Biden's pick to lead HUD is Ohio Congresswoman Marcia Fudge

Fudge, who has served in the House since 2008, represents most of the majority-Black areas of Cleveland as well as part of Akron. If nominated, she would be one of just a few House members to leave for the Biden administration as Democrats fight to hold on to the small majority they still have in the next Congress.

(Read the full story

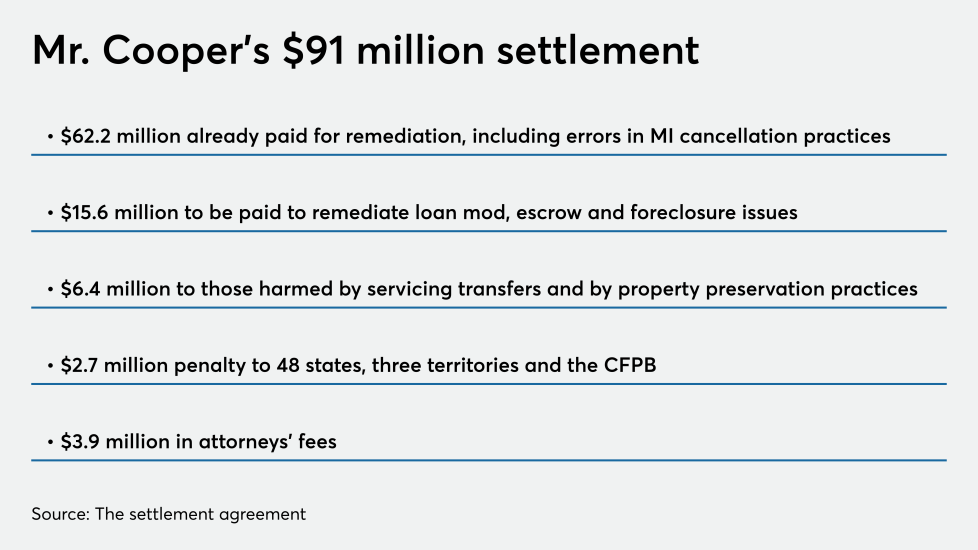

Mr. Cooper, PNC and U.S. Bank settle government cases

Mr. Cooper agreed to pay out over $91 million to consumers and state and federal regulators in order to settle charges regarding problems with loan modifications, foreclosures and mortgage insurance policy cancellations.

The Justice Department's U.S. Trustee office, which oversees the administration of bankruptcy cases and private trustees, came to its own agreement with Mr. Cooper, U.S. Bank and PNC Bank regarding noncompliance with the Bankruptcy Code and Federal Rules of Bankruptcy Procedure, which impacted over 60,000 accounts at all three companies, dating back to 2011.

(Read full story

CFPB finalizes overhaul of mortgage underwriting rules

It finalized one rule establishing a new general QM standard, adopting a pricing threshold to determine if loans can avoid liability under ability-to-repay requirements, replacing the current debt-to-income limit of 43%. The final QM rule would give lenders relief for loans capped at 150 basis points above the prime rate.

In the second final rule, the CFPB detailed how a loan can automatically gain QM status if a lender holds on to it for a while. Loans can earn the "seasoned" QM label if they are on the lender's balance for at least three years.

(Read full story

Retaining existing mortgage customers remains a struggle: Black Knight

Cash-out refinances had a particularly low average retention rate of 12% in the third quarter, when their market share fell to 27%, marking the lowest share in this category in seven years.

Rate-and-term refinances had a slightly higher retention rate of 22%. Home loans originated in 2018 and 2019 also had slightly higher retention rates at 25% and 26%, respectively.

These numbers put the average retention rate at a record low for the post-crisis period that followed the Great Recession.

(Read full story

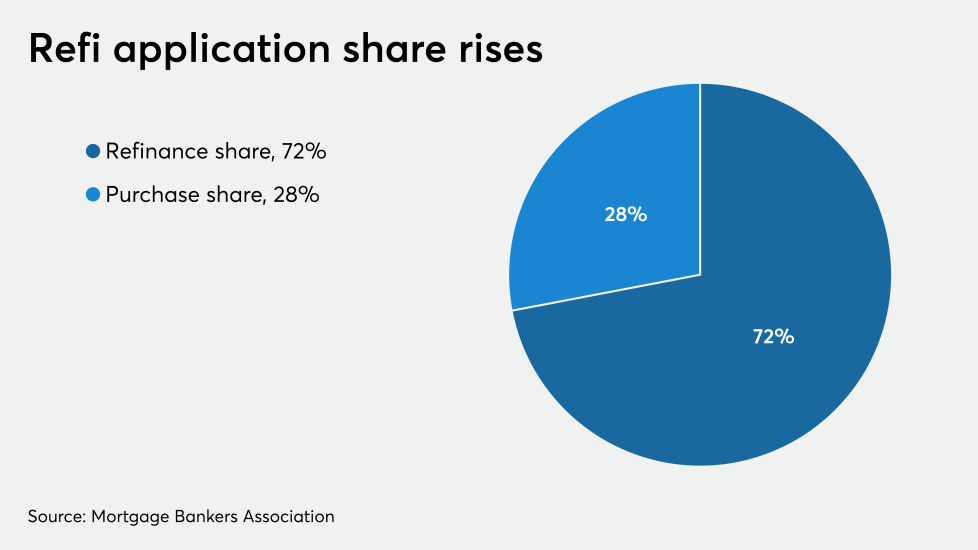

Mortgage applications slip, although record low rates spur refis

The MBA’s Weekly Mortgage Applications Survey for the week ending Dec. 4 found that the refinance index increased 2%

(Read the full story

Supreme Court hints FHFA's Calabria could keep job after all

At issue is whether the powers afforded to Senate-confirmed directors such as FHFA chief Mark Calabria, who can only be fired for cause and do not answer to a board, are unconstitutional. Justices signaled that that constitutionality question may be moot because the "net worth sweep" at the center of the case was implemented by former acting FHFA Director Ed DeMarco, who lacked Senate confirmation and therefore any protection from presidential firings.

(Read full story

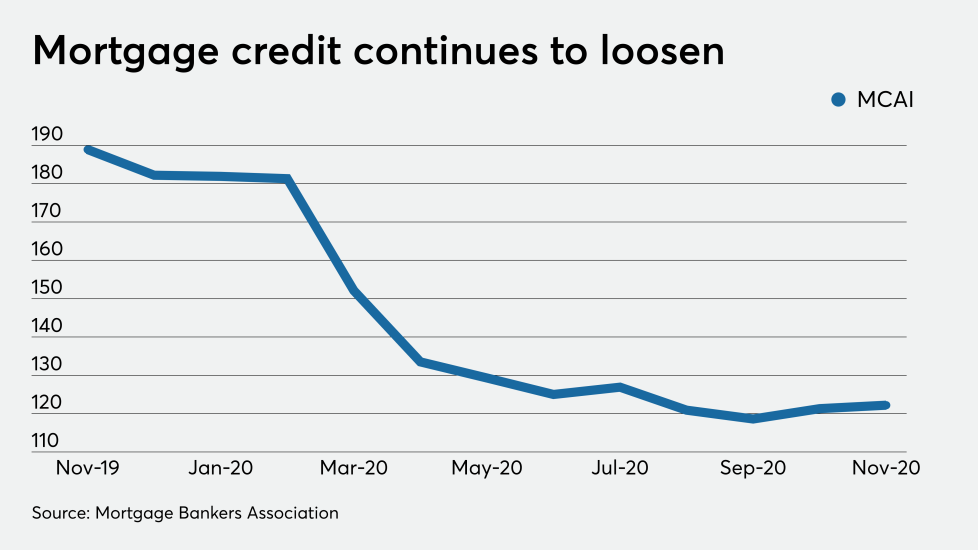

Credit availability expanded for second month in a row

November's Mortgage Credit Availability Index was 122.2, up 0.7% from

(Read the full story

Nexsys Technologies, sister to Rocket Mortgage, launches home insurance verification tool

The automation software aims to cut down on the time spent on verifying homeowners insurance to minutes, confirming it in real time, using multiple authentications. Insurers currently on the platform include Allstate, Farmers Insurance, Lemonade and Liberty Mutual.

(Read full story

2021 RMBS to benefit from tighter underwriting put in place for COVID

Comparing transactions from the same issuers (JPMorgan and Wells Fargo) in late 2019, the start of 2020 and this fall show measurable tightening in most metrics, including credit scores, along with loan-to-value and debt-to-income ratios.

(Read the full story

Americans gain $1 trillion in home equity in 3Q

"The housing market has remained a strong pillar in an otherwise tumultuous economic year," Frank Martell, president and CEO of CoreLogic, said in a press release. "A sharp rise in demand, spurred by record-low interest rates, continues to bolster homeowner equity."

Homeowners with a mortgage — about 63% of all properties — found their properties added 10.8% in value when compared with

(Read the full story