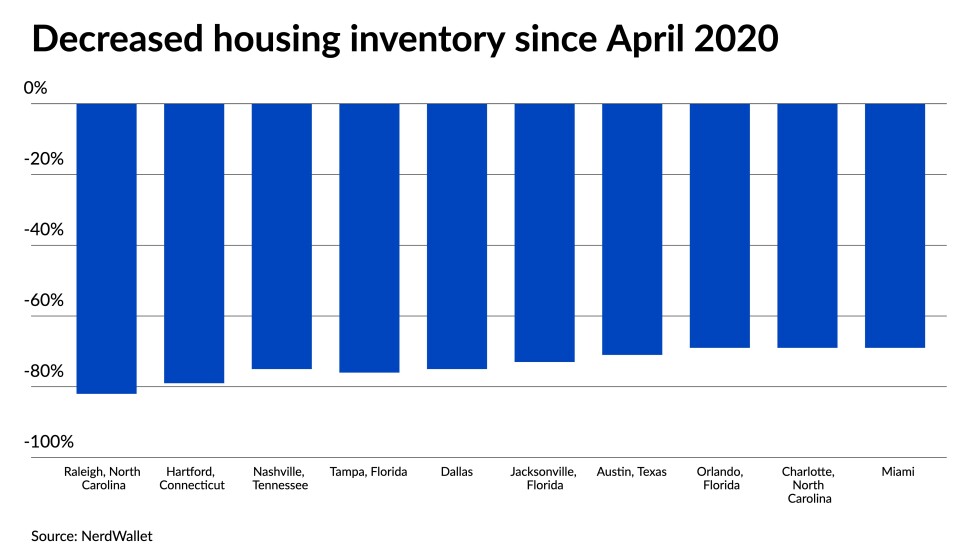

Wildfire threat hasn’t deterred purchases in higher-risk areas

Mortgage statements may be subject to collection rules: 11th Circuit

Home prices surged another 21% in April but experts say it’s not a bubble

FHFA, CFPB urge financial firms to offer disclosures in Spanish

Figure Technologies, Homebridge end merger plans

VantageScore notches a win in FICO-dominated securitization market

Figure Technologies, Homebridge end merger plans

Equifax’s credit scoring snafu ensnares lenders