Mortgage rates surge at fastest pace since 1987

CFPB plans to review Qualified Mortgage rule

For some mortgage execs, the Fed hike is welcome

New Residential rebrands itself to Rithm Capital

Wells Fargo says discrimination suit plaintiffs lack standing

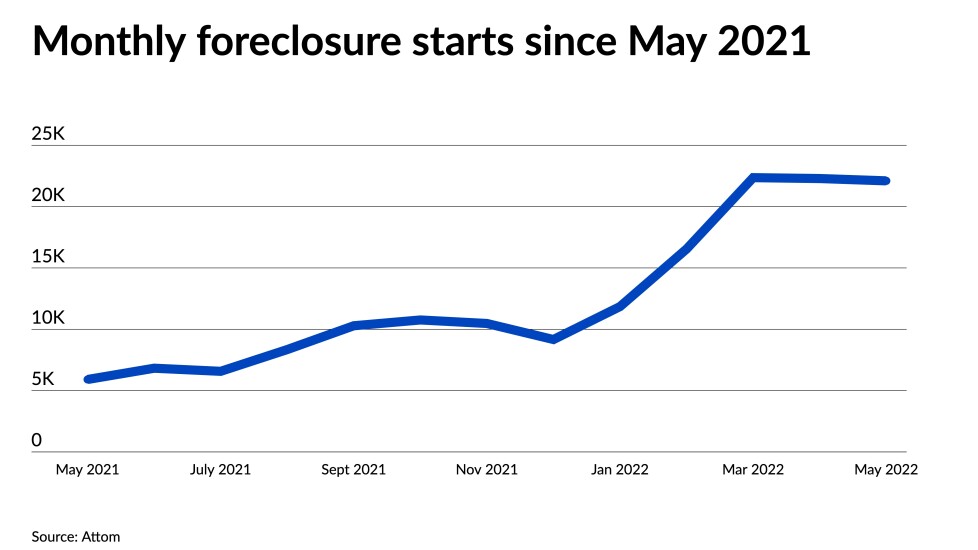

Foreclosure starts outnumbered completions by nearly tenfold in May

Mortgage loan rate lock activity slips in May

Home renovation lending demand may get temporary boost from inflation

Notarize is the latest fintech to lay off workers

June mortgage mergers aim to fill industry gaps

How servicers are putting available originators to work

The mortgage staffing outlook by loan channel and lender type

Lower reveals data breach impacting 86,000 customers

First Guaranty’s non-QM unit launches closed-end home equity loan